- United States

- /

- Insurance

- /

- NYSE:AFL

Aflac (AFL) Valuation in Focus After Recent Momentum and Long-Term Shareholder Gains

Reviewed by Simply Wall St

See our latest analysis for Aflac.

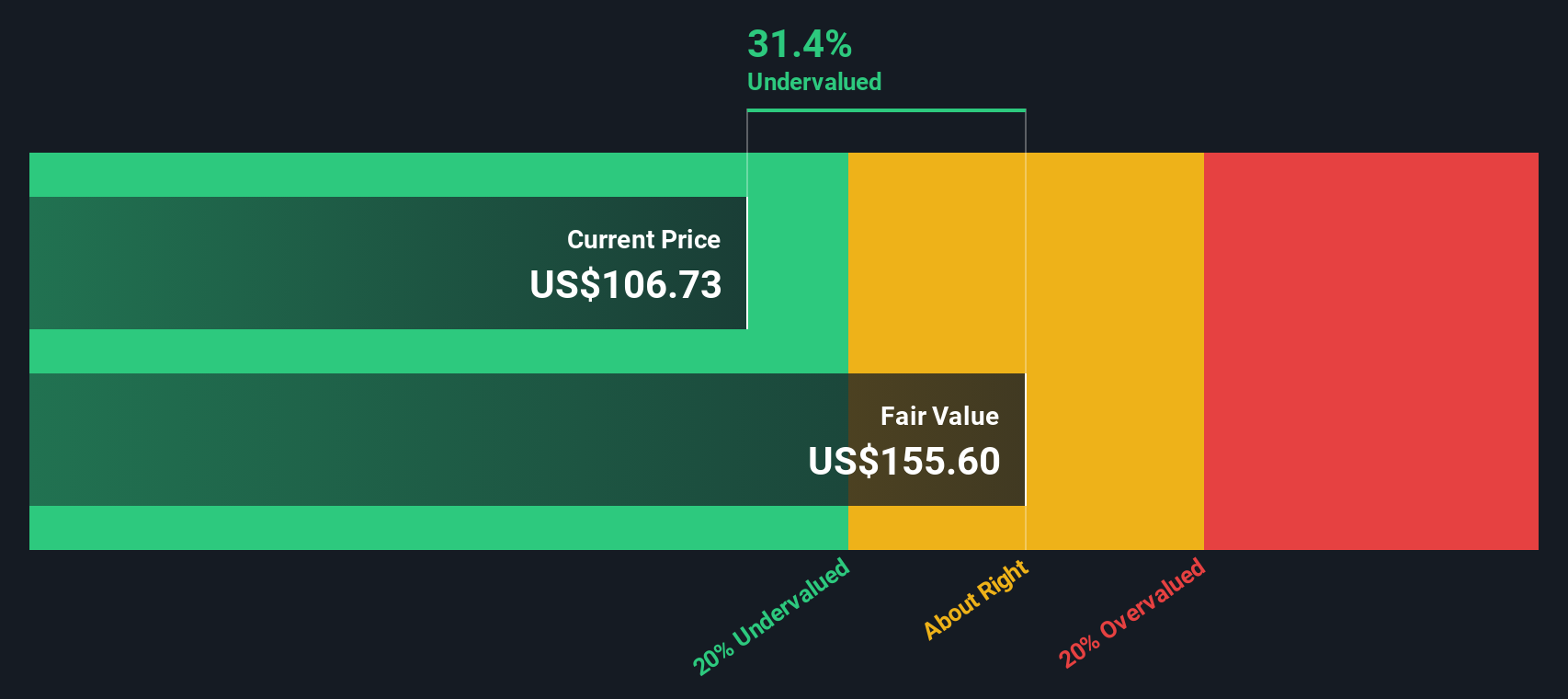

It has been a steady run for Aflac, with recent momentum building as the share price climbed 4.6% over the past week and notched an 11.2% gain year-to-date. While short-term price movement has been positive, Aflac’s 5-year total shareholder return of 196% really highlights the long-term value creation on offer.

If you’re curious what else is catching market attention right now, this could be the perfect moment to expand your perspective and discover fast growing stocks with high insider ownership

With Aflac’s steady share gains and robust long-term returns, investors are left to consider if current valuations reflect all future prospects or if there could still be an opportunity for further upside from here.

Most Popular Narrative: 3% Overvalued

The most widely followed narrative values Aflac at $110 per share, a touch below its recent close around $114. This perspective aggregates the key catalysts and hesitations shaping analyst consensus on fair value today.

The analysts have a consensus price target of $108.077 for Aflac based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $124.0, and the most bearish reporting a price target of just $99.0.

Ever wondered which projections are powering this narrow fair value gap? The answer lies in firm profit margin forecasts and a valuation multiple that is higher than many of its peers. Want to discover what critical assumptions drive this narrative? Unlock the deeper story behind this price target now.

Result: Fair Value of $110 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in Aflac's core Japanese premiums and lingering challenges in U.S. sales growth remain clear risks that could challenge the bullish outlook.

Find out about the key risks to this Aflac narrative.

Another View: Discounted Cash Flow Upside

While analysts see Aflac as slightly overvalued using consensus price targets, our SWS DCF model presents a very different picture. The DCF method values Aflac shares at $237, which is more than double the current price. This suggests considerable upside if you accept these long-term cash flow assumptions. Could this disconnect signal a missed opportunity, or are the risks already reflected in the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aflac for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aflac Narrative

If you’d like to take a different approach or prefer hands-on analysis, you can put together an alternative viewpoint in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Aflac.

Looking for More Investment Ideas?

Don’t wait on the sidelines while opportunities pass you by. Use these powerful screeners to pinpoint stocks with exciting potential you might be missing.

- Tap into breakthrough tech trends and seize early growth by reviewing these 26 AI penny stocks which are reshaping industries with innovative applications in artificial intelligence.

- Unlock valuable income streams by checking out these 15 dividend stocks with yields > 3% that offer attractive yields and the potential for dependable returns.

- Step ahead of the crowd and uncover hidden value through these 872 undervalued stocks based on cash flows which could be poised for a strong comeback based on proven cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives