- United States

- /

- Insurance

- /

- NYSE:AIZ

Assessing Assurant (AIZ) Valuation After Q3 2025 Beat, Guidance Raise and Continued Buybacks

Reviewed by Simply Wall St

Assurant (AIZ) just cleared a key hurdle for investors, surpassing third quarter 2025 expectations on both net operating income and revenue, while raising its full year guidance and keeping buybacks firmly in play.

See our latest analysis for Assurant.

The market reaction has been measured so far, with the share price at $222.87 and a modest 90 day share price return of 5.54%, but the standout 3 year total shareholder return of 79.98% suggests longer term momentum remains firmly intact.

If Assurant’s steady compounding has caught your eye, this could be a good moment to see what else fits a durable growth profile via fast growing stocks with high insider ownership.

Yet with the shares still trading below analyst targets and a hefty intrinsic value gap implied, investors now face a key question: is Assurant quietly undervalued, or are markets already baking in years of future growth?

Most Popular Narrative: 12.1% Undervalued

With the narrative fair value sitting comfortably above Assurant’s last close, the gap hinges on how convincingly future margins and earnings can compound.

Improved long term earnings visibility, supported by disciplined underwriting and expense control, is seen as enhancing the company’s ability to compound book value and support ongoing capital returns. Execution on strategic initiatives, including portfolio optimization and focus on higher margin segments, is viewed as a key driver that can keep returns on equity above sector averages despite a softer cycle ahead.

Want to see how steady mid single digit growth, rising margins, and a leaner share count are translated into today’s valuation call? The full narrative lays out the exact earnings runway, the implied future multiple, and the capital return playbook that must all line up for this fair value to hold.

Result: Fair Value of $253.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny of lender placed insurance, along with intensifying digital competition from tech and insurtech players, could still challenge Assurant’s margin and growth narrative.

Find out about the key risks to this Assurant narrative.

Another Angle: Valuation Looks Richer On Earnings

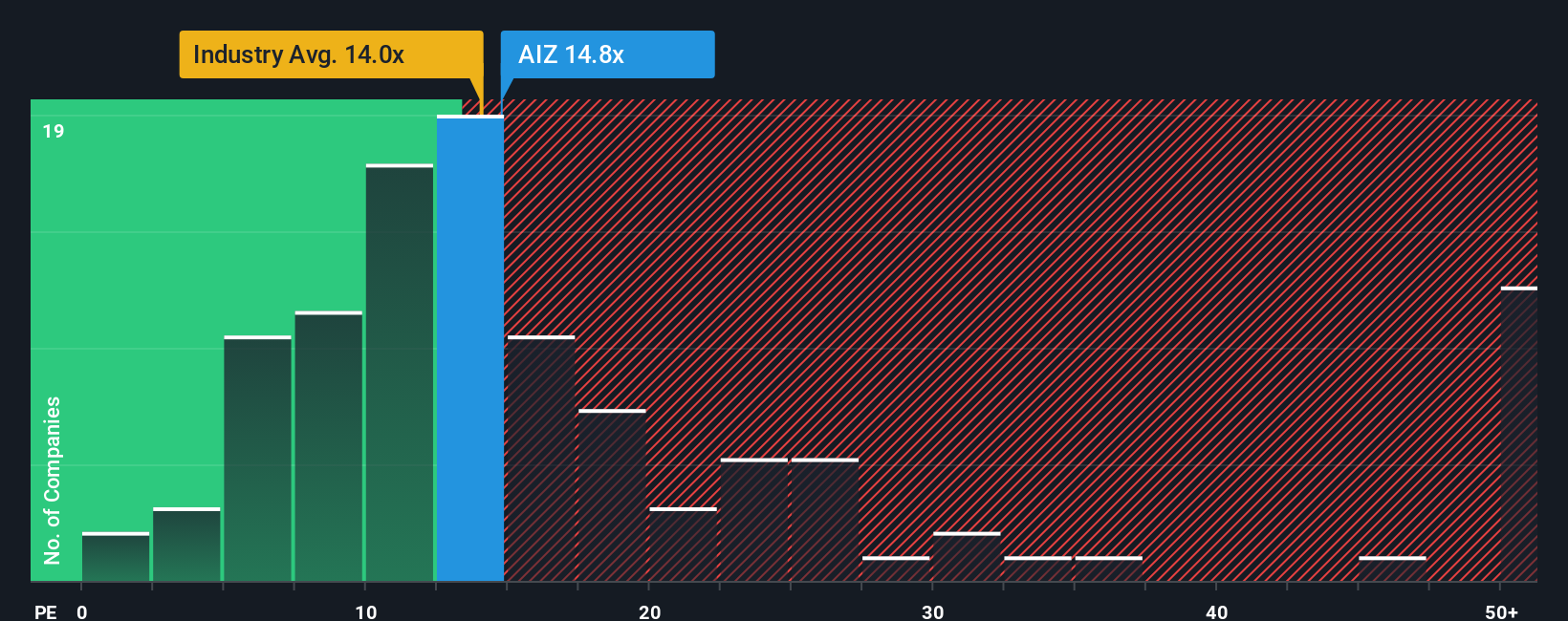

While our narrative fair value points to upside, the simple price to earnings lens sends a cooler signal. Assurant trades on 13.1 times earnings, above both its peer average of 11.5 times and the US Insurance industry at 12.8 times, even though its fair ratio sits higher at 15.2 times.

This gap suggests some valuation risk in the near term if sentiment softens, but also room for the market to re rate closer to that fair ratio if earnings keep compounding. Which way it breaks may depend on how much confidence you have in margins and capital returns holding up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Assurant Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Assurant.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to pinpoint your next smart idea before the crowd closes the gap.

- Target reliable cash generators by checking out these 15 dividend stocks with yields > 3% that aim to balance income today with resilience tomorrow.

- Position yourself early in transformative innovation by reviewing these 26 AI penny stocks reshaping business with intelligent automation and data driven products.

- Sharpen your value strategy by scanning these 908 undervalued stocks based on cash flows where prices still trail underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026