- United States

- /

- Insurance

- /

- NYSE:AFG

Assessing American Financial Group’s Valuation After Expanded Share Repurchase Authorization Through 2030

Reviewed by Simply Wall St

American Financial Group (AFG) just expanded its share repurchase authorization by 5 million shares and extended the program to 2030, a shareholder-friendly move that tightens supply and underscores management confidence.

See our latest analysis for American Financial Group.

Despite the fresh buyback news, American Financial Group’s recent share price performance has been subdued, with a 30 day share price return of minus 7.47 percent and a one year total shareholder return of minus 1.52 percent. However, its five year total shareholder return of 159.28 percent suggests the long term wealth creation story is still intact even as short term momentum has cooled.

If this kind of capital return story has you thinking more broadly about opportunities in insurance and beyond, it could be a good time to explore fast growing stocks with high insider ownership.

With the stock trading at a small discount to analyst targets but a hefty implied intrinsic discount, investors now face a critical question: Is American Financial Group undervalued after this pullback, or is future growth already baked in?

Most Popular Narrative: 5.2% Undervalued

With American Financial Group closing at $132.38 versus a narrative fair value of $139.60, the spread is modest but directionally supportive of upside.

The combination of higher interest rates, which are boosting net investment income on the $16B portfolio, and continued strong capital management with regular dividends and share buybacks is expected to enhance bottom-line earnings and support per-share earnings growth.

Read the complete narrative. Read the complete narrative.

Want to see how shrinking share count, rising margins and steady earnings growth all fuse into that valuation call? The key assumptions may surprise you.

Result: Fair Value of $139.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising catastrophe losses and volatile alternative investment returns could pressure margins and derail the earnings and valuation trajectory implied by today’s narrative.

Find out about the key risks to this American Financial Group narrative.

Another Lens on Value

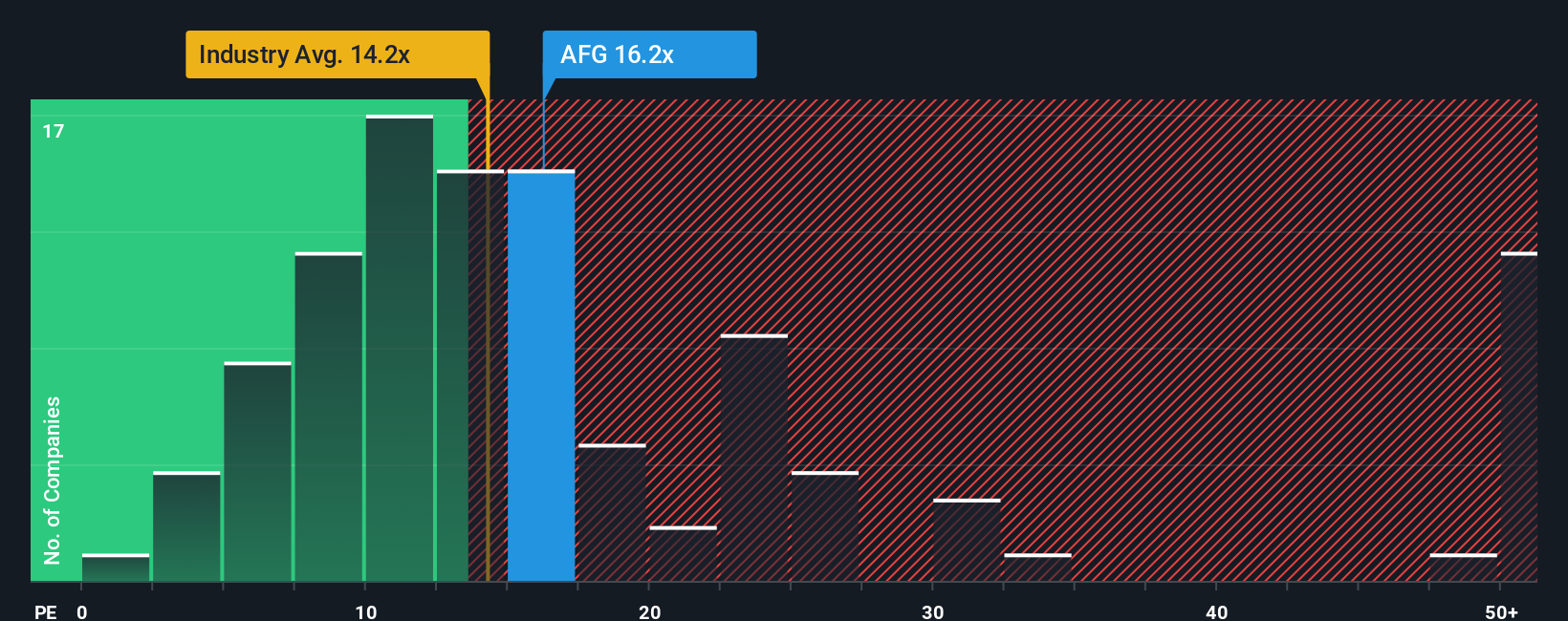

While the consensus narrative sees American Financial Group only 5.2 percent undervalued, its 13.8 times earnings multiple looks richer than both peers at 12.7 times and a fair ratio of 14.9 times. This suggests less of a bargain and more of a balancing act for new buyers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Financial Group Narrative

If you are skeptical of this view or simply prefer hands on research, you can build a custom narrative in minutes: Do it your way.

A great starting point for your American Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunity with fresh ideas from our screeners so potential winners do not slip past your radar.

- Review these 3582 penny stocks with strong financials to find early growth stories with solid financial foundations instead of purely speculative names.

- Use these 27 AI penny stocks to identify companies involved in automation, data intelligence, and real world AI adoption.

- Explore these 15 dividend stocks with yields > 3% to find income-focused ideas that combine attractive yields with sustainable payout ratios and stable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFG

American Financial Group

An insurance holding company, provides specialty property and casualty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026