- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

WD-40 (WDFC): A Closer Look at Valuation After Strong Sales, Earnings Growth, and Insider Buying

Reviewed by Simply Wall St

WD-40 (WDFC) saw its stock move after the company reported increases in both sales and net income for the fourth quarter and full year. Results were driven by steady demand for its core maintenance products as well as ongoing innovation efforts.

See our latest analysis for WD-40.

WD-40’s latest update caps off a year marked by both operational wins and heightened market volatility. Despite steady revenue growth, the share price return for 2025 sits at -19.3%, with a one-year total shareholder return of -24.8%. Recent insider buying and ongoing buybacks have helped shore up investor confidence, but the stock’s momentum has faded compared to previous multi-year gains and its strong run in the Asia Pacific segment. All eyes are now on whether renewed product innovation will support a recovery in sentiment.

If you’re exploring fresh investment ideas shaped by market shifts, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

But after significant gains in sales and profit, along with active buybacks and insider purchases, the question remains whether WD-40’s weaker share performance signals an undervalued opportunity or if the market has already priced in future growth.

Most Popular Narrative: 26.8% Undervalued

WD-40 closed at $193.70 while the most widely followed narrative places fair value at $264.50. This creates a significant gap that has investors paying close attention to the catalysts and assumptions behind the figure.

*The company’s focus on premiumization of products, with targets for a compound annual growth rate for premium products exceeding 10%, is poised to improve net margins by shifting the product mix towards higher-margin offerings. WD-40’s strategy to divest its less profitable home care and cleaning brands is expected to position the company as a higher growth and higher gross margin enterprise. This move could ultimately boost operational margins and net margins once complete.*

Want to know what justifies such a strong upside target? The real story behind this valuation is a bold mix of margin expansion, shifting product focus, and aggressive forecasts. Find out how bullish assumptions around growth and profitability could reshape the narrative. Dive in to see what’s driving that fair value call.

Result: Fair Value of $264.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, foreign currency swings and uncertainty around WD-40’s planned divestitures could easily derail the company's current margin and growth trajectory.

Find out about the key risks to this WD-40 narrative.

Another View: What Do Market Multiples Say?

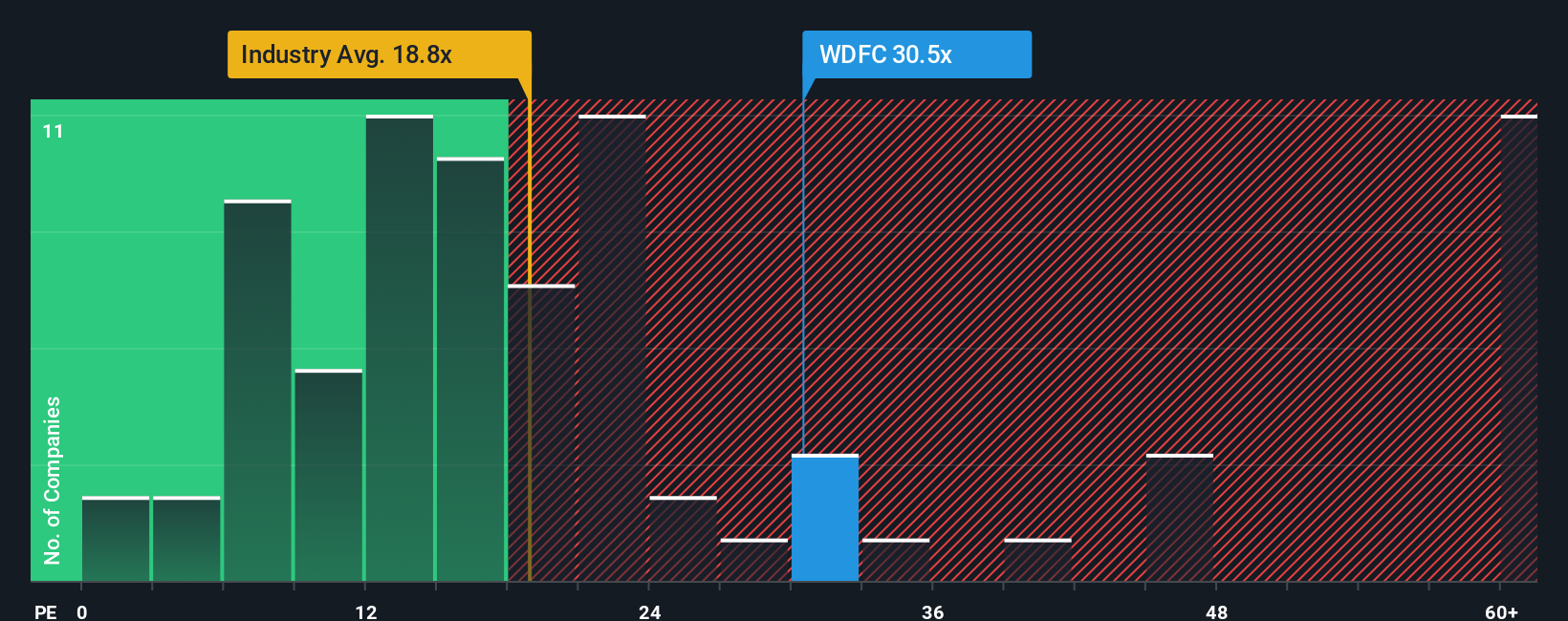

While the analyst narrative paints WD-40 as undervalued, looking through the lens of earnings multiples tells a different story. WD-40’s price-to-earnings ratio stands at 28.9x, which is much higher than both the US Household Products industry average of 15.1x and a fair ratio of 16.5x. This premium could mean investors expect outsized growth, or it could be a sign the stock is expensive compared to peers. Are markets missing something, or is the premium risky?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WD-40 Narrative

If you’d rather put the numbers to the test yourself or think a different angle reveals the real story, building your own narrative takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WD-40.

Looking for More Smart Investing Moves?

Smart investors don’t wait for the next big headline. Expand your watchlist now to capture opportunities across emerging trends, overlooked value, and future-ready sectors.

- Spot tomorrow’s market leaders early by scanning these 3582 penny stocks with strong financials with outstanding financials and rapid growth potential.

- Enhance your portfolio income with these 24 dividend stocks with yields > 3% offering solid yields and a track record of payout stability above 3%.

- Tap into the future of healthcare by tracking these 34 healthcare AI stocks as it transforms patient care through breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDFC

WD-40

Engages in the provision of maintenance products and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives