- United States

- /

- Insurance

- /

- NasdaqGS:SKWD

Skyward Specialty Insurance Group (SKWD): Reassessing Valuation After a Year of Share Price Underperformance

Reviewed by Simply Wall St

Skyward Specialty Insurance Group (SKWD) has been sliding recently, with the stock down about 13% over the past year even as revenue and net income have been growing at roughly 21% annually.

See our latest analysis for Skyward Specialty Insurance Group.

That softer sentiment has shown up in the numbers, with a 1 year total shareholder return of about minus 13% and a roughly 7% 3 month share price decline leaving the stock at around $46.60. This suggests investors are reassessing near term risks even as the growth story stays intact.

If Skyward’s recent pullback has you rethinking your insurance exposure, it could be a good moment to see what else is out there via healthcare stocks for fresh ideas beyond financials.

With shares lagging despite double digit growth, analysts still see nearly 35% upside to their price target and an even larger gap to some intrinsic value estimates. Is this a mispriced insurer, or is the market already factoring in that future growth?

Most Popular Narrative: 23.6% Undervalued

With Skyward Specialty Insurance Group last closing at $46.60 against a narrative fair value near $61, the gap points to meaningful upside if projections land as expected.

The company's focus on complex, underserved markets such as small group medical stop loss, innovative property captives, and niche aviation risk enables continued high retention, high margin growth insulated from softening rates in more commoditized lines. This underpins strong earnings quality and sustainable margin expansion. Strategic alignment and ownership stakes in key MGA and program manager partnerships provide Skyward with preferential access to unique distribution channels and proprietary business, enhancing sticky premium flows and supporting stable, long term growth in net earned premiums.

Curious how double digit revenue growth, rising margins, and only a modest future earnings multiple add up to that valuation gap? The narrative breaks down the precise growth runway, profitability step up, and discount rate assumptions that together justify a higher long term price than today.

Result: Fair Value of $61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on execution, with softer property markets and reliance on key MGA partners both serving as potential catalysts for disappointing growth and profitability.

Find out about the key risks to this Skyward Specialty Insurance Group narrative.

Another Lens on Value

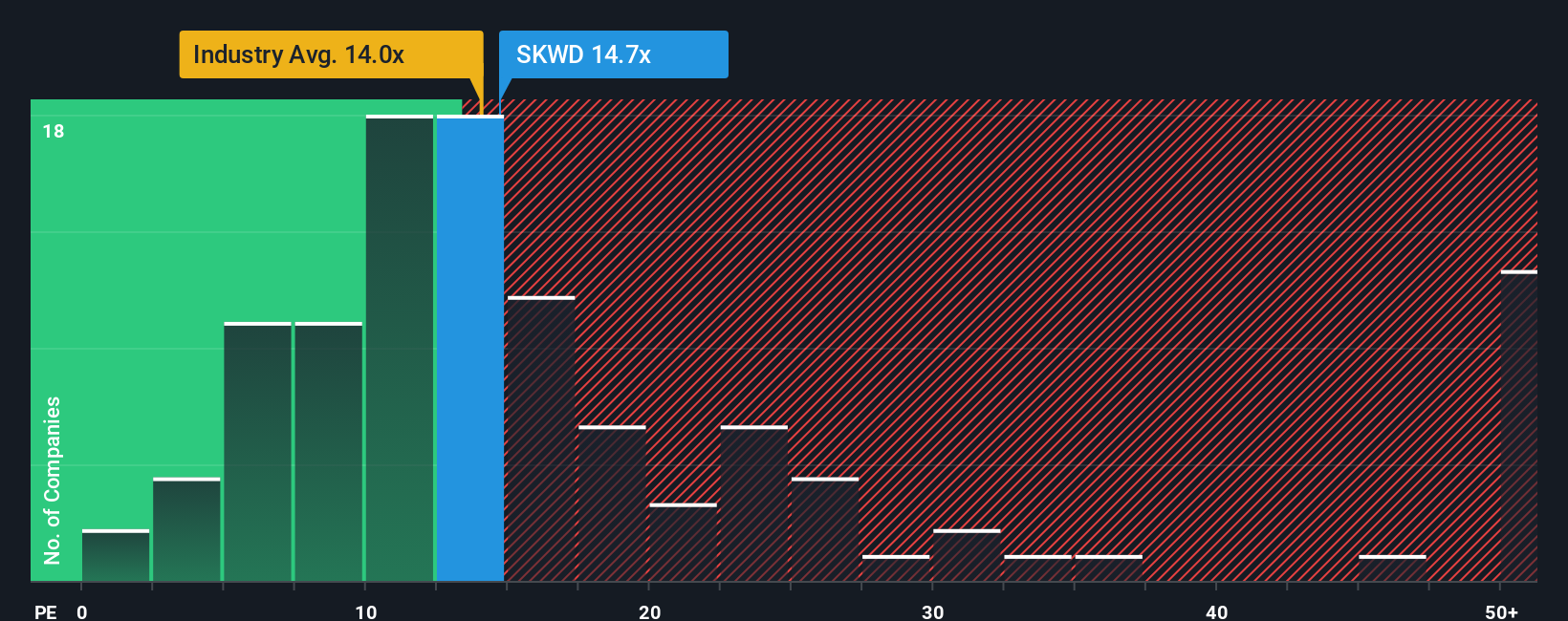

While narratives point to Skyward as 23.6% undervalued, the earnings multiple tells a tighter story. At 13.4 times earnings versus the US insurance average of 12.8, but below peers at 31.5 and a fair ratio of 17.8, is the market offering selective value or flagging risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Skyward Specialty Insurance Group Narrative

If this narrative does not fully align with your view, or you would rather rely on your own analysis, you can build one yourself in under three minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Skyward Specialty Insurance Group.

Looking for more high conviction ideas?

Before you move on, put Skyward in context by scanning a few targeted stock lists on Simply Wall Street that could reveal your next standout opportunity.

- Capitalize on mispriced potential by comparing Skyward against these 906 undervalued stocks based on cash flows built around strong cash flow fundamentals and attractive valuation gaps.

- Ride structural tailwinds in automation and machine learning by lining up Skyward next to these 26 AI penny stocks that could outgrow traditional financial names.

- Boost your portfolio income stream by setting Skyward alongside these 15 dividend stocks with yields > 3% that combine reliable payouts with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKWD

Skyward Specialty Insurance Group

An insurance holding company, underwrites commercial property and casualty insurance products in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026