- United States

- /

- Insurance

- /

- NYSE:AHL

Aspen Insurance Holdings (NYSE:AHL): Exploring Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Something is catching investors’ eyes at Aspen Insurance Holdings (NYSE:AHL) lately, and it is not because of a headline-grabbing event. The company’s share price has jumped sharply over the past month, rising over 27% despite the absence of any major corporate developments. This kind of move can raise questions about whether the market sees signals beneath the surface or if momentum is just picking up pace.

Looking at the bigger picture, Aspen Insurance Holdings has achieved a 13% gain year-to-date, with much of that upward swing occurring in recent weeks. The earlier part of the year saw relatively modest returns, and the recent upward trend comes with a backdrop of annual revenue and net income growth. While longer-term numbers are less visible, it is apparent the stock has moved from a quieter period into a phase where momentum is building.

Now, with this sharp move in the past, investors may be considering whether Aspen Insurance Holdings could see further gains, or if the market is already reflecting expectations for what is ahead.

Price-to-Earnings of 10.1x: Is it justified?

Aspen Insurance Holdings is currently trading at a price-to-earnings (P/E) ratio of 10.1, which is below both the peer average (11.5x) and the US Insurance industry average (14.4x). This indicates the stock could be undervalued compared to similar companies in its sector.

The P/E ratio gives investors a snapshot of how much they are paying for one dollar of earnings. In the insurance industry, it is a widely used measure to assess whether a company’s stock price reflects its underlying profitability and growth prospects.

Given that Aspen Insurance Holdings' ratio is comfortably below its peers, this suggests that the market may not be fully factoring in the company’s recent earnings quality and improved profitability over the past several years. The low multiple could point to a potential undervaluation if current earnings momentum continues.

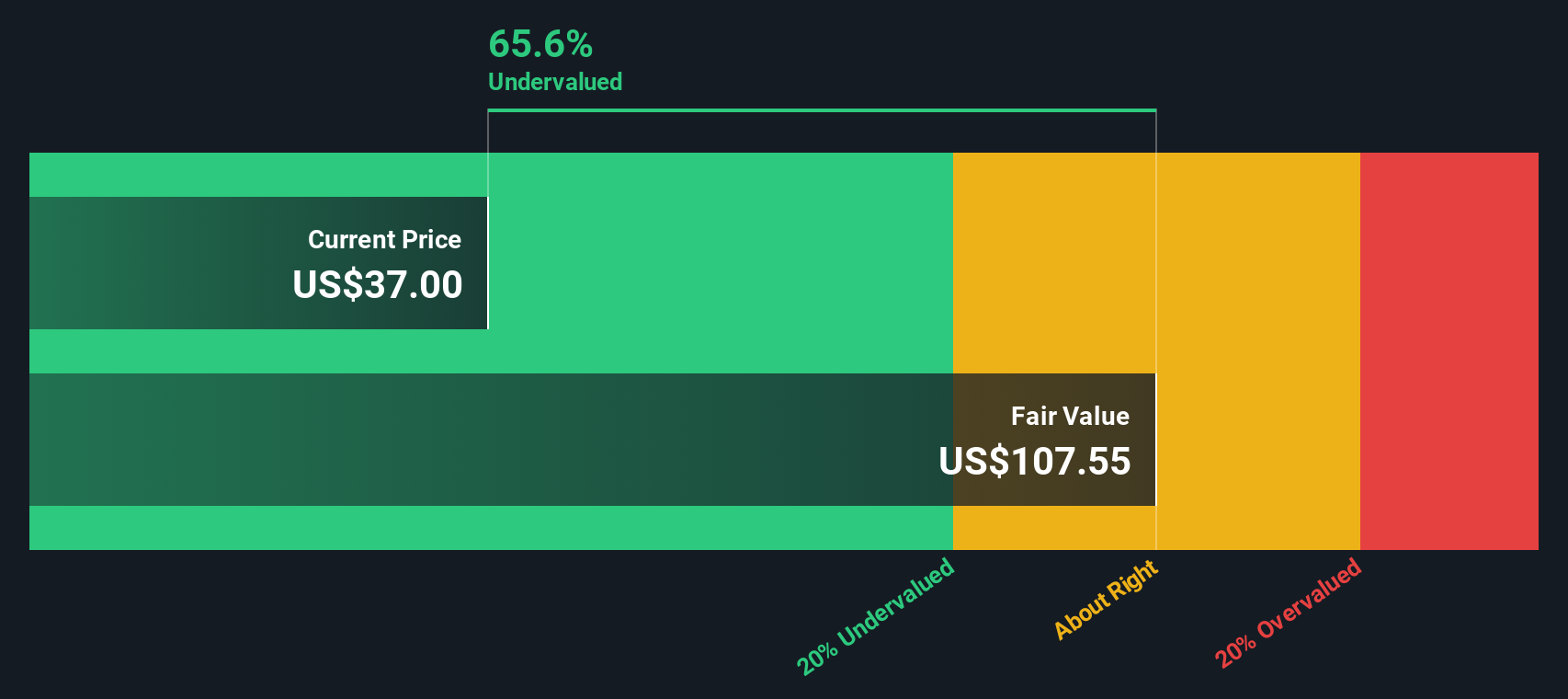

Result: Fair Value of $36.69 (UNDERVALUED)

See our latest analysis for Aspen Insurance Holdings.However, any slowdown in revenue growth or unexpected shifts in insurance market trends could quickly challenge the current optimism around Aspen’s valuation.

Find out about the key risks to this Aspen Insurance Holdings narrative.Another View: What Does the SWS DCF Model Say?

Looking at things from a different angle, our DCF model also points to Aspen Insurance Holdings being undervalued at present. However, this approach relies on projecting future cash flows, which can introduce its own set of uncertainties. Is the market missing an opportunity or is it accounting for hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aspen Insurance Holdings Narrative

If you'd like to form your own perspective or prefer independent research, you can explore the data and build your personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Aspen Insurance Holdings.

Looking for More Investment Ideas?

You do not want to miss out on stocks making waves across new technology, untapped value, and dependable income. Put your research to work with these handpicked opportunities and see what the market could be offering next.

- Spot hidden gems among undervalued companies based on cash flows and stay ahead of the crowd with undervalued stocks based on cash flows.

- Prepare for tomorrow’s tech breakthroughs by tracking visionary teams driving artificial intelligence forward with AI penny stocks.

- Discover reliable returns with companies offering robust dividend yields that could help build a stronger, income-focused portfolio thanks to dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:AHL

Aspen Insurance Holdings

Engages in the insurance and reinsurance businesses in Australia, Asia, the United Kingdom, Ireland, rest of Europe, the United States, Canada, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success