- United States

- /

- Healthcare Services

- /

- NYSEAM:NHC

Should Executive Changes and Insider Selling at National HealthCare (NHC) Prompt Investors to Reevaluate Their Outlook?

Reviewed by Sasha Jovanovic

- In the past week, National HealthCare Corporation announced key leadership changes, including the appointment of Dr. Lisa Piercey to its Board of Directors and the elevation of Stephen F. Flatt to CEO and President, while executives Emil Hassan and Stephen Flatt disclosed recent insider sales totaling over US$1.17 million.

- This period of transition was accompanied by the company's declaration of a quarterly dividend, highlighting ongoing efforts to maintain shareholder value amid executive changes.

- We'll explore how insider selling by key executives frames the evolving investment narrative for National HealthCare.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is National HealthCare's Investment Narrative?

To be a shareholder in National HealthCare, you need confidence in its ability to balance steady dividends and operational stability with the pressures of evolving industry trends and management changes. The past week's announcement of leadership appointments and increased insider selling doesn't materially shift the short-term catalysts, which continue to be defined by reliable dividend payouts, facility expansions, and operational continuity following executive transitions. While insider sales can sometimes signal uncertainty, the company's recent share price strength, trading near its 52-week high, suggests the market has so far taken these events in stride. However, more significant executive turnover and a dip in net income highlight ongoing risks, particularly if further leadership changes disrupt strategic direction. The importance of strong cash flow and maintaining quality care standards remains vital, as the market weighs these recent moves and dividend consistency against any emerging risks.

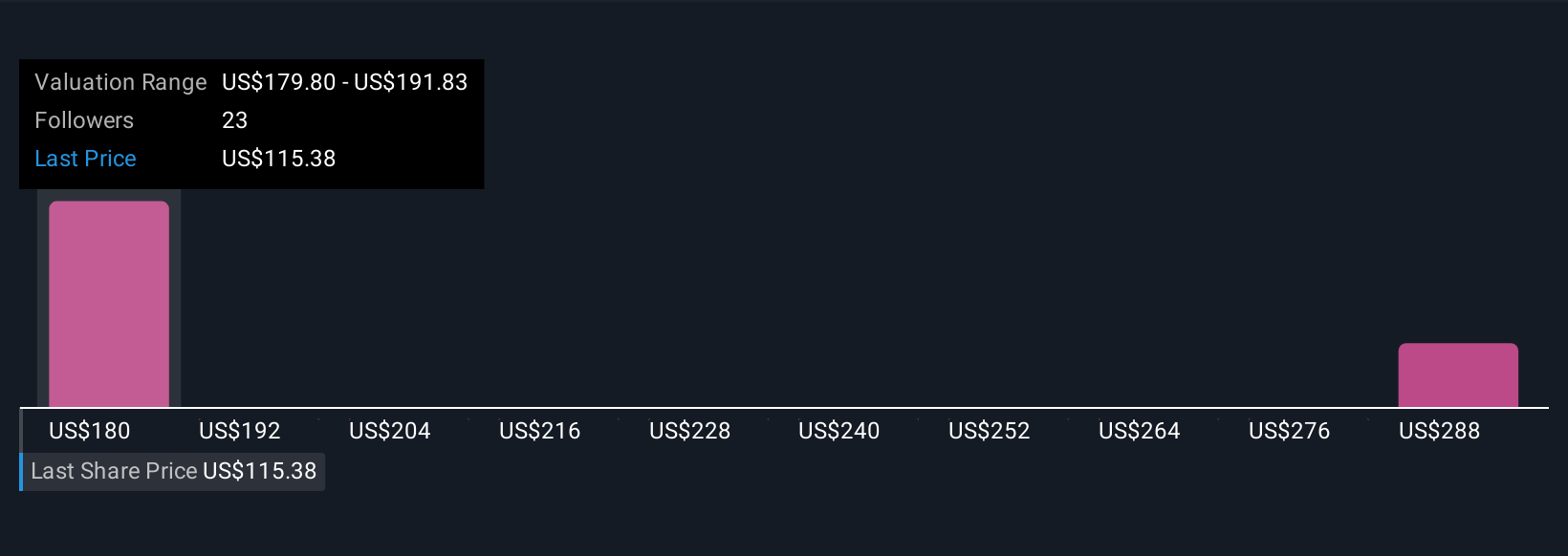

But while recent stability is encouraging, insider selling should remain on your radar. National HealthCare's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on National HealthCare - why the stock might be worth over 3x more than the current price!

Build Your Own National HealthCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National HealthCare research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National HealthCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National HealthCare's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National HealthCare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:NHC

National HealthCare

Engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.