- United States

- /

- Personal Products

- /

- NYSE:BRBR

Retailer Inventory Probe Could Be A Game Changer For BellRing Brands’ Growth Story (BRBR)

Reviewed by Sasha Jovanovic

- BellRing Brands is now under investigation for potential federal securities law violations after disclosing that key retailers had reduced inventories from Q2 2023, which hurt growth projections and coincided with weak Premier Protein ready‑to‑drink shake consumption in August 2025.

- The probe centers on whether BellRing accurately represented the sustainability of its sales growth and retailer inventory levels, raising fresh questions about the resilience of its previously perceived market moat and category momentum.

- We’ll now examine how this securities law investigation, centered on retailer inventory reductions, reshapes BellRing Brands’ existing investment narrative and risk profile.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BellRing Brands Investment Narrative Recap

To own BellRing Brands today, you need to believe the core protein shake category can keep expanding and that Premier Protein’s brand strength will outlast near term noise around inventory and consumption. The new securities investigation directly touches the biggest short term catalyst and risk: confidence in the durability of reported growth and retailer support. If investors start doubting the reliability of BellRing’s disclosures, both the growth story and the perceived moat could be meaningfully questioned.

The investigation ties closely to BellRing’s recent disclosure that key retailers cut inventories beginning in Q2 2023, which in turn weighed on growth projections and coincided with softer August 2025 Premier Protein shake consumption. That same update sits awkwardly beside prior commentary emphasizing sustained category momentum and retailer enthusiasm, which had underpinned expectations for ongoing distribution gains and household penetration as key drivers of future growth.

Yet behind the growth story, investors should also be aware of how concentrated BellRing is in Premier Protein and what happens if retailer support and consumer demand ever begin to...

Read the full narrative on BellRing Brands (it's free!)

BellRing Brands' narrative projects $2.8 billion revenue and $312.5 million earnings by 2028. This requires 8.1% yearly revenue growth and a $84.2 million earnings increase from $228.3 million today.

Uncover how BellRing Brands' forecasts yield a $39.07 fair value, a 25% upside to its current price.

Exploring Other Perspectives

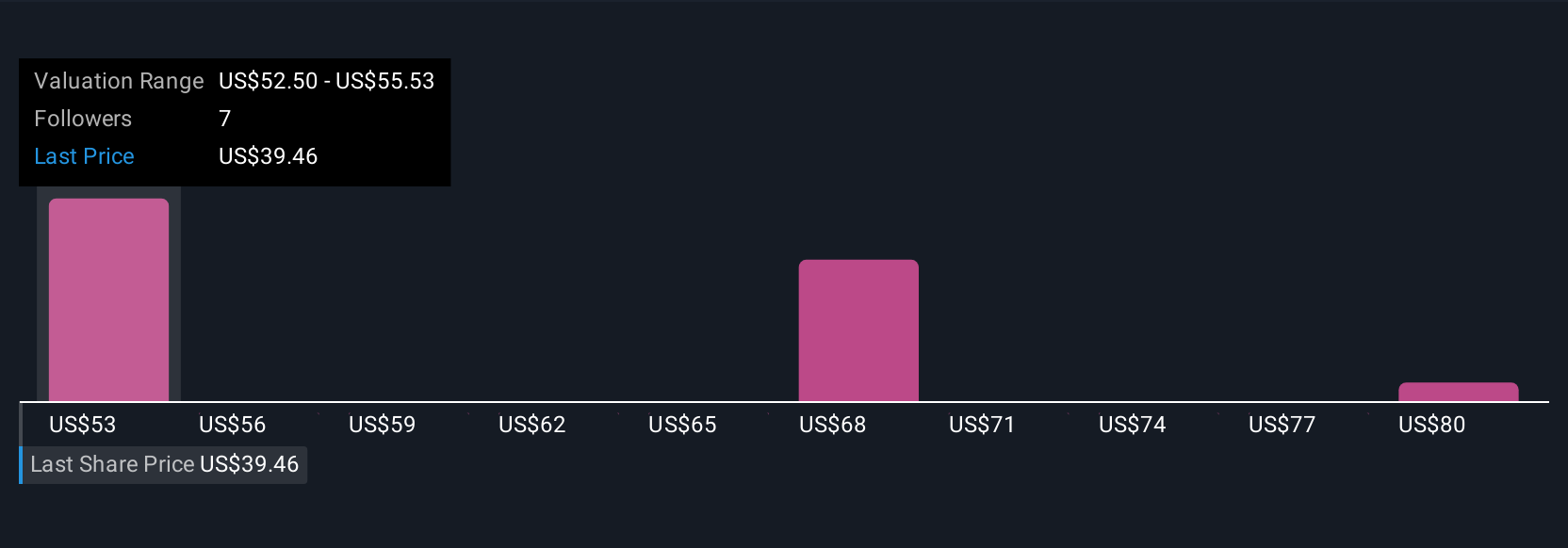

Five members of the Simply Wall St Community currently see BellRing’s fair value between US$39.07 and US$82.83, underscoring wide disagreements about upside potential. Against that backdrop, the new scrutiny of BellRing’s sales sustainability and retailer inventory disclosures may influence how you think about the resilience of its growth profile and whether to compare several different valuation viewpoints before forming your own view.

Explore 5 other fair value estimates on BellRing Brands - why the stock might be worth over 2x more than the current price!

Build Your Own BellRing Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BellRing Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BellRing Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BellRing Brands' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRBR

BellRing Brands

Provides various nutrition products in the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026