- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Will Profitability Gains and ErieSecure Auto Launch Shift Erie Indemnity's (ERIE) Investment Narrative?

Reviewed by Sasha Jovanovic

- Erie Indemnity recently reported progress toward profitability, with an improved combined ratio, growth in direct written premiums, and the launch of its new ErieSecure Auto insurance product in Ohio.

- This momentum comes alongside continued underwriting challenges from severe weather and a rating adjustment by A.M. Best, spotlighting both successes and ongoing risks in its operations.

- We'll explore how ErieSecure Auto's rollout and the company's profitability progress shape the developing investment narrative for Erie Indemnity.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Erie Indemnity's Investment Narrative?

To believe in Erie Indemnity as a shareholder, you need confidence that its drive for efficiency and product innovation can counter balance current sector pressures and operational risks. The improved combined ratio and growth in direct written premiums, highlighted in the most recent update, offer tangible signs of progress on profitability, while the ErieSecure Auto product could open doors to new markets and longer-term expansion if successful beyond Ohio. Yet, the recent A.M. Best rating adjustment and underwriting losses from severe weather bring risk management into sharper focus, raising questions about how much near-term upside can be captured if major claims events persist. Compared to prior assessments, the latest news adds fresh momentum on the catalyst side but amplifies concerns about the headwinds Erie faces in controlling costs and claims volatility. For now, recent share price weakness hints that the market is weighing those risks heavily even as growth efforts accelerate.

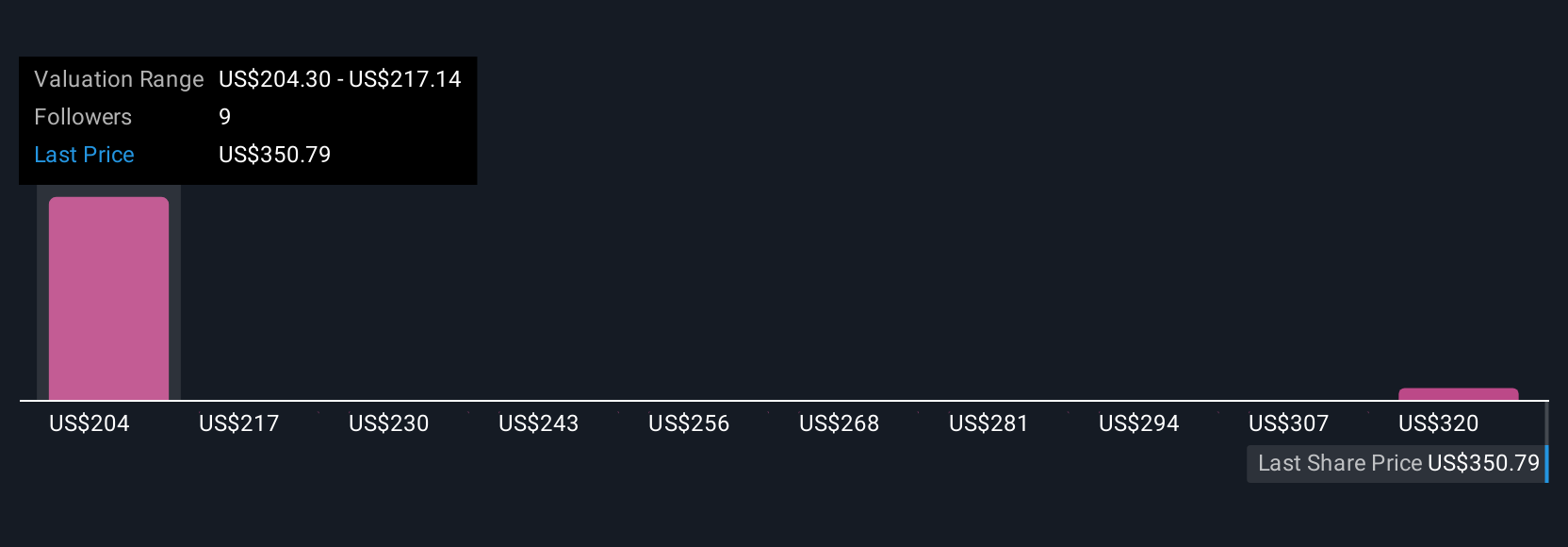

But while profitability is improving, the A.M. Best outlook signals risks investors shouldn't ignore. Erie Indemnity's shares are on the way up, but they could be overextended by 32%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth 24% less than the current price!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026