- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Erie Indemnity (ERIE) Valuation in Focus After Court Ruling Escalates Legal Risks and Earnings Optimism

Reviewed by Kshitija Bhandaru

Erie Indemnity (ERIE) is in the spotlight after a federal appellate court cleared the way for a state challenge to its management fee. This development may highlight legal risks as the company approaches its anticipated third-quarter earnings report.

See our latest analysis for Erie Indemnity.

After a turbulent year, Erie Indemnity’s share price sits at $318.4, reflecting a 22.3% decline year-to-date. Its 1-year total shareholder return of -37% shows the legal overhang and changing sentiment are weighing on momentum. Despite some positive news around upcoming earnings and continued innovation efforts, the latest court decision has amplified near-term risk. Its three- and five-year total shareholder returns remain solidly positive.

If you’re watching how headlines impact performance, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership.

With recent legal headlines and analysts forecasting double-digit profit growth, investors are left wondering whether Erie Indemnity is trading at a true discount or if the market has already priced in the company’s potential rebound.

Price-to-Earnings of 26.6x: Is it justified?

Erie Indemnity’s shares currently trade on a price-to-earnings (PE) ratio of 26.6x, well above both the US insurance industry average and typical fair value levels. At a last close price of $318.4, the market is paying a premium for each dollar of company earnings compared to peers.

The price-to-earnings ratio measures how much investors are willing to pay for a dollar of annual profits. This is a critical metric for mature industries like insurance, where reliable earnings form the backbone of long-term value. A higher PE ratio can signal expectations for fast growth, but it might also indicate over-optimism if fundamentals or growth rates lag.

In Erie Indemnity’s case, the PE is nearly double the US insurance industry average of 14.1x and the estimated fair PE ratio of 16.3x. This premium suggests the market is pricing in superior future growth or quality, but it leaves little margin for error if performance disappoints. For this reason, any shift toward the fair ratio could mean significant price volatility going forward.

Explore the SWS fair ratio for Erie Indemnity

Result: Price-to-Earnings of 26.6x (OVERVALUED)

However, ongoing legal uncertainties and recent price volatility could undermine expectations. These factors serve as key catalysts that may alter Erie Indemnity’s current market outlook.

Find out about the key risks to this Erie Indemnity narrative.

Another View: SWS DCF Model Offers a Contrasting Perspective

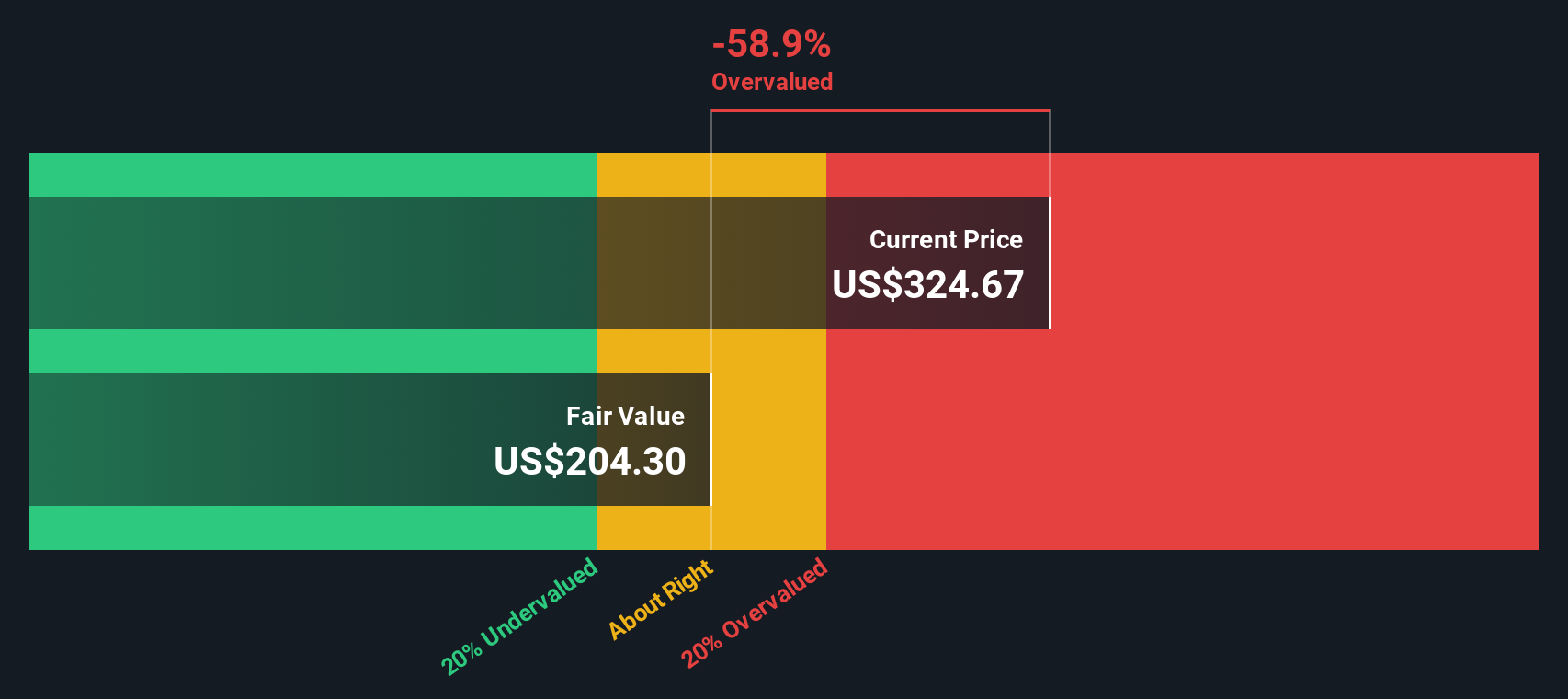

While the market assigns Erie Indemnity a much higher price-to-earnings ratio than both the industry and its own fair ratio, the SWS DCF model suggests an even starker picture. According to our model, shares are trading about 56% above fair value, flagging a potential overvaluation that could leave little room for disappointment.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Erie Indemnity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Erie Indemnity Narrative

If you’d like to dig deeper, you can examine the data firsthand and build your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Erie Indemnity.

Looking for More Investment Ideas?

Smart investors always keep fresh opportunities on their radar. Don’t miss a chance to get ahead of the curve. Take the next step and see what else could belong in your portfolio.

- Pinpoint undervalued growth stories by checking out these 871 undervalued stocks based on cash flows making waves across the market, where attractive fundamentals meet real momentum.

- Tap into powerful passive income opportunities and uncover these 18 dividend stocks with yields > 3% built to deliver healthy yields even in uncertain times.

- Position yourself at the crossroads of healthcare and artificial intelligence through these 33 healthcare AI stocks unlocking medical breakthroughs and next-level innovation before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives