- United States

- /

- Insurance

- /

- NasdaqGS:BHF

Brighthouse Financial (BHF): Analyzing Valuation After Strong Monthly Gains and Upgraded Analyst Outlook

Reviewed by Simply Wall St

See our latest analysis for Brighthouse Financial.

Brighthouse Financial’s share price has surged 39% over the past month, signaling growing investor confidence and strong momentum after a period of steady gains. Looking back, the company has delivered a 25% total shareholder return in the past year, with long-term holders seeing their patience well rewarded.

If the sharp move in Brighthouse’s price has you thinking bigger picture, it might be the right time to discover fast growing stocks with high insider ownership

With Brighthouse’s shares now trading just below analyst price targets and its recent rally reflecting improved fundamentals, investors are left to wonder whether there is still value to be found or if the market has already priced in future growth.

Most Popular Narrative: 8% Overvalued

The latest widely followed narrative assigns a fair value of $60.89 to Brighthouse Financial, notably below its last close price of $65.83. This gap sets the tone for a closer look at what is driving valuation sentiment.

"Bullish analysts have upgraded their view of Brighthouse Financial after the company agreed to an acquisition. They anticipate improved shareholder value and a higher fair value estimate."

What powerful factors are fueling this higher price target? It all hinges on surging demand and the company’s next phase of earnings growth. Want the inside scoop on how shifting assumptions and one headline-making catalyst are recalibrating the numbers behind this valuation? Find out which projections are making waves and why the consensus fair value may surprise you.

Result: Fair Value of $60.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent statutory losses and heavy reliance on volatile market-driven products could quickly derail these optimistic growth projections.

Find out about the key risks to this Brighthouse Financial narrative.

Another View: What Does Our DCF Model Say?

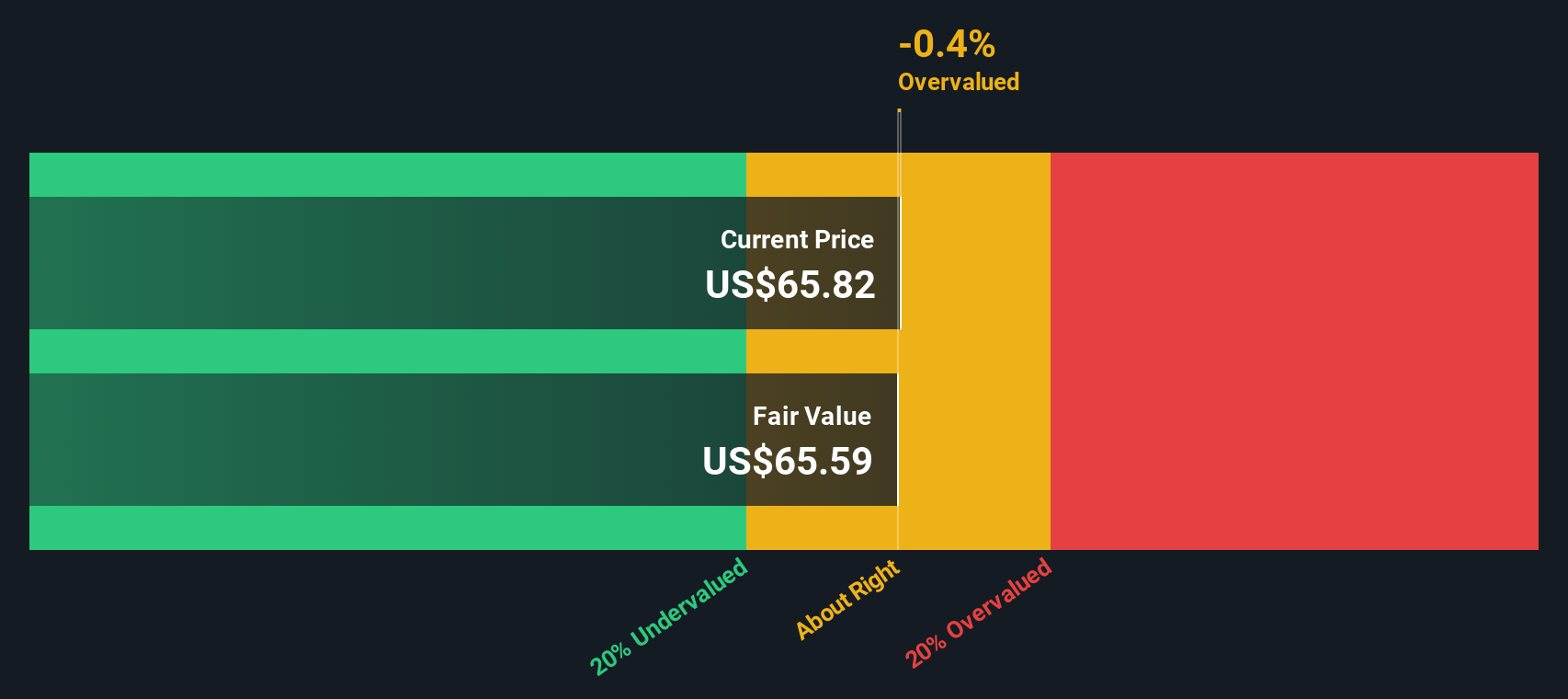

While the earlier fair value estimate relied on market multiples, our SWS DCF model takes a different approach by projecting future cash flows to assess intrinsic value. According to this method, Brighthouse Financial shares are actually trading slightly below our estimated fair value of $67.20. This suggests modest undervaluation. Does this change the story for patient investors, or is the market already looking beyond the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brighthouse Financial Narrative

If you see things differently or want to dig deeper, you can assemble your own perspective using the data. Just set aside a few minutes and Do it your way.

A great starting point for your Brighthouse Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Act now to energize your portfolio with fresh opportunities. Don’t let the best stocks pass you by when the market rewards the boldest thinkers.

- Boost your passive income by targeting higher yielding opportunities using these 15 dividend stocks with yields > 3%, perfect for investors searching for reliable payouts above 3%.

- Tap into cutting-edge sectors by getting ahead of the latest medical breakthroughs with these 32 healthcare AI stocks and stay on the right side of innovation.

- Ride the trend and spot tomorrow’s leaders at low prices by exploring these 3566 penny stocks with strong financials with solid financials that set them apart from the pack.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brighthouse Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BHF

Brighthouse Financial

Provides annuity and life insurance products in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives