- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

Trupanion (TRUP): Evaluating Valuation After Record Operating Income, Strong Pet Growth, and New Partnerships

Reviewed by Simply Wall St

Trupanion (TRUP) drew attention this week after reporting record subscription adjusted operating income and improved margins, supported by strong net pet additions and higher customer retention. The company also secured a sizable new credit facility and formed new brand partnerships.

See our latest analysis for Trupanion.

Trupanion’s recent string of positive operating updates has played out against a backdrop of notable volatility. Even with record-high adjusted operating income and new partnerships, the company’s share price has slid by nearly 15% over the past month and is down almost 30% year-to-date. In the longer term, the 1-year total shareholder return stands at -37.7%, reflecting persistent market skepticism and a challenging environment for pet insurance stocks. Momentum is still fading for now, but some investors may see these operational wins as a setup for a turnaround if sentiment improves.

If you’re interested in seeing what’s working elsewhere in the market, now could be the perfect time to branch out and discover fast growing stocks with high insider ownership

With shares now trading at a sizable discount to analysts’ price targets despite improving fundamentals, is Trupanion an overlooked opportunity for investors seeking value, or is the market already factoring in its future growth?

Most Popular Narrative: 39.8% Undervalued

Trupanion's fair value estimate stands dramatically higher than its recent closing price, highlighting the significant gap between analysts' expectations and current market sentiment.

Enhanced operational efficiencies, disciplined underwriting, and optimized customer acquisition support higher margins, improved cash flow, and sustainable profitability.

Want to know what factors could be fueling such a large valuation gap? The narrative isolates one critical set of future financial drivers that may surprise you. Curious what backbone assumptions push Trupanion’s fair value far above its current stock price? See which forward-looking calculations are setting the tone for the next chapter.

Result: Fair Value of $56.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competitive pressures and reliance on price increases could undermine these optimistic forecasts if subscriber growth does not accelerate meaningfully.

Find out about the key risks to this Trupanion narrative.

Another View: What Do Multiples Suggest?

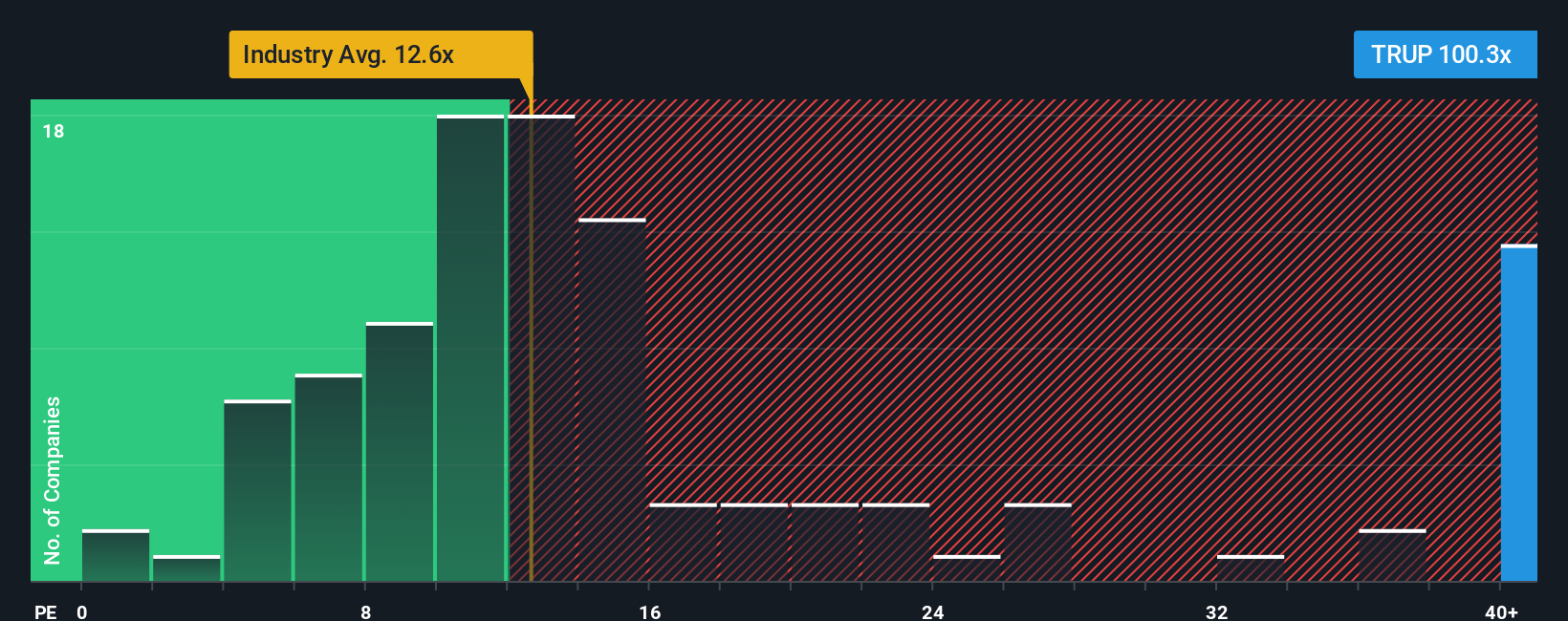

While analysts see substantial upside based on future earnings potential, the current price-to-earnings ratio tells a much less optimistic story. Trupanion is trading at 95.1 times earnings, which is far above both the US Insurance industry average of 13.3 and the peer average of 11.6. Even when compared to a fair ratio of 22, this steep premium signals real valuation risk. Could the stock’s lofty multiple come under pressure if growth expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trupanion Narrative

If you want to challenge this perspective or dig into the numbers on your own terms, you can quickly craft a personalized take from scratch, your way in just a few minutes with Do it your way

A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now and access fresh opportunities that could help take your portfolio to the next level. Don’t let unique strategies and market movers pass you by.

- Capitalize on some of the market’s strongest cash flow values with these 927 undervalued stocks based on cash flows for overlooked stocks trading at compelling discounts.

- Grow your income stream by tapping into these 14 dividend stocks with yields > 3% offering reliable yields above 3% and steady cash returns.

- Tap into the future of medicine by searching these 30 healthcare AI stocks for companies at the intersection of AI and healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026