- United States

- /

- Household Products

- /

- NYSE:PG

What Procter & Gamble (PG)'s Massive Office Job Cuts and CEO Transition Mean For Shareholders

Reviewed by Sasha Jovanovic

- In recent months, Procter & Gamble announced a major restructuring starting in fiscal 2026 that will cut up to 7,000 office jobs over two years, while reaffirming guidance for modest organic sales and core EPS growth amid tariff and cost pressures.

- This combination of headcount reductions and an upcoming CEO transition to Shailesh Jejurikar on January 1, 2026 highlights how P&G is reshaping its cost base and leadership to protect profitability in a challenging demand backdrop.

- We’ll now examine how this large office job reduction plan may affect Procter & Gamble’s longer-term investment narrative and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Procter & Gamble Investment Narrative Recap

To own Procter & Gamble, you need to believe in the resilience of its global brands, steady cash generation, and long dividend record, even while growth expectations remain modest. The announced office restructuring and CEO transition do not appear to change the near term catalyst of productivity-driven margin support, but they do sit alongside the key risk that softer demand and cost inflation could still pressure earnings.

Against this backdrop, the plan to cut up to 7,000 office jobs starting in fiscal 2026 is especially relevant, because it directly ties into P&G’s push for productivity improvements to offset tariffs and cost pressures. How effectively those savings balance rising input and tariff costs will influence how the existing catalysts around innovation, market share defense, and ongoing shareholder returns play out over time.

Yet investors should still be aware that tariff and commodity cost risks could materially affect margins if productivity gains underwhelm or pricing power weakens...

Read the full narrative on Procter & Gamble (it's free!)

Procter & Gamble's narrative projects $92.8 billion revenue and $17.8 billion earnings by 2028. This requires 3.3% yearly revenue growth and about a $2.1 billion earnings increase from $15.7 billion today.

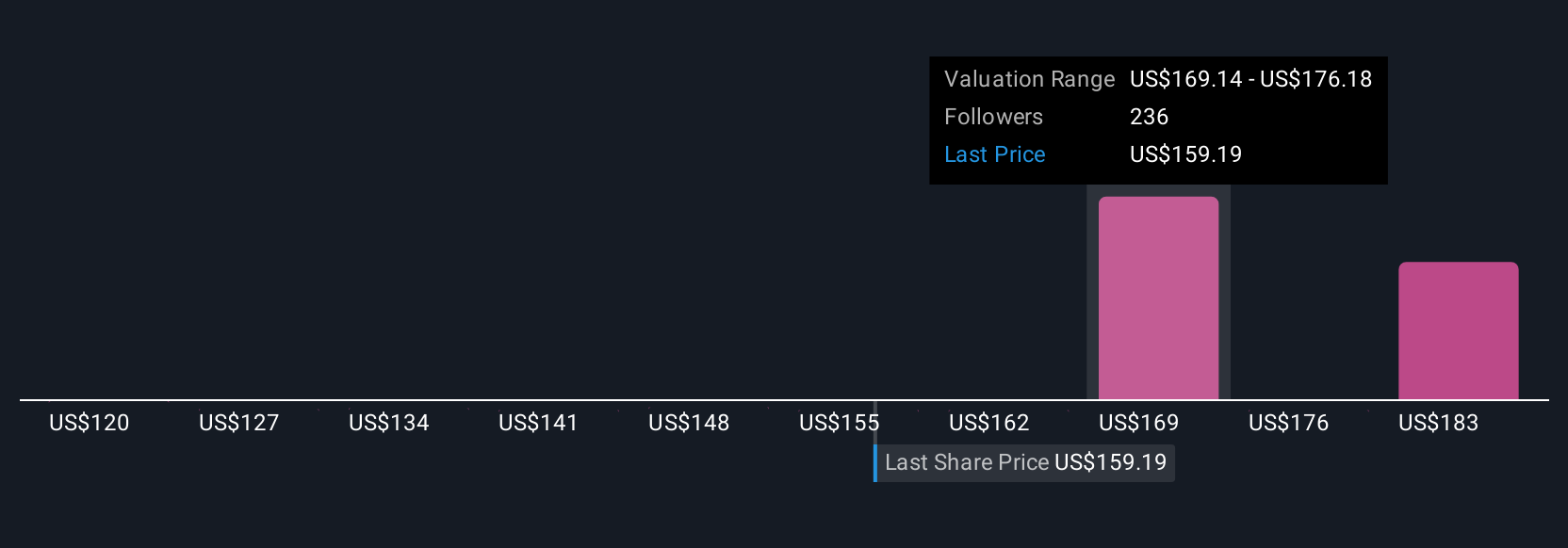

Uncover how Procter & Gamble's forecasts yield a $169.05 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Nineteen members of the Simply Wall St Community currently see P&G’s fair value between US$119.81 and US$185.05, highlighting how far apart individual expectations can be. When you set these against the risk that tariffs and input cost inflation could weigh on margins if productivity savings fall short, it becomes clear why comparing several viewpoints before forming a view on P&G’s outlook matters.

Explore 19 other fair value estimates on Procter & Gamble - why the stock might be worth as much as 29% more than the current price!

Build Your Own Procter & Gamble Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Procter & Gamble research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procter & Gamble's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026