- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Molina Healthcare Jumps 16% as ACA Subsidy Decisions Loom Over Valuation in 2025

Reviewed by Bailey Pemberton

If you’re watching Molina Healthcare stock and wondering if it’s time to jump in, hold steady, or move on, you’re far from alone. The last month has been a wild ride with the stock climbing 16.4% in just 30 days, and a solid 6.2% gain over the past week. Those moves are especially eye-catching after what has been a tough stretch for the company, with shares down 29.2% year-to-date and off 37.4% from one year ago. Over a longer view, three- and five-year returns are also hovering near break-even, which says a lot about the volatility that has recently defined this stock.

So, what has been fueling all these ups and downs? The news cycle has been especially active for healthcare insurers like Molina. There’s talk of major rate hikes for ACA marketplace plans next year and ongoing legal back-and-forth over Medicare drug price negotiations. Even broader issues, like government subsidies tied up in shutdown negotiations, have injected both risk and potential opportunity into the sector. Some of that recent momentum may be from renewed optimism as Molina looks better positioned against shifting policies, while investors reassess the risks and possible rewards ahead.

When it comes to valuation, Molina Healthcare actually shines brighter than recent headlines might suggest. By standard valuation methods, it is undervalued on 5 out of 6 key checks, giving it a strong value score of 5. But as with any stock, numbers only tell part of the story. In the next section, we’ll break down those different valuation approaches and hint at an even deeper way to think about Molina’s true value a little later on.

Why Molina Healthcare is lagging behind its peers

Approach 1: Molina Healthcare Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting future free cash flows and discounting them back to today's dollars. This method helps investors see past short-term market noise by focusing on the business’s longer-term cash generation potential.

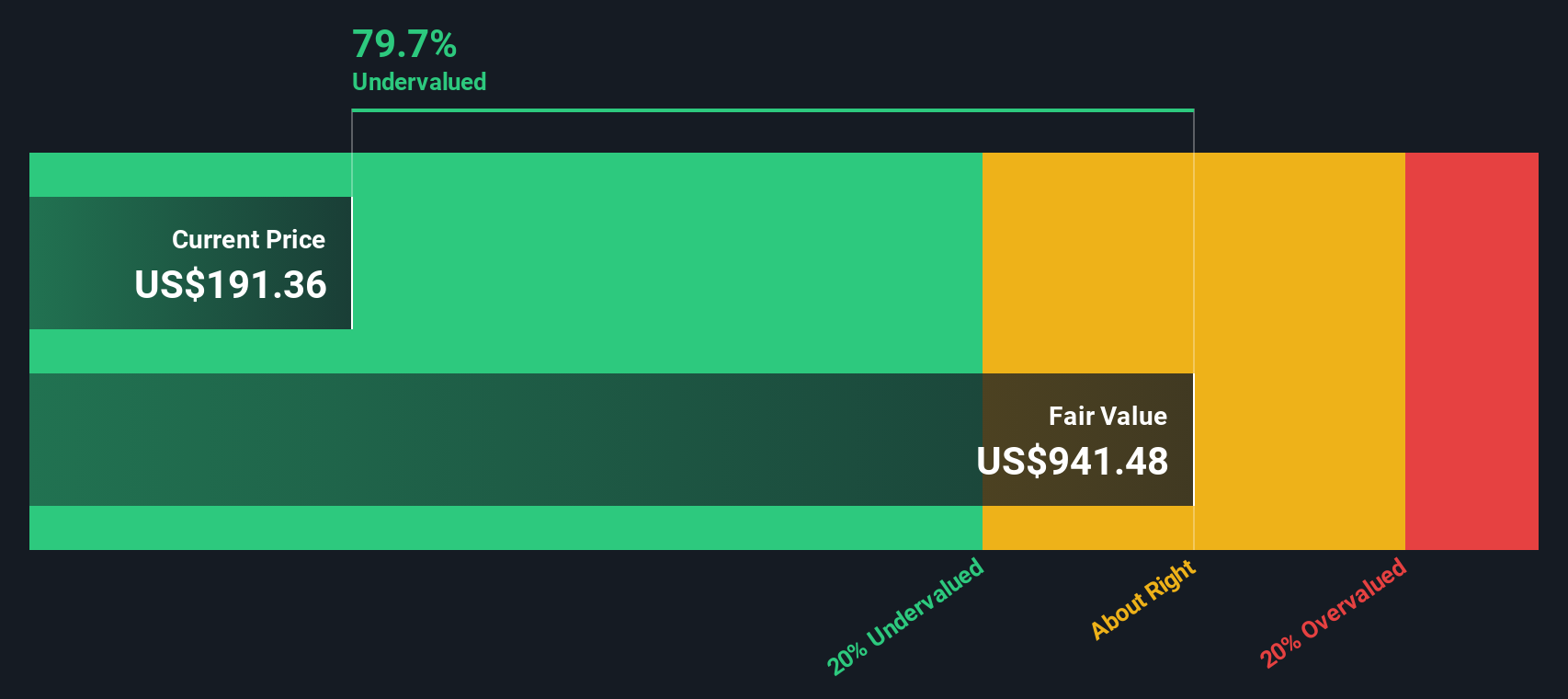

For Molina Healthcare, the most recent Free Cash Flow is $427 Million. Analyst projections only go out five years, with forecasts reaching $1.87 Billion in 2029. Beyond that, future projections provided by Simply Wall St suggest Free Cash Flow continuing to climb into the 2030s, peaking above $2.5 Billion per year by 2035. All estimates and calculations are made in U.S. dollars.

Using these inputs and discounting future cash flows back to present value, the DCF model calculates Molina Healthcare’s intrinsic value at $941.48 per share. This implies the stock trades at a 78.4% discount to its estimated fair value, indicating significant undervaluation relative to current market pricing.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molina Healthcare is undervalued by 78.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Molina Healthcare Price vs Earnings

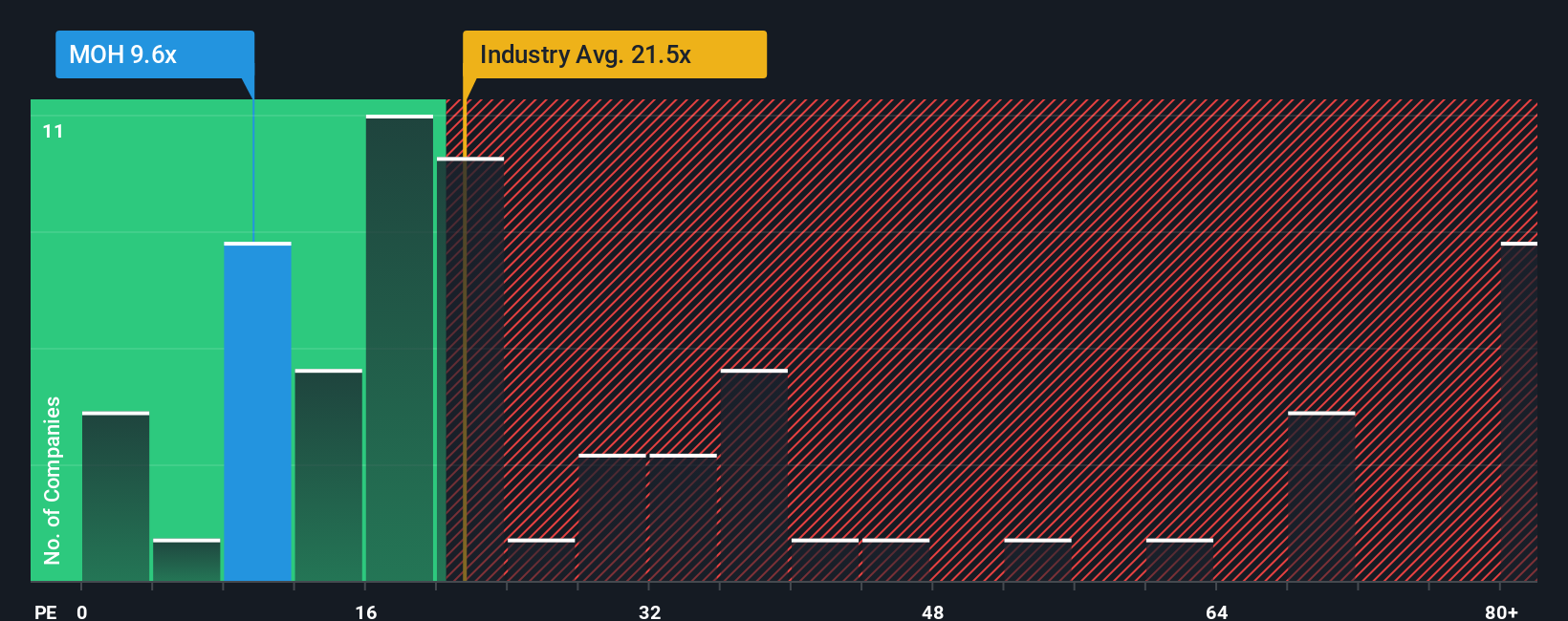

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly relates a company's share price to its per-share earnings. For investors, it quickly shows how much is being paid for every dollar of earnings, making it a handy tool for comparing profitability across firms.

However, not all PE ratios are created equal. Companies with higher expected earnings growth, more stable profits, or lower risk profiles can usually justify higher PE ratios. In contrast, companies facing more uncertainty or lower growth prospects tend to trade at lower multiples. Understanding these factors helps set expectations for what constitutes a “normal” or “fair” PE ratio.

Molina Healthcare currently trades at a PE ratio of 9.7x. That is well below both the healthcare industry average of 21.6x and the North American peer group average of 29.1x. Looking beyond simple averages is key. Simply Wall St calculates a “Fair Ratio” for Molina Healthcare at 26.4x, taking into account the company’s earnings growth, risk profile, profit margins, business size, and industry dynamics. This approach offers a more nuanced valuation because it moves past the surface-level peer comparisons to address Molina’s unique qualities and risks.

With Molina’s actual PE ratio at 9.7x compared to a Fair Ratio of 26.4x, the stock appears materially undervalued on this metric too.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Molina Healthcare Narrative

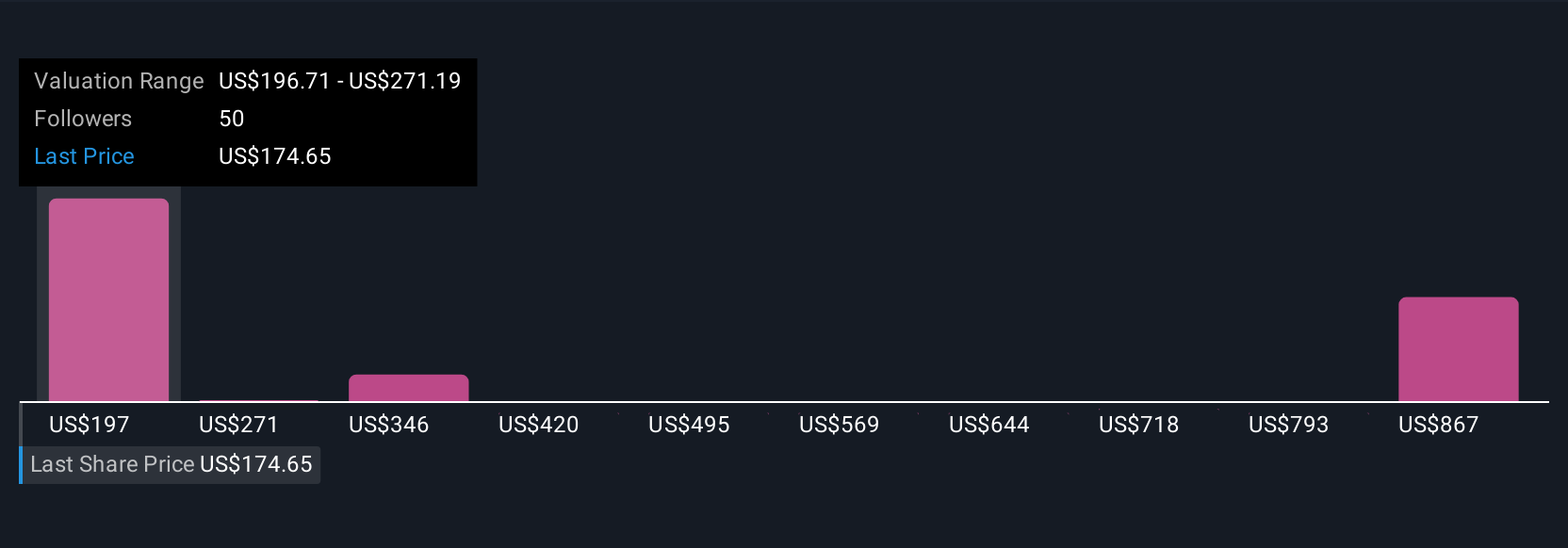

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about Molina Healthcare, combining your unique expectations about future revenue, earnings, and margins into a financial forecast that leads directly to your estimate of fair value. It lets investors move beyond the headline numbers and connect what they believe about the company's future with what they think the stock is worth.

Narratives are designed to be easy and accessible, and on Simply Wall St’s Community page, millions of investors use them to make smarter decisions. When you create or follow a Narrative, it automatically tracks the company's latest data and updates your fair value in real time as new news or earnings are released. This means your story and your valuation evolve as the facts change, helping you make buy or sell decisions based on the up-to-date gap between fair value and market price.

For example, some Narratives for Molina Healthcare project fair values as high as $411 based on robust government contract wins and membership growth, while others are more cautious, pegging fair value closer to $189 due to concerns about Medicaid funding and industry cost pressures. The takeaway is that whatever your perspective, Narratives help you clarify your thinking and make investing a more dynamic and personal process.

For Molina Healthcare, we'll make it really easy for you with previews of two leading Molina Healthcare Narratives:

Fair Value: $411.65

Current Price is undervalued by 50.6%

Revenue Growth Rate: 7.42%

- Membership growth and recent government contract wins are driving both revenue and future earnings expectations, with premium revenue projected to continue rising.

- Key risks include regulatory changes, competitive pressures, and Medicaid redeterminations that could impact profitability and revenue stability.

- Analysts expect moderate, steady revenue and earnings growth, projecting forward P/E ratios to stay attractive compared to peers.

Fair Value: $189.43

Current Price is overvalued by 7.3%

Revenue Growth Rate: 6.80%

- Recent RFP wins and Medicaid strategy are boosting revenue and earnings prospects, but future growth depends on continued operational execution and integration of acquisitions.

- Major risks stem from potential Medicaid funding cuts, higher medical costs, and the loss of key contracts, which could limit earnings visibility and put pressure on margins.

- Analyst consensus holds that Molina Healthcare is trading close to its fair value, with only a modest upside, and expect industry cost pressures and regulatory headwinds to cap near-term gains.

Do you think there's more to the story for Molina Healthcare? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives