- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG) One-Off $602M Loss Challenges Bull Case Despite Margin Gains

Reviewed by Simply Wall St

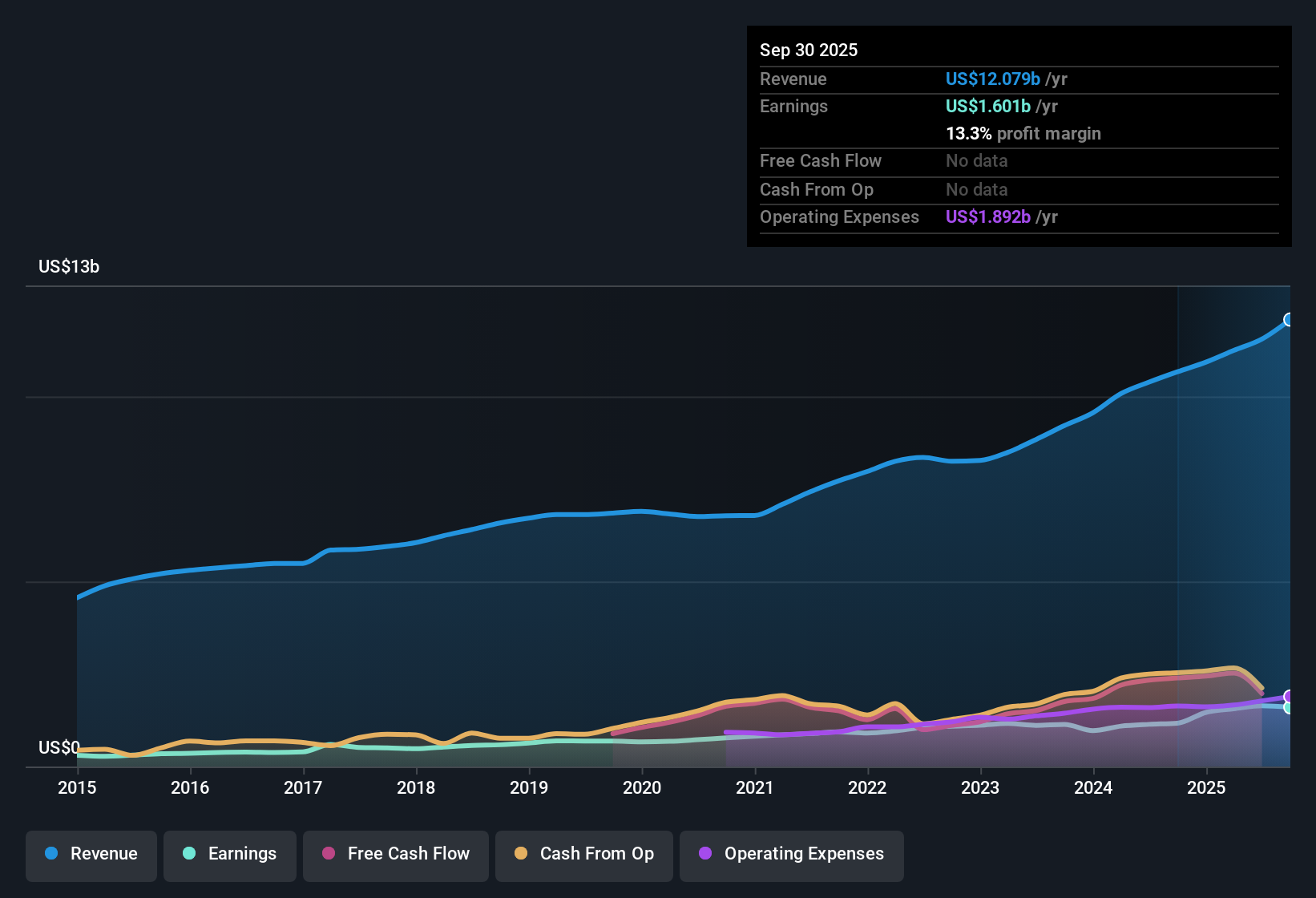

Arthur J. Gallagher (AJG) reported annual earnings growth of 13.1% over the past five years, but its most recent period delivered a standout 36.6% jump, according to new filings. Net profit margins expanded to 12.9% from 11% a year ago, and the company is forecasting revenue growth of 17.6% per year going forward. With ongoing earnings growth forecast at 19.4% per year and margins on the rise, investors will now weigh these metrics alongside a recent one-off $602.3 million loss and a valuation that sits well above the estimated fair value.

See our full analysis for Arthur J. Gallagher.Next, we will check how these headline numbers compare to the major narratives that investors and analysts have built around AJG’s story.

See what the community is saying about Arthur J. Gallagher

Recurring, Higher-Margin Revenue Drives the Story

- Analysts expect Arthur J. Gallagher’s profit margins to rise from 14.2% today to 17.7% in three years, pointing to stronger recurring income as the company increases its focus on specialized, data-driven solutions for complex risks and employee benefits.

- According to the analysts' consensus view, the company’s recurring, higher-margin revenue model not only supports profit growth but also provides resilience as businesses increasingly seek tailored insurance amid regulatory pressures and evolving risks.

- This shift is further reinforced by broad adoption of digital tools and early AI projects. Both have already delivered measurable efficiency improvements and margin expansion for AJG.

- Ongoing demand growth for advisory and benefits solutions helps the company diversify away from more cyclical lines, leading to improved earnings durability even when traditional insurance markets face volatility.

What’s behind these efficiency gains, and could digital initiatives deliver even greater upside? Read the full Arthur J. Gallagher Consensus Narrative. 📊 Read the full Arthur J. Gallagher Consensus Narrative.

M&A Pipeline: Expansion and Risks

- Analysts forecast the number of shares outstanding to increase by 7% per year for the next three years, a sign that ongoing acquisitions like Assured Partners continue to shape AJG’s growth trajectory.

- Analysts' consensus view highlights that while active M&A broadens the company’s geographic reach and client base, it also introduces risk from integration challenges, potential delays, or even regulatory scrutiny.

- Bears caution that overreliance on acquisitions raises the odds of not achieving cost synergies, possibly limiting future margin expansion and earnings growth against expectations.

- Despite these risks, a robust M&A track record and discipline have helped AJG deliver both organic and inorganic growth that outpaces much of the broader insurance market.

Valuation: Premium to Fair Value and Peers

- With a current share price of $249.49, Arthur J. Gallagher trades more than 56% above its DCF fair value of $159.26 and at a PE ratio of 40x, well above the US insurance industry average of 14.3x and the 37.3x ratio analysts would expect for 2028 earnings.

- The analysts' consensus view warns that this valuation premium means investors will need to believe in delivery of long-term profit and revenue growth, and also be comfortable with possible volatility as both analyst price targets and market sentiment show some disagreement about just how far AJG’s outperformance can go.

- Despite a current analyst consensus price target of $327.07, the share price already reflects significant optimism for continued margin gains and top-line growth.

- Trading at higher multiples than both peers and its own fair value puts extra pressure on the company to hit its ambitious growth projections in the years ahead.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arthur J. Gallagher on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own interpretation of the numbers? Share your perspective and craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Arthur J. Gallagher’s premium valuation and reliance on future high growth leave investors exposed if the company misses ambitious targets or faces market volatility.

Want more value for your investment? Shift your focus to these 832 undervalued stocks based on cash flows that are trading below fair value and offer potential upside with less valuation risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives