- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Will ResMed’s (RMD) Margin Expansion Define Its Role as a Defensive Portfolio Anchor?

Reviewed by Sasha Jovanovic

- Recent analyst commentary highlights ResMed's strong fundamentals, including expanding margins, robust cash flow, and resilience against economic downturns, as key reasons for optimism about the company's future prospects.

- This focus on financial stability and operational efficiency has drawn increased investor attention, especially for those seeking portfolio protection during uncertain economic conditions.

- We'll explore how ResMed's proven financial resilience and operational strengths may shape its current and future investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ResMed Investment Narrative Recap

To own ResMed shares, you need confidence in the company's ability to sustain earnings growth and expand margins even as the competitive environment in sleep therapy evolves. The recent analyst optimism centers on resilient fundamentals and strong cash flow, but this does not appear to materially alter the most influential near-term catalyst, ongoing product adoption, or the principal risk of reimbursement policy tightening. Of the latest announcements, ResMed's ongoing share buyback initiatives stand out. Continued buybacks, supported by robust cash generation, demonstrate management's consistent emphasis on capital returns, which builds shareholder value as long as core profitability and cash flows remain resilient. However, investors should also consider the contrasting risk posed by potential changes to CMS competitive bidding in the US, which, if resumed or tightened, could...

Read the full narrative on ResMed (it's free!)

ResMed's narrative projects $6.4 billion revenue and $1.9 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion earnings increase from $1.4 billion today.

Uncover how ResMed's forecasts yield a $295.13 fair value, a 21% upside to its current price.

Exploring Other Perspectives

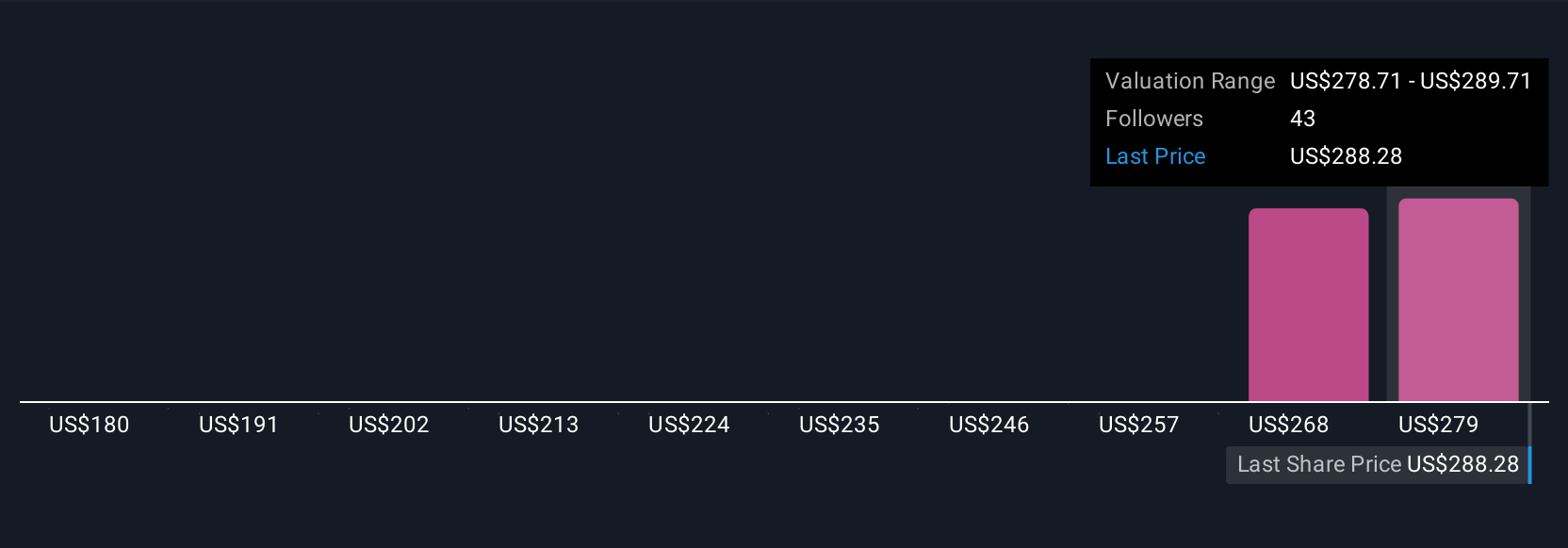

Seven members of the Simply Wall St Community set fair value estimates for ResMed ranging from US$193.80 to US$295.13 per share. As participants weigh these differences, the looming uncertainty over reimbursement policies may play a significant role in future investor sentiment, explore how others see the company's outlook today.

Explore 7 other fair value estimates on ResMed - why the stock might be worth 21% less than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026