- United States

- /

- Household Products

- /

- NYSE:ENR

Energizer Holdings (ENR): Reassessing Valuation After Earnings, 2026 Guidance, and Impairment Charges

Reviewed by Simply Wall St

Energizer Holdings (ENR) grabbed investors’ attention after reporting its fourth quarter and full-year earnings. The company unveiled improved annual profits but some softness in Q4 results, along with new guidance and impairment charges.

See our latest analysis for Energizer Holdings.

Energizer Holdings' recent earnings and new guidance set off a sharp move in the shares, with the stock now sitting at $18.23 after a volatile stretch. The past year has been tough for shareholders, with a total one-year return of -51.36%, highlighting that momentum has cooled off markedly despite earlier optimism.

If you're reassessing your strategy after these results, it could be a smart moment to expand your search and discover fast growing stocks with high insider ownership.

This leaves investors wondering if Energizer’s sharp stock drop signals a bargain that undervalues its rebound in profits, or if the current price already reflects the challenging outlook and full-year guidance for 2026.

Price-to-Earnings of 5.2: Is it justified?

Energizer Holdings is trading at a price-to-earnings ratio (P/E) of just 5.2, which looks notably low compared to industry benchmarks and the company’s last close at $18.23.

The P/E ratio measures how much investors are willing to pay for a dollar of earnings, making it a key signal for value-focused investors and analysts. For a household products manufacturer like Energizer, a low P/E can indicate undervaluation or reflect concerns about future growth and risk factors.

This low P/E ratio stands in sharp contrast to both its global industry peers (average of 17.4x) and the peer group average (17.9x). The figure is also far below the estimated fair P/E of 12.8x. This suggests significant headroom if market sentiment improves and the company meets profit expectations. If the market re-rates the stock even part way towards its fair ratio, there could be substantial upside.

Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 5.2 (UNDERVALUED)

However, a sustained drop in earnings growth or further weakness in revenue could quickly change market sentiment around Energizer Holdings’ perceived value.

Find out about the key risks to this Energizer Holdings narrative.

Another View: What Does Our DCF Model Say?

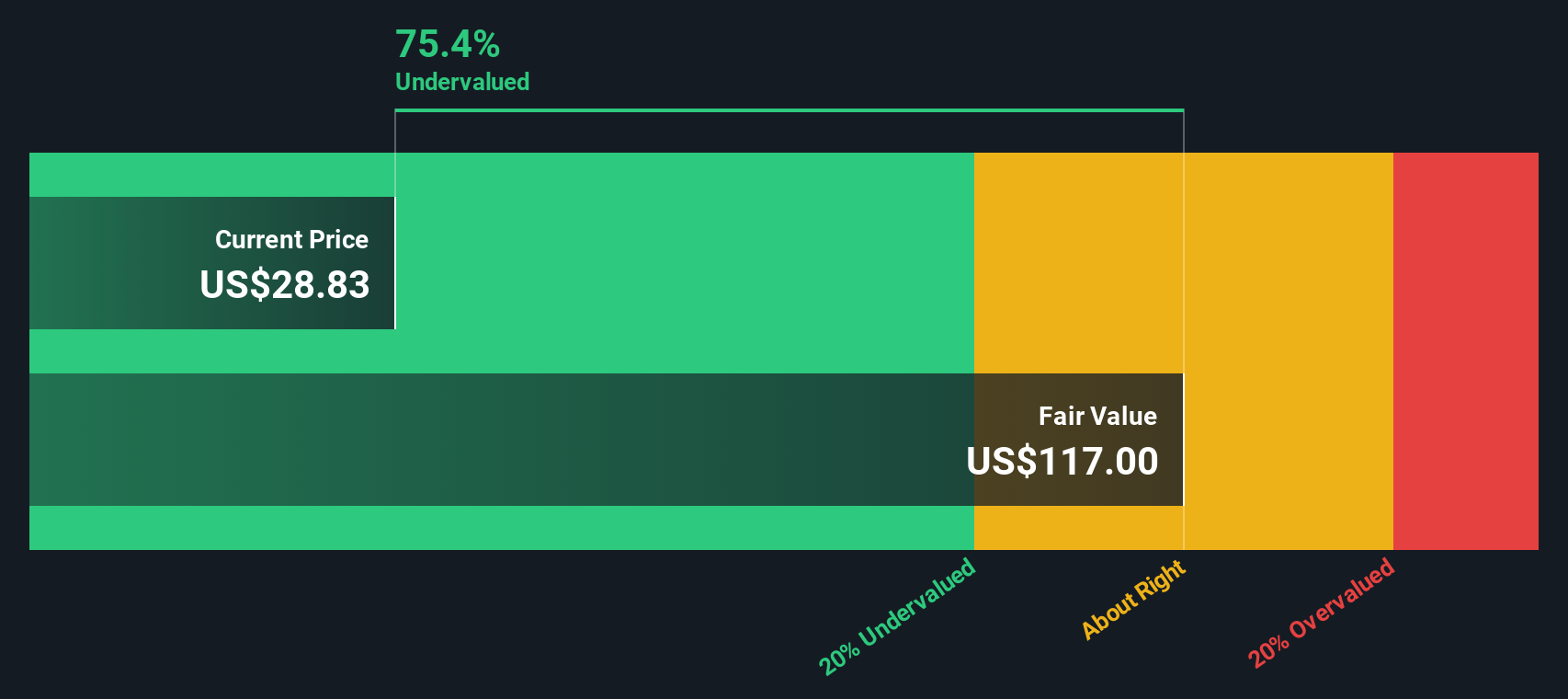

While the low price-to-earnings ratio points to undervaluation, our SWS DCF model presents an even starker divergence. According to this approach, Energizer Holdings is trading at $18.23, which is well below our estimate of fair value at $90.07. That is a substantial gap, but does the current price truly reflect these future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, it is easy to build and share your own take in just a few minutes, so why not Do it your way.

A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Thousands of investors have already spotted their next big opportunity. Why stop at Energizer when you could uncover companies ready to surge ahead?

- Capture unique opportunities in revolutionary tech trends by scanning these 28 quantum computing stocks. Find stocks at the forefront of tomorrow's computing breakthroughs.

- Boost your portfolio’s income and stability by selecting from these 15 dividend stocks with yields > 3%. Explore companies offering reliable yields and solid fundamentals for long-term growth.

- Find hidden market gems trading below their true value by reviewing these 919 undervalued stocks based on cash flows. Discover opportunities with strong cash flow potential and room to run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026