- United States

- /

- Household Products

- /

- NasdaqGS:CENT

Central Garden & Pet (CENT): Assessing Valuation Opportunities After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

Central Garden & Pet (CENT) shares have trended lower over the past month, sliding nearly 18%. Many investors are watching for what could spark a turnaround or further declines as we move deeper into the year.

See our latest analysis for Central Garden & Pet.

Central Garden & Pet’s share price has declined sharply in recent weeks, with a 30-day share price return of -17.8% that has weighed on sentiment. Despite this recent weakness, the stock’s one-year total shareholder return presents a less dramatic story, suggesting fading momentum compared to previous years.

If you’re weighing new opportunities in the market, now’s a smart moment to discover fast growing stocks with high insider ownership

This recent pullback raises a critical question: Is Central Garden & Pet trading at an attractive price given its fundamentals, or has the market already factored in all future growth expectations?

Most Popular Narrative: 26.9% Undervalued

Central Garden & Pet’s last close at $30.93 sits well below the fair value figure put forward by the most widely followed narrative, which implies significant upside potential based on future earnings power and operational efficiency.

Persistent operational streamlining, via the Cost and Simplicity program, footprint rationalization, SKU rationalization, and consolidation of distribution centers into DTC-enabled hubs, continues to unlock operating leverage. This supports steady margin expansion and improves bottom-line earnings despite transitory headwinds.

Curious what’s driving this bold valuation? The answer rests in ambitious growth targets, rising margins, and a transformation that could reshape Central Garden & Pet’s earnings quality. Analysts are betting on a playbook that only a deep dive can reveal. Find out what numbers could push the stock much higher.

Result: Fair Value of $42.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if revenue stalls due to SKU cuts or if supply chain pressures increase, Central Garden & Pet’s growth narrative could face more serious challenges in the future.

Find out about the key risks to this Central Garden & Pet narrative.

Another View: How Do Multiples Stack Up?

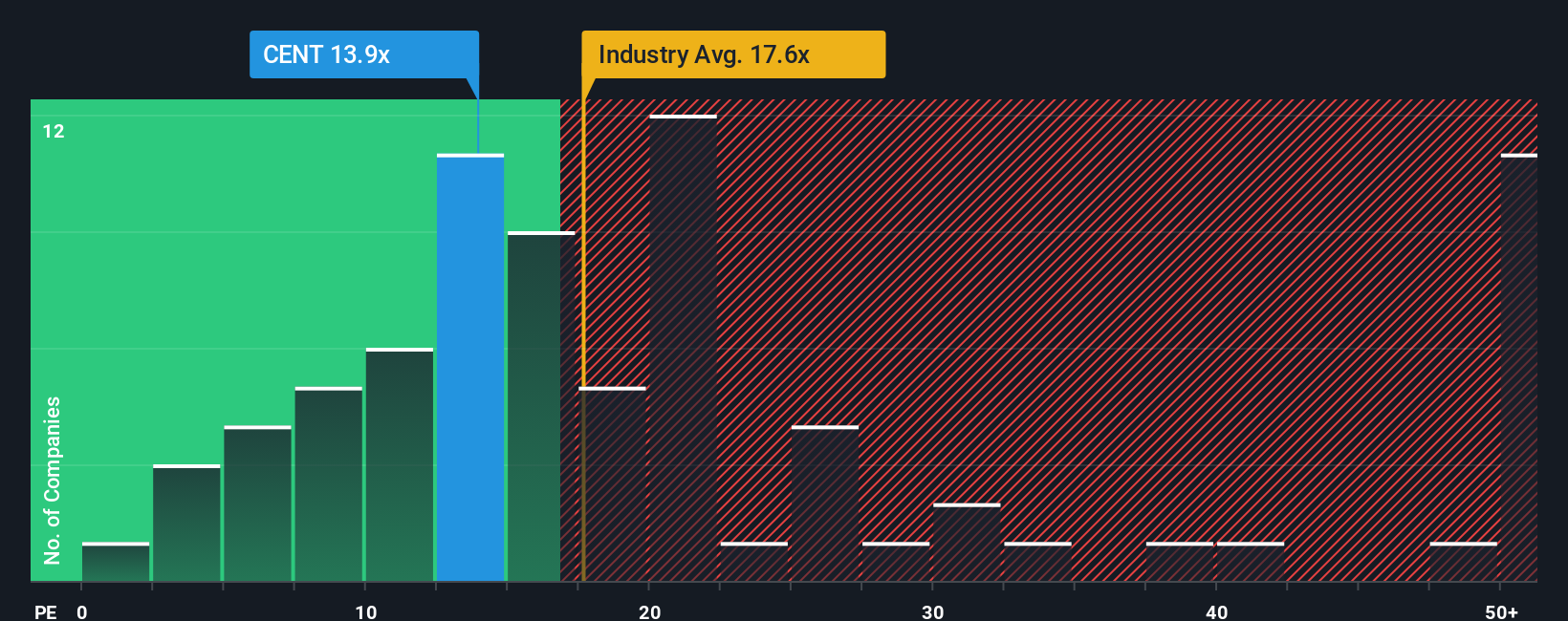

Looking at Central Garden & Pet’s valuation through its price-to-earnings ratio offers a different angle. The current ratio is 14x, which is noticeably lower than both the industry average (18.8x) and its peers (18.8x), and well below the fair ratio of 18.3x. This gap can signal opportunity, but does it suggest lasting value or simply reflect underlying risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Garden & Pet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Garden & Pet Narrative

If you’d rather rely on your own research and insights, you can easily craft a narrative backed by the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Central Garden & Pet.

Looking for More Investment Ideas?

Don’t let the next breakthrough pass you by. Boost your investing strategy today with these handpicked opportunities set to change the game.

- Spot high-potential newcomers shaking up markets by checking out these 3574 penny stocks with strong financials and see which companies could be tomorrow’s big winners.

- Capitalize on the AI revolution, where rapid innovation and soaring demand are driving growth. Get the inside track with these 25 AI penny stocks.

- Enhance your portfolio’s stability with steady yield from these 19 dividend stocks with yields > 3% offering strong returns and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENT

Central Garden & Pet

Produces and distributes various products for the lawn and garden, and pet supplies markets in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives