- United States

- /

- Household Products

- /

- NYSE:ENR

Is Energizer Holdings (ENR) Undervalued After Recent Share Price Uptick? An In-Depth Valuation Review

Reviewed by Simply Wall St

See our latest analysis for Energizer Holdings.

While Energizer’s share price inched up midweek, it is still down significantly in 2024, with a year-to-date share price return of -31.12% and a 1-year total shareholder return of -25.99%. Recent gains signal some renewed interest; however, momentum remains muted overall following a volatile stretch.

If you’re open to expanding your watchlist, now’s an ideal moment to discover fast growing stocks with high insider ownership.

This backdrop of persistent declines and fresh, albeit modest, gains brings investors to a familiar crossroads as they weigh whether Energizer Holdings is currently undervalued or if the market has already factored in all foreseeable growth. Is there real upside left here, or is everything already priced in?

Price-to-Earnings of 6.5x: Is it justified?

With Energizer Holdings trading at a price-to-earnings (P/E) ratio of just 6.5x, the shares look noticeably undervalued compared to both peers and broader industry averages, given the last close of $23.84. This may indicate a disconnect between the company’s recent profitability and how the market currently prices its future potential.

The P/E ratio compares a company’s current share price to its earnings per share. For Energizer Holdings, a 6.5x P/E multiple means investors are paying much less for each dollar of earnings than is typical among competitors in the household products sector. This could suggest the market is discounting Energizer’s growth prospects or reflecting increased skepticism about profitability trends.

Relative to peers, Energizer’s P/E ratio is well below the industry average of 17.8x and below the estimated fair P/E of 17.1x. Such a large gap may signal that the market is being overly pessimistic. If earnings performance stabilizes, this multiple could move to a higher level.

Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 6.5x (UNDERVALUED)

However, persistent long-term underperformance and only modest revenue growth could lead to continued skepticism among investors. This could potentially limit near-term share price gains.

Find out about the key risks to this Energizer Holdings narrative.

Another View: What Does the SWS DCF Model Say?

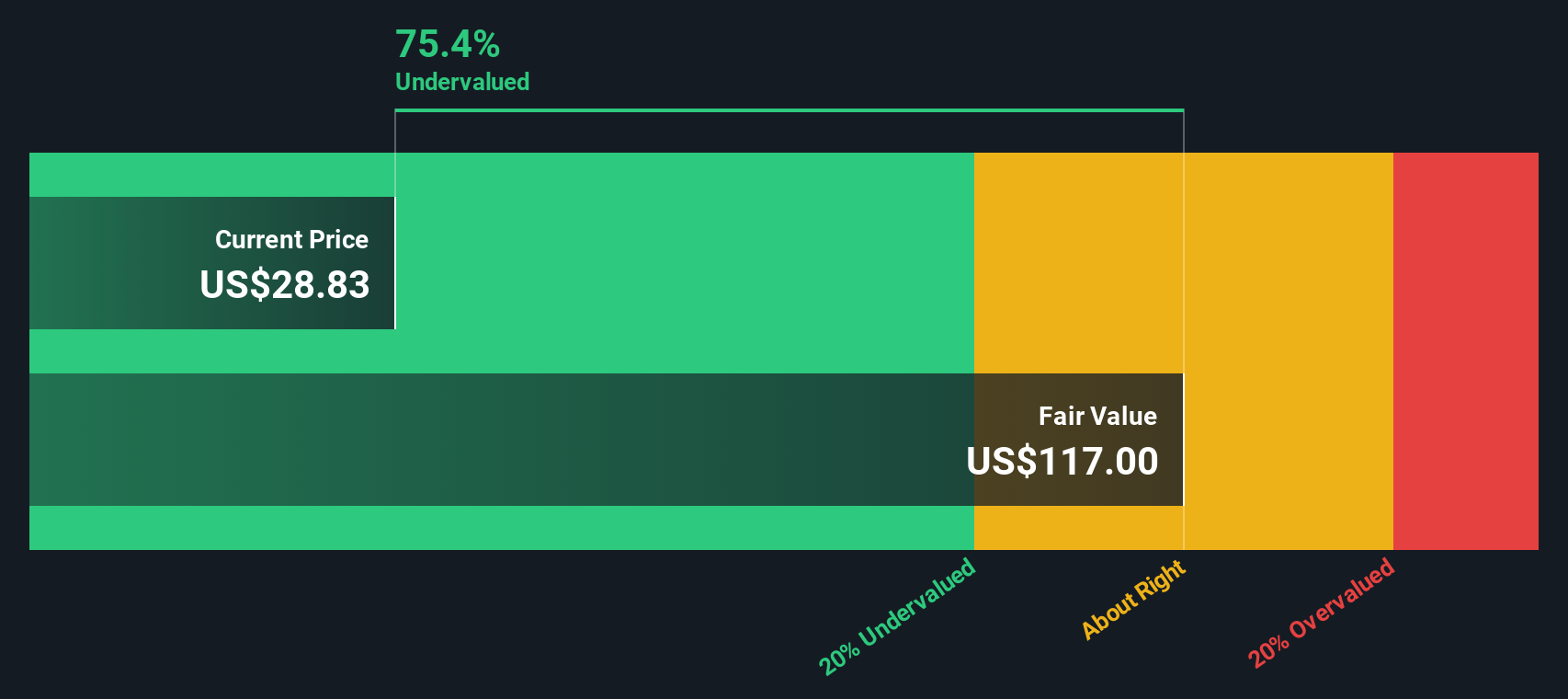

Looking at Energizer Holdings through the lens of our Discounted Cash Flow (DCF) model gives a different perspective. On this basis, the shares appear to be trading well below intrinsic value, indicating significant potential upside if cash flows materialize as projected. Could this long-term outlook be too optimistic, or is the market missing something here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you believe the story might differ or want your own hands-on look at the numbers, you can generate a personal perspective in just a few minutes. Do it your way

A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one story. Expand your horizons and seize more opportunities by checking out top picks across a broader investing universe right now.

- Capitalize on long-term growth by tapping into these 16 dividend stocks with yields > 3% with robust yields above 3% and a track record of dependable payouts.

- Benefit from innovation trends as you access these 24 AI penny stocks that focus on artificial intelligence breakthroughs with exciting upside potential.

- Ride the momentum of digital transformation by exploring these 82 cryptocurrency and blockchain stocks, where blockchain and cryptocurrency are creating new ways to build wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives