- United States

- /

- Insurance

- /

- NasdaqGS:BWIN

Will Leadership Changes at Baldwin (BWIN) Refocus Its Strategy Amid Tougher Insurance Market Conditions?

Reviewed by Sasha Jovanovic

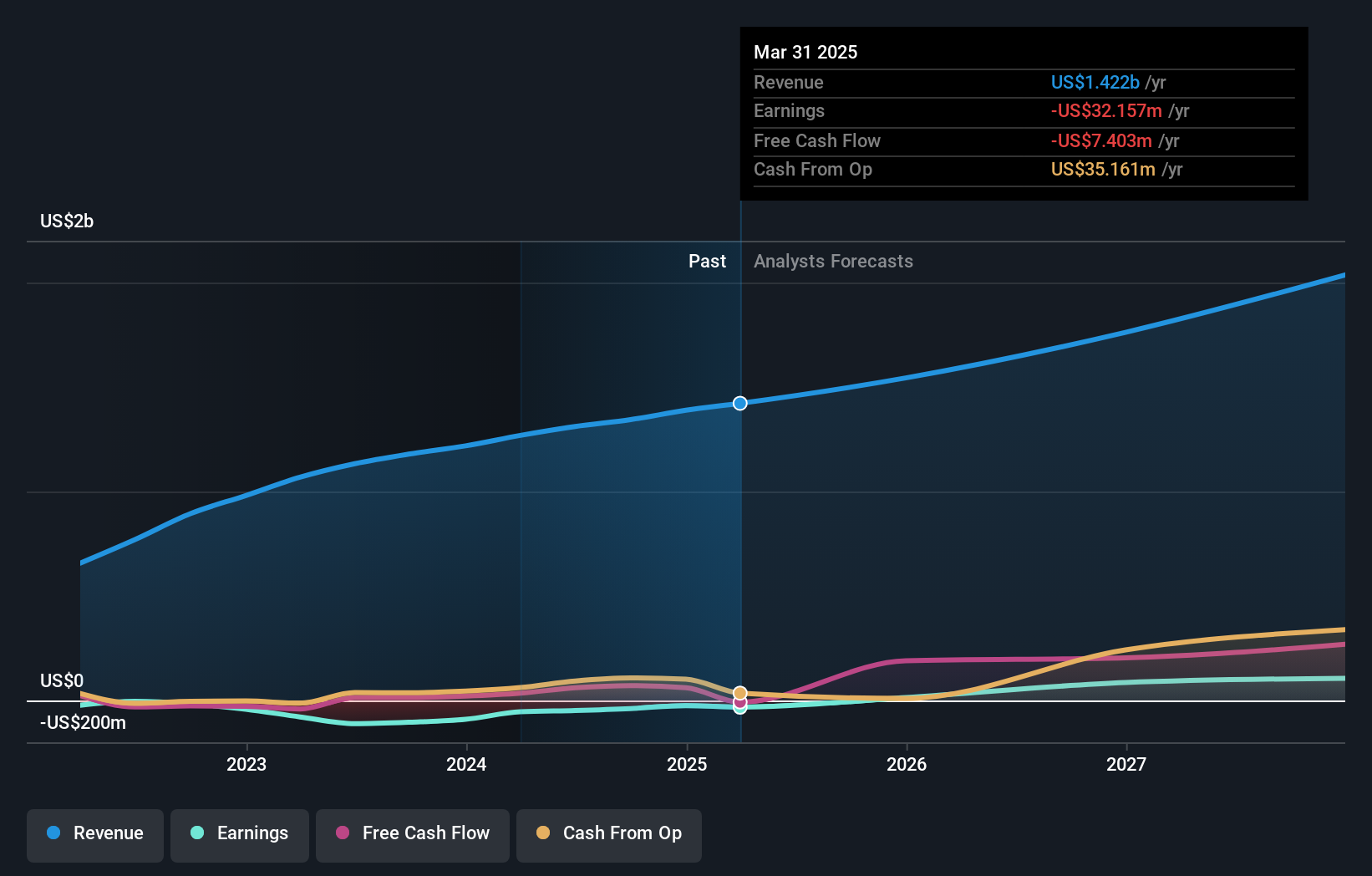

- The Baldwin Insurance Group recently reported third-quarter results showing revenue of US$365.39 million, an increased net loss of US$18.73 million, and lowered its full-year guidance due to softer property insurance pricing and reduced business from construction clients.

- In the days following these results, Baldwin also appointed Joe Valerio as Chief Operating Officer for Insurance Advisory Solutions, signaling a renewed focus on operational excellence and client experience amid industry headwinds.

- We’ll explore how the company's revised outlook, driven by challenging industry pricing, could alter the investment narrative for Baldwin Insurance Group.

Find companies with promising cash flow potential yet trading below their fair value.

Baldwin Insurance Group Investment Narrative Recap

To be a shareholder in Baldwin Insurance Group right now, you would need to believe that the company's efforts to drive operational efficiency and expand its digital insurance partnerships can overcome the immediate headwinds of weaker property insurance pricing and slowing construction client demand. The recent guidance cut directly relates to the biggest near-term risk: persistent pricing pressure across core segments, which now outweighs any near-term catalysts tied to sales pipeline expansion or technology investments.

Of the recent developments, the appointment of Joe Valerio as COO of Insurance Advisory Solutions stands out. His track record with national brokerages brings attention to Baldwin's emphasis on improving operational discipline, which has become increasingly important in the current environment where margin pressure is likely to persist until pricing improves.

However, investors should be aware that despite management’s focus on execution, competitive pricing pressure in sectors like property and construction may persist longer than expected and...

Read the full narrative on Baldwin Insurance Group (it's free!)

Baldwin Insurance Group is projected to achieve $2.1 billion in revenue and $102.5 million in earnings by 2028. This outlook assumes annual revenue growth of 12.3% and an earnings increase of $120.3 million from current earnings of -$17.8 million.

Uncover how Baldwin Insurance Group's forecasts yield a $36.12 fair value, a 32% upside to its current price.

Exploring Other Perspectives

All community fair value estimates for Baldwin Insurance Group cluster at US$36.13, with 1 analysis from Simply Wall St Community. While opinions can be closely aligned, slowing renewal premiums pose a material risk for those evaluating potential upside, so be sure to explore a range of perspectives.

Explore another fair value estimate on Baldwin Insurance Group - why the stock might be worth just $36.12!

Build Your Own Baldwin Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baldwin Insurance Group research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Baldwin Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baldwin Insurance Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baldwin Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BWIN

Baldwin Insurance Group

Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives