- United States

- /

- Insurance

- /

- NYSE:AON

What Aon (AON)'s Upgraded Moody’s Outlook Means for Shareholders

Reviewed by Sasha Jovanovic

- In recent days, Moody’s Ratings affirmed Aon plc’s Baa2 senior unsecured debt and Prime-2 commercial paper ratings while raising its outlook to positive, citing improved financial leverage post-NFP acquisition and robust free cash flow generation.

- This outlook revision highlights increased market confidence in Aon’s post-acquisition integration efforts and its ability to sustain operational performance despite ongoing debt and integration challenges.

- We’ll analyze how Moody’s improved credit outlook could influence Aon’s investment narrative, particularly regarding financial stability and growth prospects.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Aon Investment Narrative Recap

To be a shareholder in Aon today, you need to have confidence in the company’s ability to deliver consistent revenue growth and margin expansion, underpinned by its successful integration of the NFP acquisition and prudent leverage management. Moody’s recent upgrade to a positive outlook reflects stronger financial stability, but does not meaningfully alter the biggest risk: the ongoing challenges associated with debt levels and integration, which remain front of mind for investors in the near term.

Among the latest announcements, the continued share buybacks, highlighted by the recent repurchase of 690,593 shares worth US$249.99 million, are particularly relevant as they reinforce commitment to enhancing shareholder value and demonstrate operational flexibility, a potential catalyst for supporting earnings per share as the NFP integration progresses.

However, investors should be aware that despite improved credit outlooks, Aon still faces risks tied to its higher debt burden if cash flows do not...

Read the full narrative on Aon (it's free!)

Aon's outlook anticipates $19.7 billion in revenue and $3.8 billion in earnings by 2028. This reflects a 5.6% annual revenue growth rate and a $1.2 billion increase in earnings from the current level of $2.6 billion.

Uncover how Aon's forecasts yield a $402.67 fair value, a 14% upside to its current price.

Exploring Other Perspectives

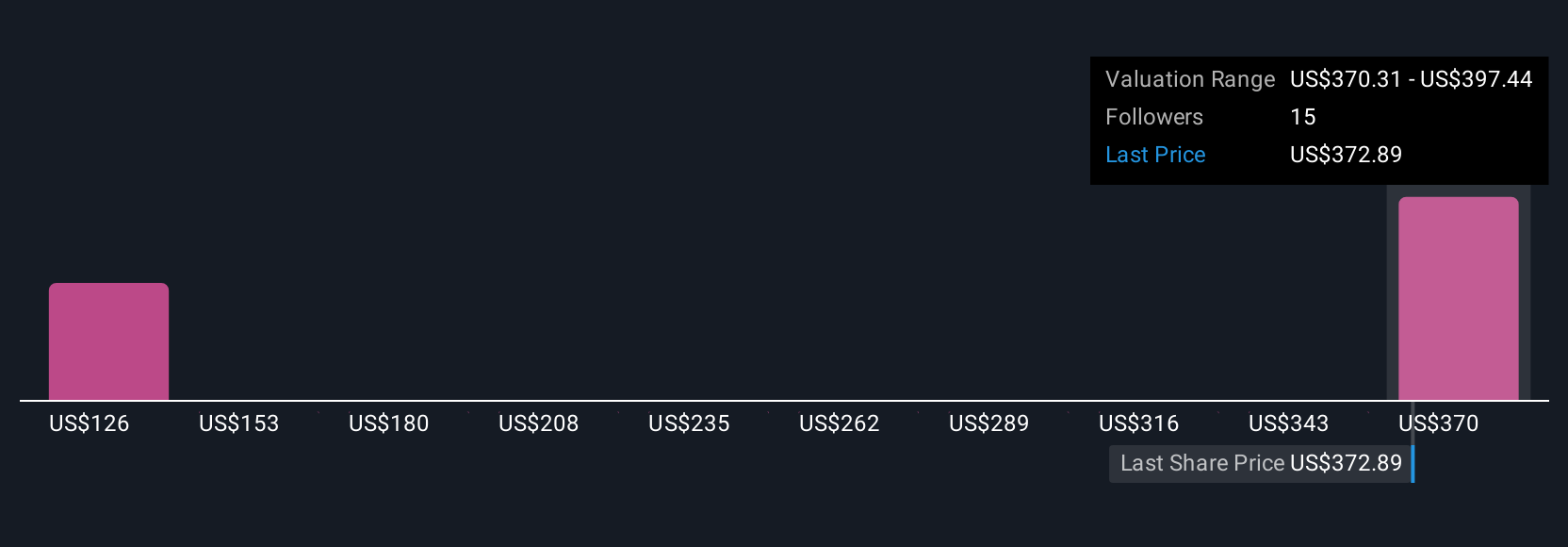

Five individual fair value estimates from the Simply Wall St Community for Aon range from US$347 to over US$18,900 per share. Given ongoing integration risks as shown by recent rating agency commentary, market participants continue to weigh a broad spectrum of scenarios for Aon’s future, there’s always room to explore more viewpoints.

Explore 5 other fair value estimates on Aon - why the stock might be a potential multi-bagger!

Build Your Own Aon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aon's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success