- United States

- /

- Healthtech

- /

- NYSE:VEEV

Announcing: Veeva Systems (NYSE:VEEV) Stock Soared An Exciting 394% In The Last Five Years

While Veeva Systems Inc. (NYSE:VEEV) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 17% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. In fact, during that period, the share price climbed 394%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

Check out our latest analysis for Veeva Systems

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

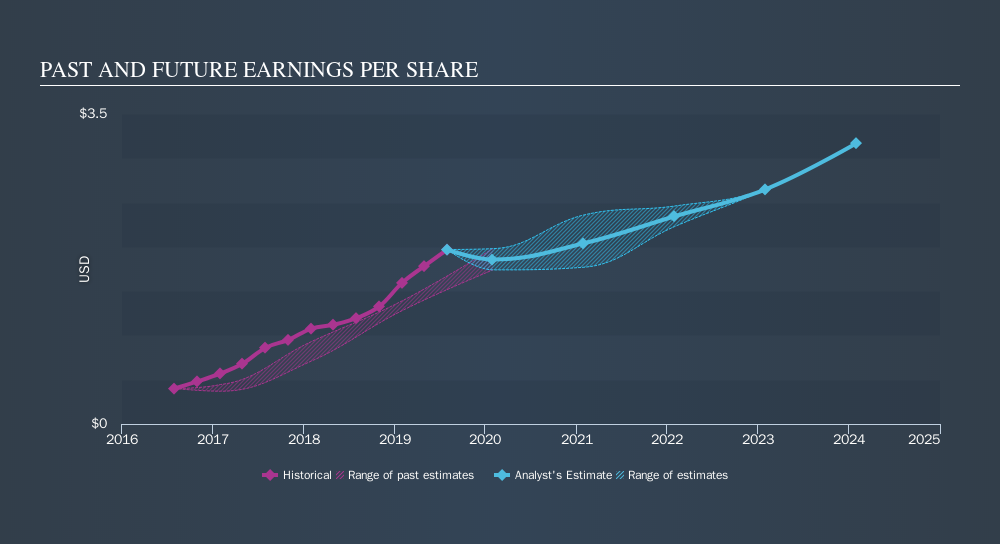

During five years of share price growth, Veeva Systems achieved compound earnings per share (EPS) growth of 52% per year. The EPS growth is more impressive than the yearly share price gain of 38% over the same period. So it seems the market isn't so enthusiastic about the stock these days. Having said that, the market is still optimistic, given the P/E ratio of 72.22.

You can see how EPS has changed over time in the image below.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Veeva Systems's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Veeva Systems shareholders have received a total shareholder return of 63% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 38% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Veeva Systems it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives