- United States

- /

- Healthcare Services

- /

- NYSEAM:NHC

Undiscovered Gems in the US Market for September 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility, with major indices like the S&P 500 and Nasdaq experiencing declines ahead of key inflation data, investors are keenly observing economic indicators such as GDP growth and jobless claims for signs of resilience. This environment underscores the importance of identifying stocks that demonstrate strong fundamentals and potential for growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Investors Title (ITIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Investors Title Company specializes in providing title insurance for residential, institutional, commercial, and industrial properties with a market capitalization of $490.26 million.

Operations: The primary revenue stream for Investors Title Company comes from title insurance, generating $265.11 million, while exchange services contribute $12.02 million. The company focuses on these segments to drive its financial performance.

Investors Title, a nimble player in the insurance sector, showcases robust financial health with no debt over the past five years and high-quality earnings. Despite a 14.5% annual decline in earnings over the last five years, recent performance is promising with a 25.9% increase in earnings this year, outpacing industry growth of 6%. The company reported second-quarter revenue of US$73.65 million and net income of US$12.28 million, up from US$65.38 million and US$8.87 million respectively last year, while basic EPS rose to US$6.51 from US$4.71 per share previously.

- Take a closer look at Investors Title's potential here in our health report.

Explore historical data to track Investors Title's performance over time in our Past section.

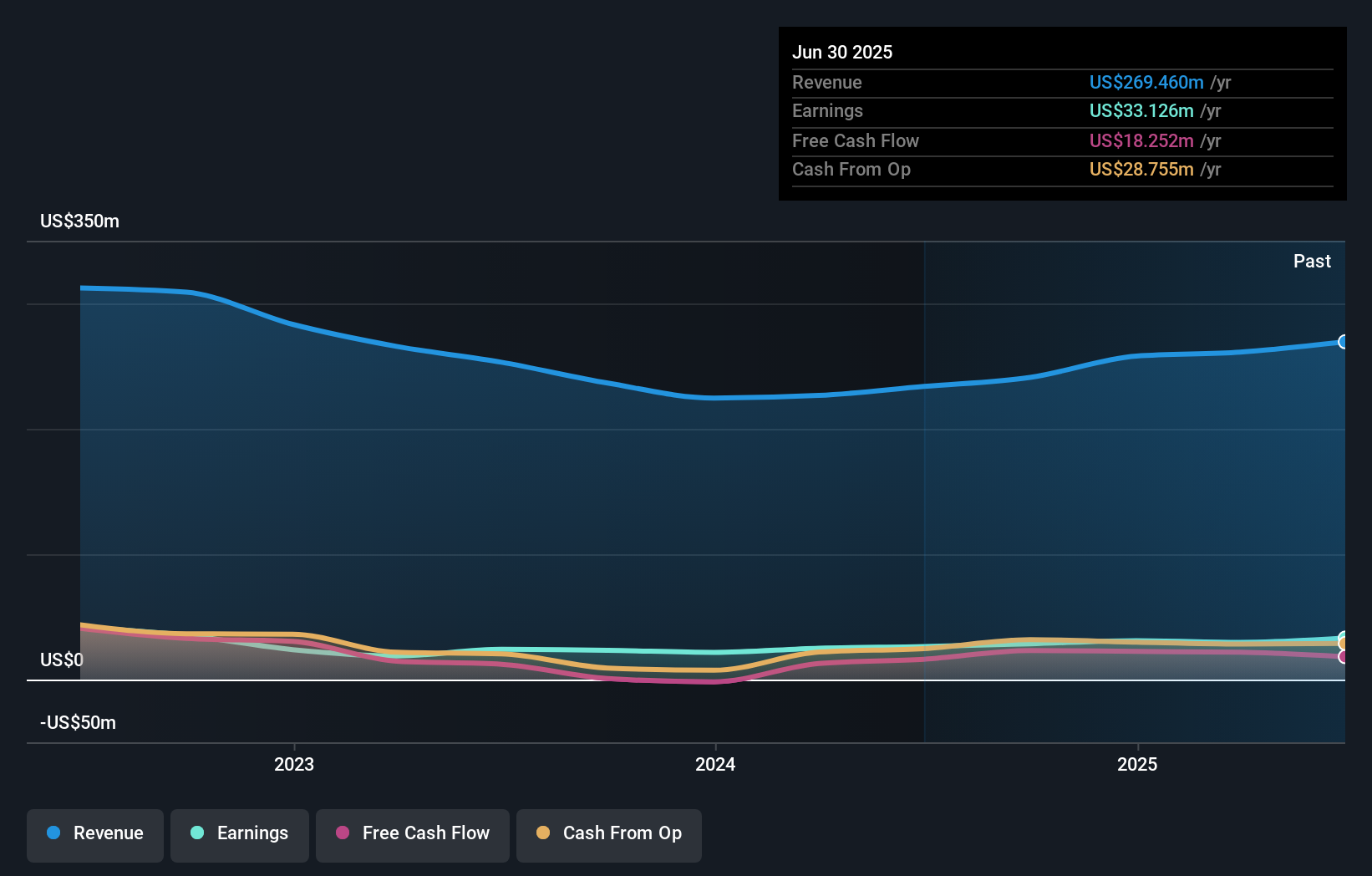

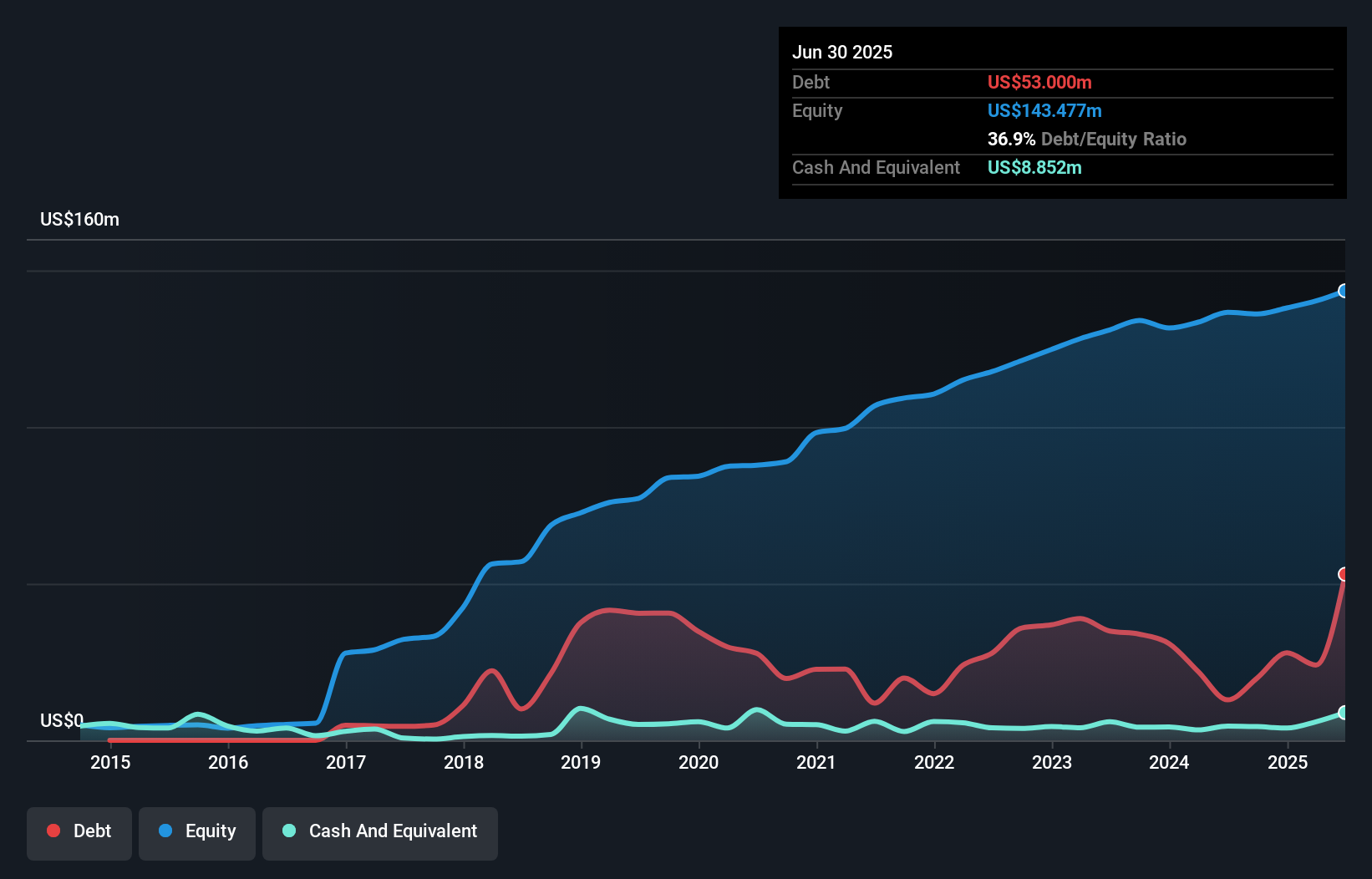

EVI Industries (EVI)

Simply Wall St Value Rating: ★★★★★☆

Overview: EVI Industries, Inc. operates through its subsidiaries to distribute, sell, rent, and lease commercial and industrial laundry and dry-cleaning equipment with a market cap of $436.97 million.

Operations: Revenue primarily stems from the commercial laundry segment, totaling $389.83 million.

EVI Industries, a smaller player in the commercial and industrial laundry sector, has shown impressive earnings growth of 30.4% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 30.8%, indicating manageable leverage levels. Recently, EVI reported full-year sales of US$389.83 million with a net income of US$7.5 million, reflecting steady financial performance compared to the previous year. Despite being dropped from several Russell indices recently, EVI's strategic acquisitions and digital investments are likely enhancing its market reach and operational efficiency while maintaining positive free cash flow at US$27.79 million as of June 2024.

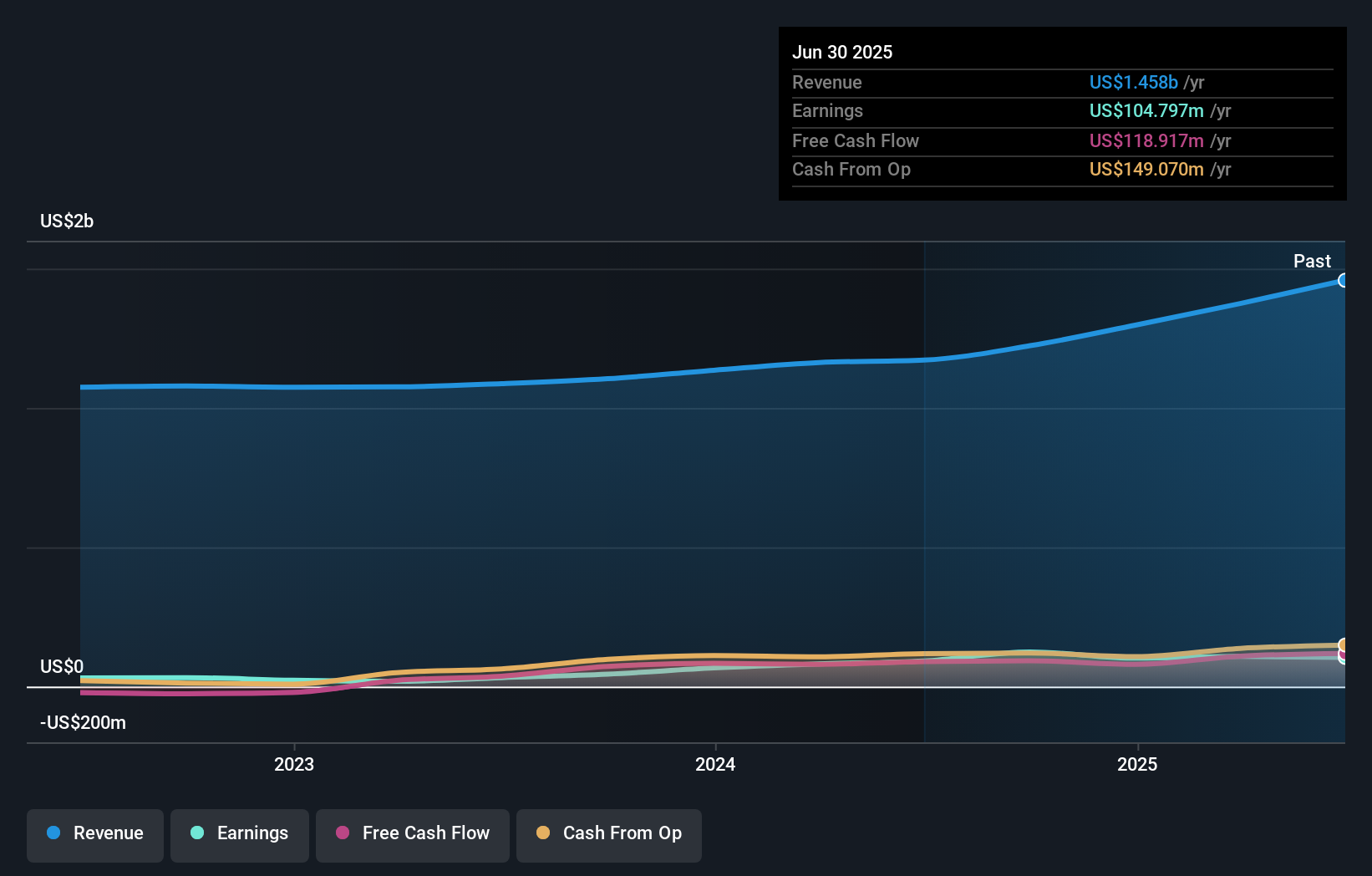

National HealthCare (NHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: National HealthCare Corporation operates skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals with a market cap of $1.93 billion.

Operations: National HealthCare Corporation generates revenue primarily from inpatient services, contributing $1.27 billion, and homecare and hospice services, adding $146.82 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

National HealthCare (NHC) stands out with its robust financial health, boasting more cash than total debt and a debt to equity ratio that rose from 0% to 10.7% over five years. The company’s earnings surged by 14.1% last year, outpacing the healthcare industry's 8.3%. Despite trading at a significant discount of 59.2% below estimated fair value, NHC maintains high-quality earnings and positive free cash flow. Recent results showed revenue climbing to US$374 million in Q2 from US$301 million the previous year, though net income slightly dipped to US$23 million from US$27 million, reflecting mixed performance dynamics amidst growth prospects.

Taking Advantage

- Click here to access our complete index of 285 US Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National HealthCare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:NHC

National HealthCare

Engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026