- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Is Climate Risk Innovation Expanding the Long-Term Growth Story for Willis Towers Watson (WTW)?

Reviewed by Sasha Jovanovic

- The Government of the Philippines, along with Rare and Willis (a WTW business), announced the launch of the country's first parametric insurance solution for small-scale fishers to provide timely financial protection against income loss from adverse weather conditions.

- This initiative signals the expanding use of innovative insurance products to support both climate resilience and sustainable livelihoods for vulnerable communities.

- We'll examine how this move into climate risk solutions for underserved markets may influence Willis Towers Watson's long-term growth narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Willis Towers Watson Investment Narrative Recap

To be a shareholder in Willis Towers Watson today, you generally need to believe in the company's ability to expand its portfolio of advanced risk solutions and advisory services globally, especially in areas like climate risk and underserved markets. The recent launch of parametric insurance for small-scale fishers in the Philippines highlights WTW's commitment to innovation and opening new revenue streams, though it is not likely to be a material short-term catalyst or risk at this stage.

Of the recent announcements, the launch of the Radar Connector for Snowflake stands out as most relevant in context of this climate coverage initiative, reflecting WTW's emphasis on deploying data-driven, scalable technology. These efforts speak directly to the company's focus on strengthening its competitive edge through analytics and specialized product offerings, which has been highlighted as a primary growth catalyst.

However, investors should also be aware that if adoption of AI-driven platforms accelerates faster in the insurance sector, WTW could be exposed to...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's narrative projects $10.9 billion revenue and $2.5 billion earnings by 2028. This requires 3.7% yearly revenue growth and a $2.36 billion increase in earnings from $137.0 million currently.

Uncover how Willis Towers Watson's forecasts yield a $371.61 fair value, a 15% upside to its current price.

Exploring Other Perspectives

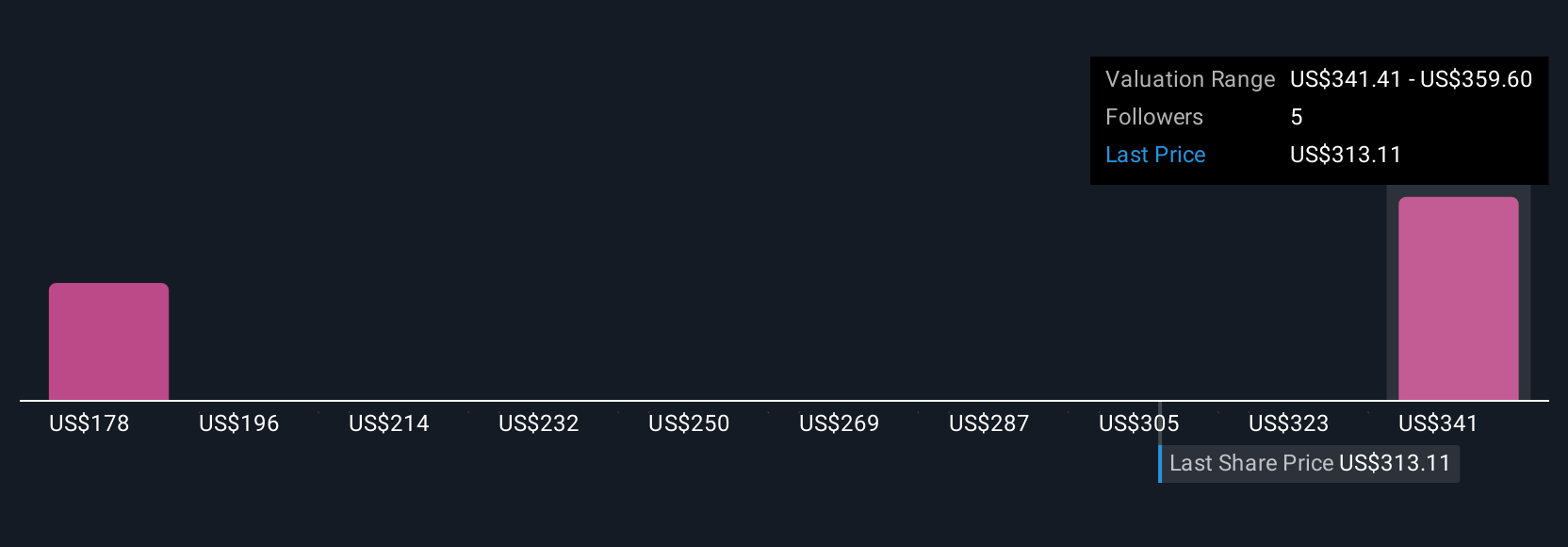

Simply Wall St Community members provided two fair value estimates for WTW ranging from US$371.61 to US$392.29 per share. With digital automation identified as a key risk, consider how shifts in sector technology could reshape company prospects and see how your outlook compares.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth just $371.61!

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives