- United States

- /

- Personal Products

- /

- NYSE:BRBR

Did BellRing Brands’ (BRBR) Major Buyback and New Guidance Signal a Shift in Growth Strategy?

Reviewed by Sasha Jovanovic

- In recent days, BellRing Brands announced strong full-year financial results, completed significant share repurchases totaling over US$226 million, and introduced a new share buyback program for up to US$600 million set to expire in two years. The company also projected positive sales guidance for fiscal 2026 and appointed an experienced executive to its Board of Directors.

- BellRing’s initiatives reflect a dual focus on rewarding shareholders via buybacks and expanding category leadership, as the company continues to highlight growth in ready-to-drink protein shake sales and strengthened marketing efforts despite margin and competition challenges.

- We'll examine how the recently announced buyback program and robust sales outlook could impact BellRing Brands' investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

BellRing Brands Investment Narrative Recap

To be a shareholder in BellRing Brands, you need to believe that demand for ready-to-drink protein shakes remains resilient and that the company’s strong retail presence, proactive innovation, and steady distribution gains will outweigh margin pressures and intensifying competition. The recent buyback program signals confidence from management but does not materially alter the near-term risk of sustained input cost inflation and margin compression, which continues to be the most immediate challenge for the business.

Among the company’s latest announcements, the introduction of a new US$600 million share repurchase program stands out. This move follows the completion of earlier buybacks totaling over US$226 million, reflecting management's commitment to returning capital to shareholders, while potentially supporting the stock in periods of volatility arising from gross margin headwinds and rising input costs.

However, in contrast, investors should be aware that exposure to cost inflation from tariffs and input prices could meaningfully impact near-term earnings stability if...

Read the full narrative on BellRing Brands (it's free!)

BellRing Brands' outlook forecasts $2.8 billion in revenue and $312.5 million in earnings by 2028. This projection entails 8.1% annual revenue growth and a $84.2 million increase in earnings from the current $228.3 million.

Uncover how BellRing Brands' forecasts yield a $39.07 fair value, a 28% upside to its current price.

Exploring Other Perspectives

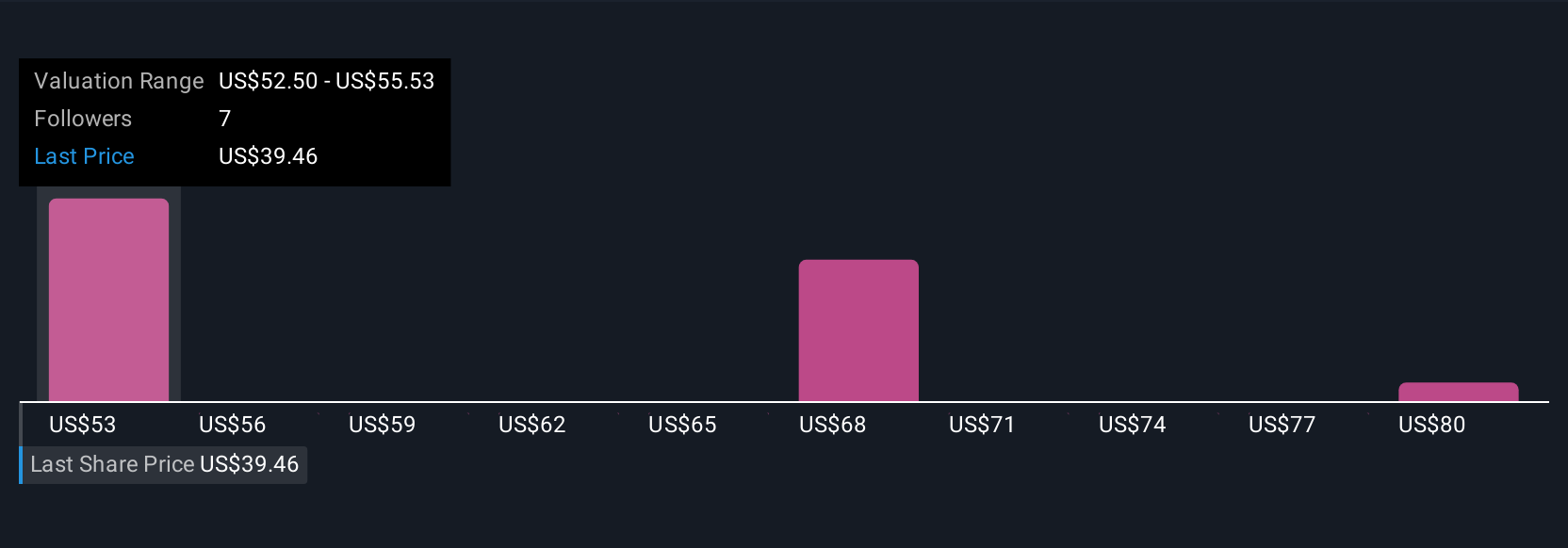

Simply Wall St Community members offer five fair value estimates for BellRing Brands ranging from US$39.07 to US$82.83 per share. With ongoing input cost inflation and margin pressures shaping the outlook, your assessment could differ meaningfully from other market participants, explore these viewpoints to see where you align.

Explore 5 other fair value estimates on BellRing Brands - why the stock might be worth over 2x more than the current price!

Build Your Own BellRing Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BellRing Brands research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BellRing Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BellRing Brands' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRBR

BellRing Brands

Provides various nutrition products in the United States.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success