- United States

- /

- Insurance

- /

- NYSE:BRO

Stephen P Hearn Joins Brown & Brown (NYSE:BRO) As COO After Resigning From Board

Reviewed by Simply Wall St

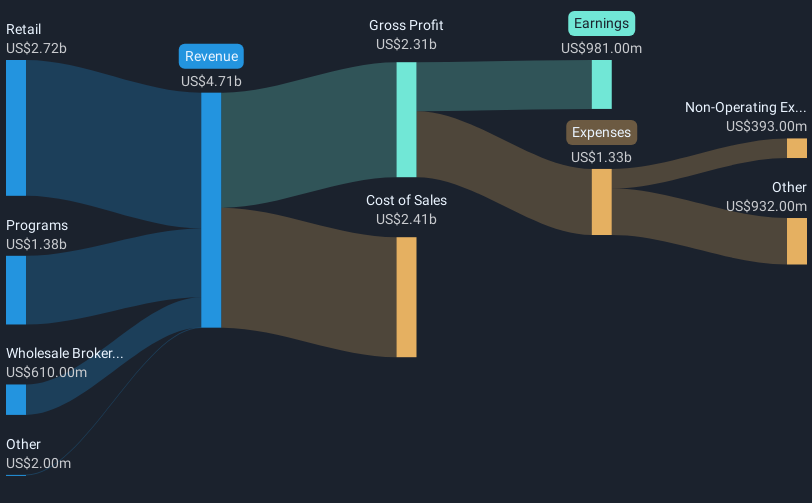

Brown & Brown (NYSE:BRO) saw a 6% increase in its share price over the last month, amid notable events such as the appointment of Stephen P. Hearn as Executive Vice President and COO, bringing his extensive experience to the company's executive team. This leadership change aligns with the company's growth objectives, potentially boosting investor confidence. Furthermore, despite a challenging environment where major indices like the S&P 500 and Nasdaq experienced significant declines due to a tech stock slump and broader investor concerns, Brown & Brown managed to outperform the market. The company's recent earnings report, showing substantial revenue growth year-over-year, may have also supported its stock price. During this period, broader market volatility was pronounced with a 3% market-wide decline, yet Brown & Brown's unique developments and solid financial performance helped it buck the trend and achieve positive returns.

Click here to discover the nuances of Brown & Brown with our detailed analytical report.

Brown & Brown (NYSE:BRO) shareholders enjoyed a total return of 156.59% over the last five years, a testament to the company's robust performance trajectory. This impressive return stems from several key developments. Among them, strategic executive appointments have strengthened leadership, including the recent addition of Stephen P. Hearn to the executive team and board in 2024. These changes have reinforced investor confidence in the company's growth prospects.

The firm's financials have also contributed significantly, with consistent revenue growth, highlighted by quarterly earnings boosts throughout 2024. This financial health, paired with a proactive approach to shareholder returns, evidenced by the 15% increase in dividends in October 2024, plays a pivotal role in fostering long-term investor trust. Furthermore, Brown & Brown has outperformed both the US Market and the US Insurance industry over the past year, showcasing its resilience amid broader economic challenges. The active exploration of acquisition opportunities further reflects its commitment to future growth.

- Unlock the insights behind Brown & Brown's valuation and discover its true investment potential

- Understand the uncertainties surrounding Brown & Brown's market positioning with our detailed risk analysis report.

- Already own Brown & Brown? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives