- United States

- /

- Insurance

- /

- NYSE:AFL

Aflac (AFL) Is Up 6.7% After Strong Earnings and Dividend Declaration—What's Changed?

Reviewed by Sasha Jovanovic

- Aflac’s board recently declared a fourth quarter dividend of US$0.58 per share, payable December 1, 2025, to shareholders of record as of November 19, alongside announcing third quarter results that saw revenue rise to US$4.74 billion and net income reach US$1.64 billion, compared to a net loss a year earlier.

- In addition to strong quarterly results and ongoing share buybacks, the company’s dividend affirmation underscores Aflac’s continued emphasis on shareholder returns and financial stability.

- We’ll explore how Aflac’s significantly improved quarterly earnings support its long-term investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Aflac Investment Narrative Recap

To be comfortable owning Aflac, investors must believe in its ability to maintain and grow its supplemental health insurance franchise, especially in Japan, even as premium growth faces near-term headwinds. The latest dividend affirmation and stronger-than-expected third quarter results are encouraging, but they do not materially change the central short-term catalyst: whether new product launches and recent digital transformation efforts translate into sustained topline improvement. The biggest risk remains Japan’s ongoing negative premium growth and exposure to currency fluctuations, which can introduce volatility regardless of headline profitability.

Among recent announcements, Aflac’s share buyback activity stands out as especially relevant. Having repurchased over 9 million shares for US$1,000 million in the last quarter alone, the company shows a strong commitment to shareholder returns, even as it works to counterbalance some of the revenue pressures in its core Japanese market.

However, against the backdrop of these positives, investors should not overlook the risk posed by continued declines in Japanese premium income and the impact on future revenue...

Read the full narrative on Aflac (it's free!)

Aflac's outlook anticipates $18.5 billion in revenue and $3.8 billion in earnings by 2028. This relies on a 5.1% annual revenue growth rate and a $1.4 billion increase in earnings from the current $2.4 billion.

Uncover how Aflac's forecasts yield a $110.00 fair value, a 4% downside to its current price.

Exploring Other Perspectives

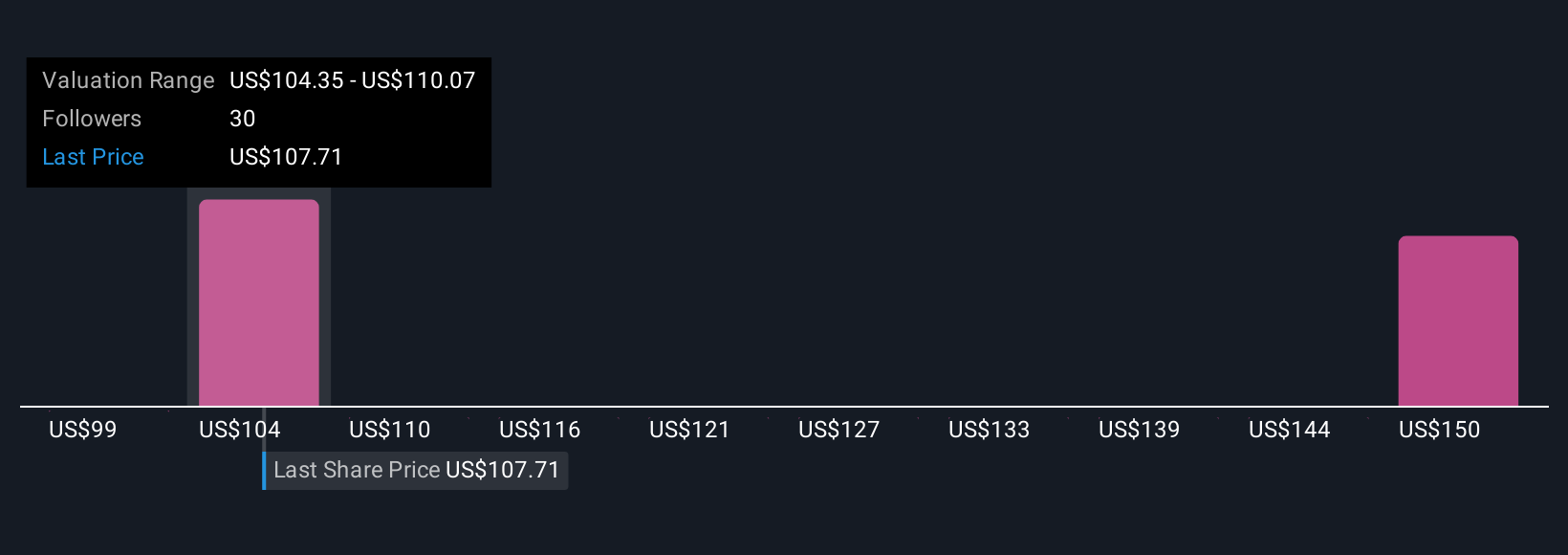

Fair value estimates from three Simply Wall St Community members span US$98.64 to US$163.61, highlighting substantial disagreement on Aflac’s outlook. With Japanese premium growth under pressure, it is important to review multiple viewpoints for a fuller picture.

Explore 3 other fair value estimates on Aflac - why the stock might be worth 14% less than the current price!

Build Your Own Aflac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aflac research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Aflac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aflac's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives