- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

Will Trupanion's (TRUP) Return to Profitability Reshape Its Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- Trupanion reported strong third quarter results for 2025, posting a net income of US$5.87 million, up significantly from US$1.43 million a year earlier, and turning a year-to-date net loss into a net income of US$13.8 million.

- This positive swing in profitability comes alongside the company's expansion of credit facilities and continued partnerships, highlighting operational improvements that contrast with prior analyst expectations.

- We'll examine how Trupanion's improved profitability in the latest quarter impacts its long-term investment outlook and risk profile.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Trupanion Investment Narrative Recap

To be a Trupanion shareholder, you need to believe in the company's ability to translate pet ownership trends and improving operational efficiency into sustained subscriber and earnings growth, while managing competitive pricing and retention risks. The recent return to profitability has a positive impact on sentiment and may help support near-term confidence; however, this shift is not likely to alter the most important catalyst, subscriber growth, or meaningfully mitigate concerns over pricing sensitivity and core segment growth rates. The biggest current risk remains muted gross pet additions, which recent results do not fully resolve.

Among recent announcements, Trupanion's renewed credit facility with PNC Bank is most relevant because it provides greater financial flexibility, supporting investment in marketing, acquisition channels, and operational initiatives that could influence future subscriber momentum. While improved access to capital can bolster strategic options, it does not directly address the reliance on pricing over volume for growing top-line revenue.

Yet, despite improved profitability, investors should not lose sight of the underlying risk if subscriber growth fails to rebound...

Read the full narrative on Trupanion (it's free!)

Trupanion's narrative projects $1.7 billion in revenue and $17.4 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $6.4 million earnings increase from the current $11.0 million.

Uncover how Trupanion's forecasts yield a $56.50 fair value, a 46% upside to its current price.

Exploring Other Perspectives

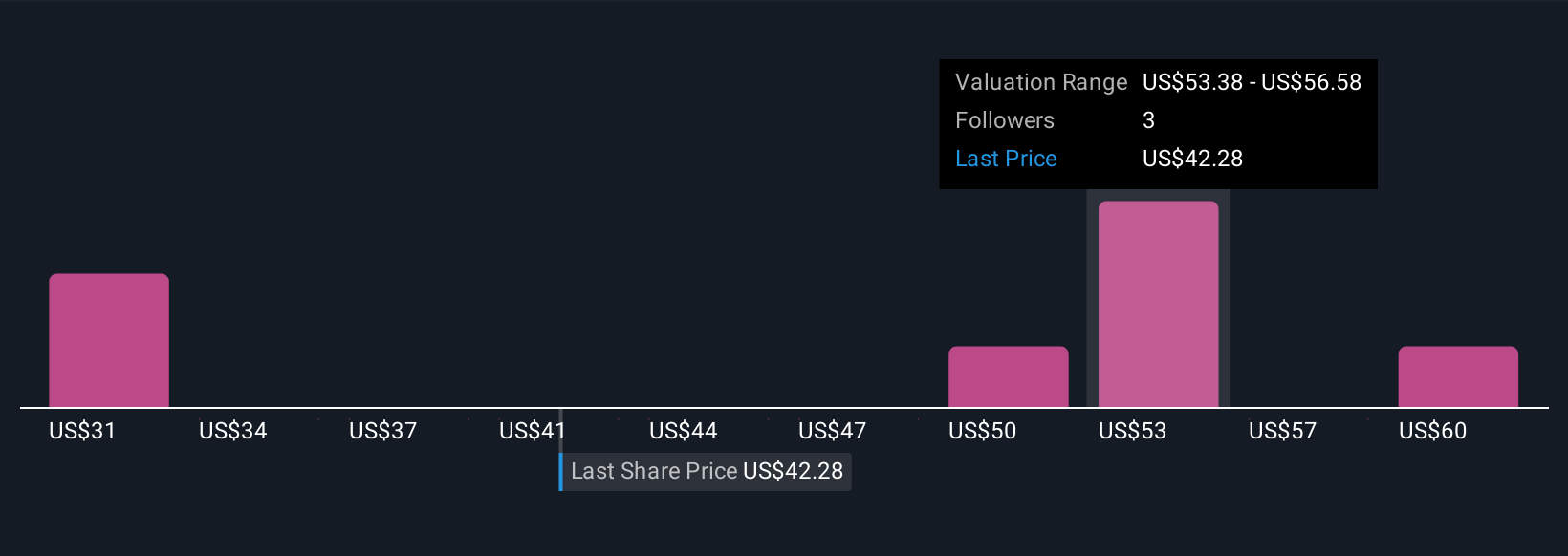

Simply Wall St Community members recently estimated Trupanion’s fair value between US$31 and US$62.97, based on five independent analyses. With so much variation, your own view on subscriber growth sustainability could greatly influence where you stand.

Explore 5 other fair value estimates on Trupanion - why the stock might be worth as much as 63% more than the current price!

Build Your Own Trupanion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Trupanion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trupanion's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives