- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Should WTW (Willis Towers Watson) Leadership Changes and Wildfire Risk Partnership Require Action From WTW Investors?

Reviewed by Simply Wall St

- In recent developments, Willis Towers Watson announced a series of senior executive appointments within its insurance consulting and technology unit, and unveiled a new partnership with the University of East Anglia to advance wildfire risk insights for the insurance industry.

- This focus on leadership expertise and addressing complex, evolving climate risks signals an effort to enhance the company's position in insurance advisory and risk management solutions.

- We’ll explore how the wildfire risk collaboration could influence Willis Towers Watson's investment narrative and innovation strategy moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Willis Towers Watson Investment Narrative Recap

To be a shareholder in Willis Towers Watson right now, you need to believe the company’s depth in insurance consulting and risk management technology can deliver growth despite economic uncertainty and competitive pressures. The recent wave of leadership appointments and the new wildfire risk partnership reinforce WTW’s focus on specialized expertise, but neither appears likely to quickly resolve the company’s main near-term catalyst, regaining consistent revenue growth amid clients’ caution in discretionary spending. These moves, while promising for the long run, do not meaningfully mitigate the risk around client delays or macro-driven headwinds for now.

Among the recent announcements, the partnership with the University of East Anglia to enhance wildfire risk insights stands out for its relevance to WTW’s core strategy. As wildfires become a more significant and unpredictable insurance peril, WTW’s ability to offer new analytical tools and advisory services could support its position as a trusted advisor in an evolving risk environment, essential for driving future business and market share, particularly as clients look for help navigating emerging threats in real time.

However, in contrast to ongoing innovation, the persistent risk of client discretion due to geopolitical and economic uncertainties is something investors should be especially aware of...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's outlook anticipates $10.8 billion in revenue and $2.8 billion in earnings by 2028. This scenario assumes a 3.1% annual revenue growth rate and a $2.85 billion increase in earnings from the current level of -$53.0 million.

Exploring Other Perspectives

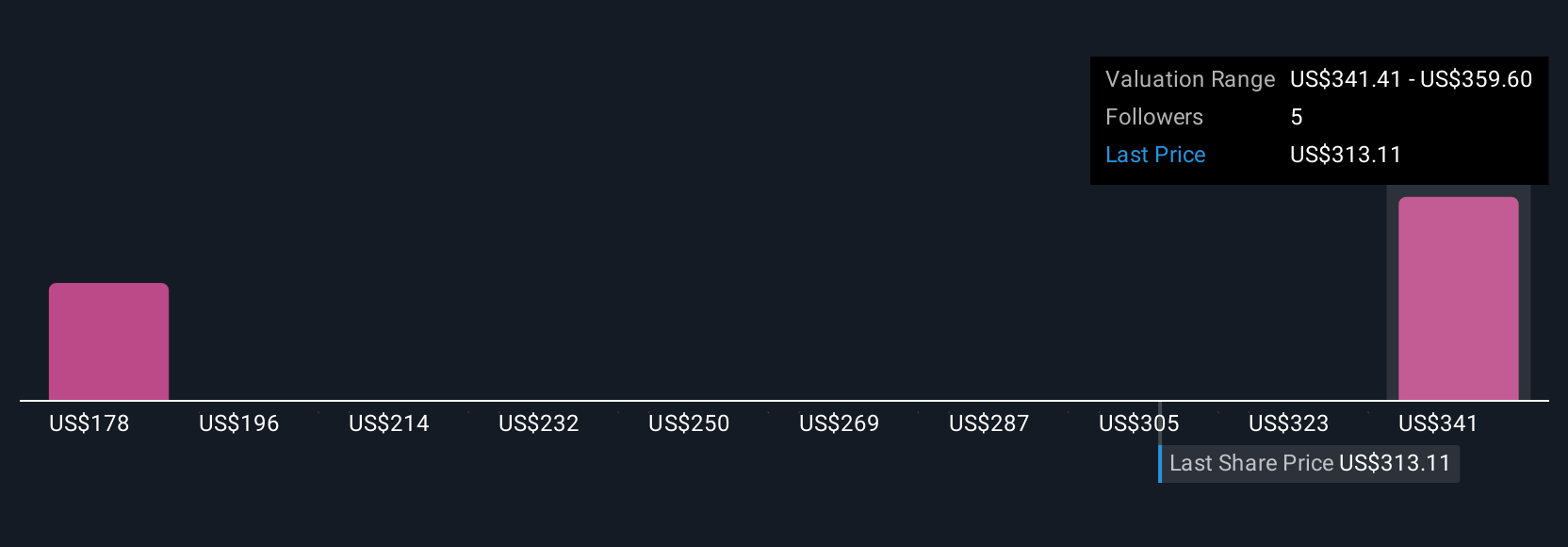

Simply Wall St Community users contributed 2 fair value estimates ranging from US$177.74 to US$364.02 per share. While some see significant upside, others emphasize risks such as clients delaying discretionary advisory work, highlighting how the outlook for WTW’s performance can vary depending on the assumptions you make.

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

No Opportunity In Willis Towers Watson?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives