- United States

- /

- Personal Products

- /

- NYSE:HLF

Herbalife (HLF): Evaluating Valuation After Analyst Upgrade on Growth-Focused Product Launches

Reviewed by Simply Wall St

Herbalife, following a recent upgrade from Argus Research, saw its stock jump 11% as optimism builds around new product launches such as HL/Skin and MultiBurn. The analyst move signals confidence in the company's turnaround.

See our latest analysis for Herbalife.

Herbalife’s impressive one-month share price return of nearly 58% highlights a real shift in momentum, which is especially noteworthy after years of underperformance. Positive investor sentiment is building not just on analyst confidence, but also as the company signals an end to its three-year slide in growth through high-profile product launches and recent industry appearances.

If this recovery story has you thinking bigger, now is the perfect time to see what else is gaining ground. There’s no better place to start than fast growing stocks with high insider ownership

With such a dramatic run in the share price and analyst optimism building around new products, the key question becomes whether Herbalife is still trading at a discount or if the recent rally already reflects those brighter growth prospects.

Most Popular Narrative: 30.7% Overvalued

Compared to Herbalife’s last close of $12.63, the most widely followed narrative places fair value at $9.67. This suggests the recent surge in price may be running ahead of fundamentals. The narrative’s discount rate is 11.26%, reflecting cautious analyst optimism alongside ongoing discussions about future growth and risk.

The company continues to experience flat to declining volumes in several regions, with only modest improvements in constant currency net sales. This indicates that the addressable market for Herbalife's traditional model may be reaching maturity and that top-line revenue growth could remain pressured. Ongoing reliance on network recruiting and regional distributor growth increases vulnerability to macroeconomic downturns and currency headwinds in emerging markets, which may result in heightened volatility in both revenue and net margins.

Earnings forecasts, margin shifts, and industry headwinds are factored into this fair value, but what drives the skepticism? Something in the analyst playbook appears to be putting a brake on projected gains. Could it be a challenging margin outlook or an unexpected twist in revenue expectations? Click through for the numbers shaping this debate.

Result: Fair Value of $9.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, early signs of a turnaround in North America and investments in personalized wellness could spark stronger growth than current forecasts suggest.

Find out about the key risks to this Herbalife narrative.

Another View: Multiples Show Deep Discount

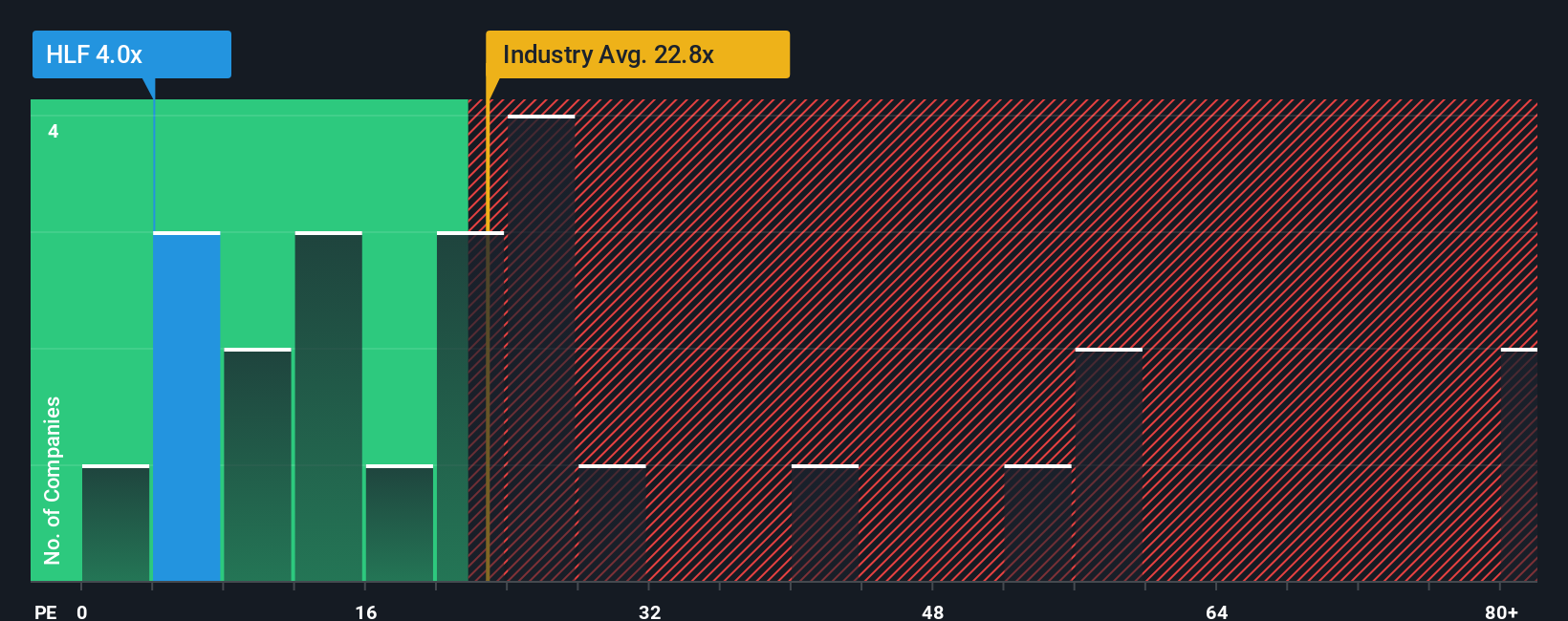

Taking a step back from analyst fair value targets, our market comparison uses the price-to-earnings ratio. Herbalife trades at just 4.1x earnings, far below its North American industry average of 22.8x and the peer average of 14.3x. Even the fair ratio is higher at 11.8x. This wide gap suggests the market may be underestimating Herbalife’s potential, but is such a discount a hidden opportunity or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Herbalife Narrative

If you think there’s more to uncover or want to dig into the details on your own, you can build your outlook in just a few minutes. Do it your way

A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Curious about what else is moving markets? Make your next smart play with ideas targeting growth, innovation, and real potential you won’t want to miss out on.

- Tap into high yield potential by checking out these 14 dividend stocks with yields > 3% for stocks offering over 3% returns that could boost your income strategy.

- Capitalize on the AI revolution by starting with these 25 AI penny stocks, connecting you to companies at the forefront of machine learning and smart technology.

- Uncover stocks priced beneath their intrinsic value using these 929 undervalued stocks based on cash flows to spot hidden bargains before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Herbalife might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLF

Herbalife

Provides health and wellness products in North America, Mexico, South and Central America, Europe, the Middle East, Africa, China, and the Asia Pacific.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026