- United States

- /

- Insurance

- /

- NYSE:ALL

Is Allstate’s (ALL) New Scam Protection Benefit Shifting the Digital Security Landscape for Employers?

Reviewed by Sasha Jovanovic

- In November 2025, Allstate announced the launch of Scam Protection as a workplace benefit to address growing digital threats like scams, ransomware, and cryptocurrency theft, offering reimbursement of up to US$50,000 per fraud event and extending coverage to employees' families, including seniors and teens.

- This move comes as cybercrime surges during the holiday season, with Allstate reporting customer savings of US$33.2 million from potential fraud losses last year, highlighting employer demand for comprehensive digital security solutions as part of employee benefits.

- We'll examine how the introduction of Scam Protection enhances Allstate's position amid rising cybercrime and evolving workplace benefits demands.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Allstate Investment Narrative Recap

Owning shares of Allstate often comes down to confidence in its ability to deliver profitable growth through digital innovation and competitive insurance offerings, while managing climate and market risks. Recent board and dividend announcements do not materially affect the key short-term catalyst, continued rollout and adoption of digitally enabled products, nor do they shift focus away from the biggest risk facing Allstate: increased catastrophe losses and their potential impact on underwriting results.

Among the recent updates, Allstate's estimated US$83 million in October catastrophe losses stands out. This figure highlights the ongoing challenges and volatility faced in property and casualty insurance, underscoring the importance of monitoring weather patterns and catastrophe exposure given industry-wide climate impacts.

Yet, despite new digital product launches, the persistent threat of increased catastrophe losses remains something every investor should pay close attention to, especially as...

Read the full narrative on Allstate (it's free!)

Allstate's narrative projects $76.3 billion revenue and $4.3 billion earnings by 2028. This requires 4.9% yearly revenue growth and a $1.4 billion decrease in earnings from $5.7 billion today.

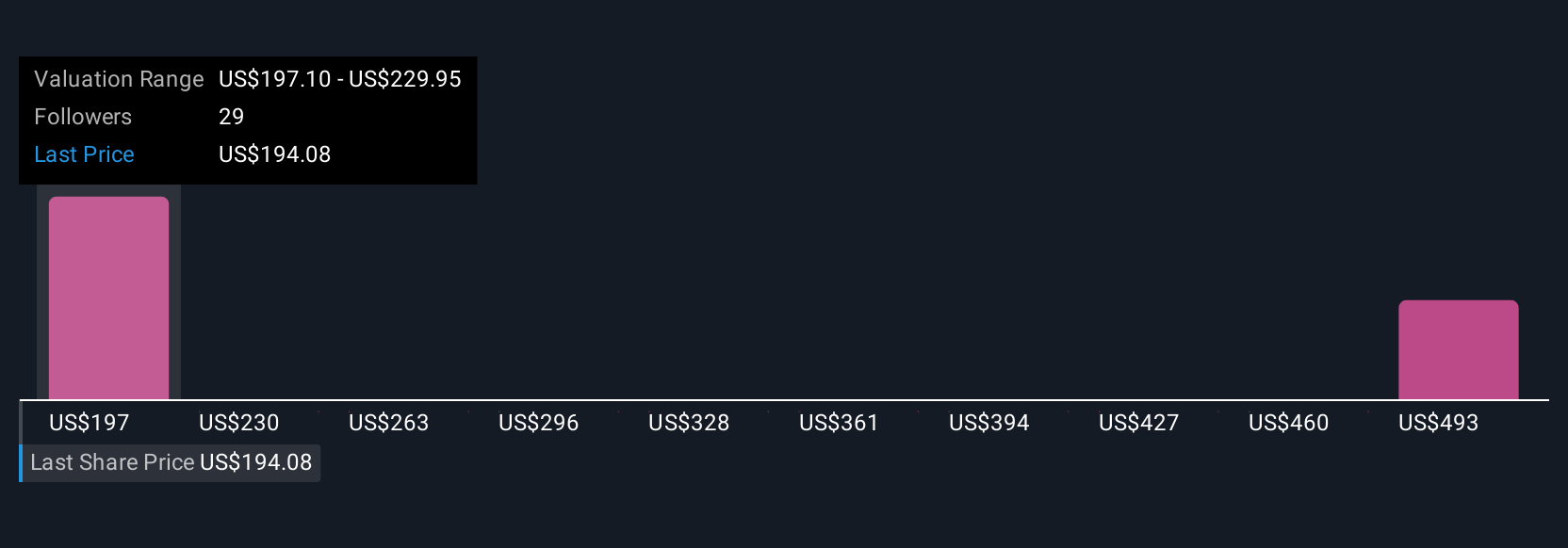

Uncover how Allstate's forecasts yield a $236.10 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five private investors in the Simply Wall St Community estimate Allstate’s fair value from US$188 to US$680, highlighting a wide span of expectations. With catastrophe risks in focus following recent events, you can review each perspective for further insight on where the company might go next.

Explore 5 other fair value estimates on Allstate - why the stock might be worth 10% less than the current price!

Build Your Own Allstate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allstate research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allstate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allstate's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026