- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Does Molina Healthcare’s 26% Drop Signal a Buying Opportunity in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Molina Healthcare’s steeply discounted stock is actually a bargain hiding in plain sight? Let’s dive into what matters most for value-focused investors like you.

- After a stretch of significant declines, Molina Healthcare is down nearly 26% this month and over 50% year-to-date. This could signal a shift in the market’s take on its prospects or risk profile.

- Recent headlines have spotlighted Molina’s competitive positioning amid shifting healthcare regulations and several new managed care contracts. These developments have brought renewed attention to its long-term strategy, which might help explain the company’s dramatic price moves as investors digest both the challenges and growth opportunities in the evolving landscape.

- On the pure numbers front, Molina Healthcare boasts a valuation score of 6 out of 6 based on six key checks for undervaluation, putting it at the top of the scale. So what does that really mean for you? Up next, we will compare all the standard ways professionals value a stock, but if you’re looking for more than just numbers, there’s a smarter approach we will reveal by the end of this article.

Find out why Molina Healthcare's -55.0% return over the last year is lagging behind its peers.

Approach 1: Molina Healthcare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Molina Healthcare, this uses cash flow projections over several years and factors in both analyst forecasts and extrapolations beyond that period.

According to the latest figures, Molina Healthcare’s most recent free cash flow was negative, at -$573 million, which means the company spent more cash than it generated during the last twelve months. However, analyst projections expect a significant turnaround with free cash flow growing consistently year over year. For example, by 2026, annual free cash flow is forecasted to reach nearly $1.4 billion and is expected to continue rising to over $1.8 billion by the end of 2029, all in dollar terms. Projections beyond the next five years are extrapolated by Simply Wall St based on observable trends.

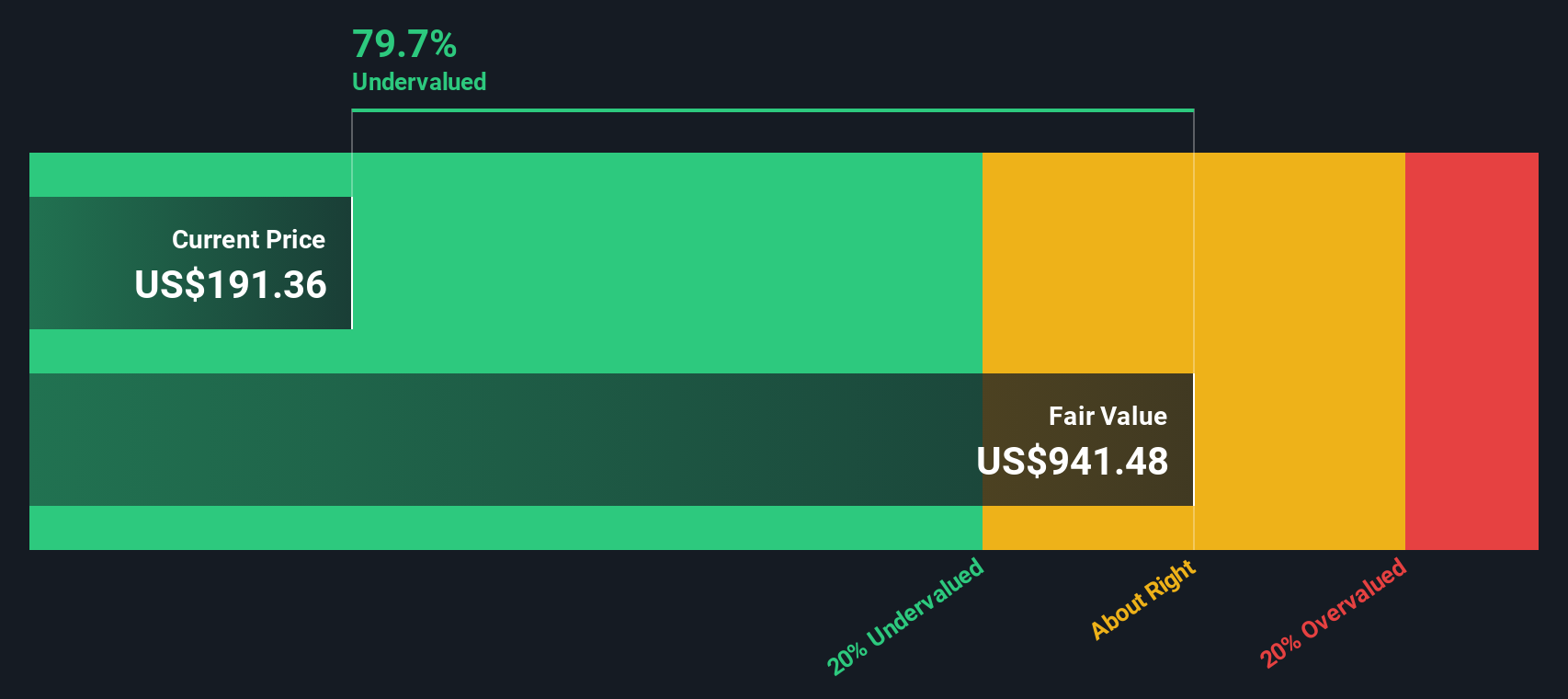

Using this method and the 2 Stage Free Cash Flow to Equity approach, Molina Healthcare’s intrinsic value per share is estimated at about $949. This is roughly 84.9% higher than the current trading price, which indicates the stock is undervalued by the market according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molina Healthcare is undervalued by 84.9%. Track this in your watchlist or portfolio, or discover 856 more undervalued stocks based on cash flows.

Approach 2: Molina Healthcare Price vs Earnings

The Price-to-Earnings (PE) ratio is often the best valuation metric for companies that are consistently profitable, like Molina Healthcare. This ratio compares a company’s share price to its earnings per share, offering a quick way to gauge how the market values its profits relative to peers or its own past performance.

When evaluating what a “normal” or fair PE ratio looks like, it’s important to consider both growth expectations and risk. Companies expected to deliver strong future earnings growth or with lower risk profiles generally justify higher PE ratios. Conversely, slower growth or more risk typically translates to lower multiples.

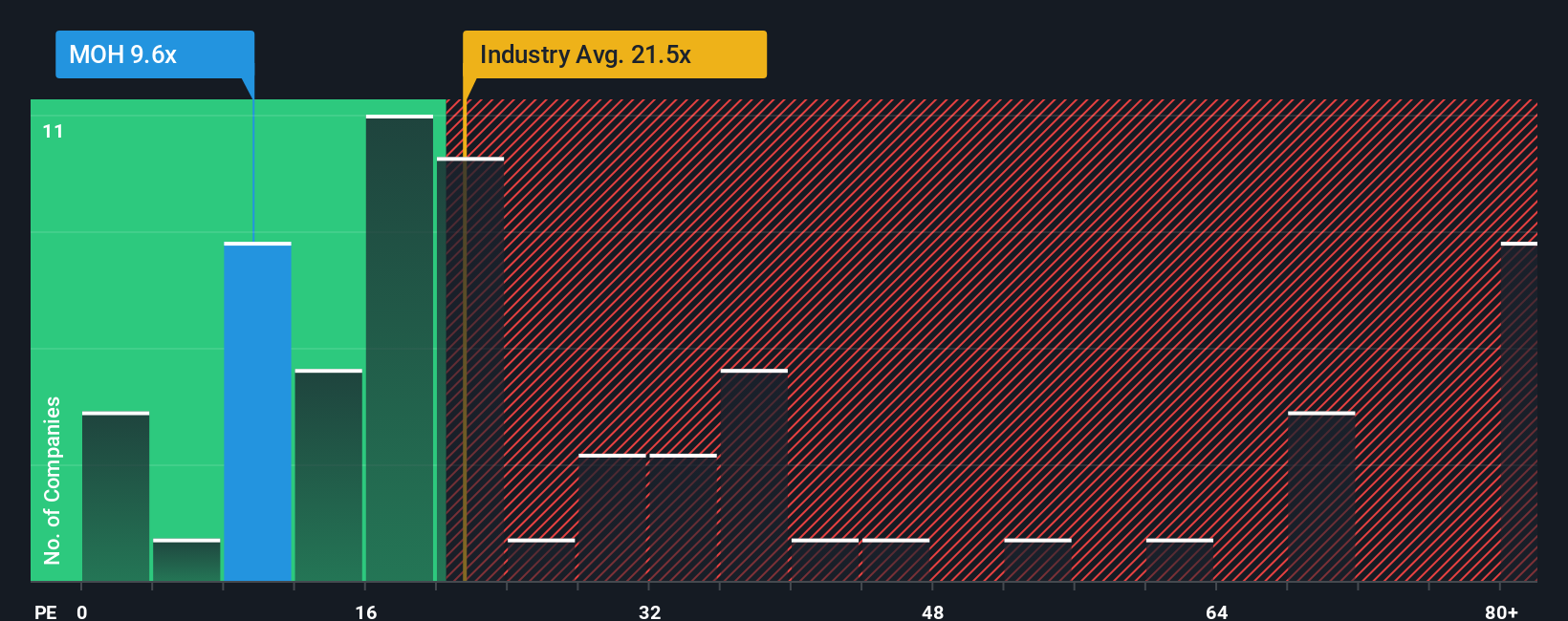

Molina Healthcare currently trades at a PE ratio of 8.4x, far below both its industry average of 21.9x and the average among its direct peers at 32.7x. While those comparisons are helpful, they can overlook important context about a company’s specific growth trends, risks, and profitability.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. This figure calculates what the company should theoretically trade at, considering all the nuances that typical comparisons might miss. For Molina Healthcare, the Fair PE Ratio is 23.5x, which factors in its earnings growth outlook, profit margins, sector dynamics, and company size. By taking these elements into account, the Fair Ratio provides a more tailored and accurate benchmark than simply comparing to peers or industry averages.

Comparing Molina Healthcare’s current PE of 8.4x to its Fair Ratio of 23.5x shows a substantial gap, suggesting the stock is trading at a significant discount to its fair value on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1373 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Molina Healthcare Narrative

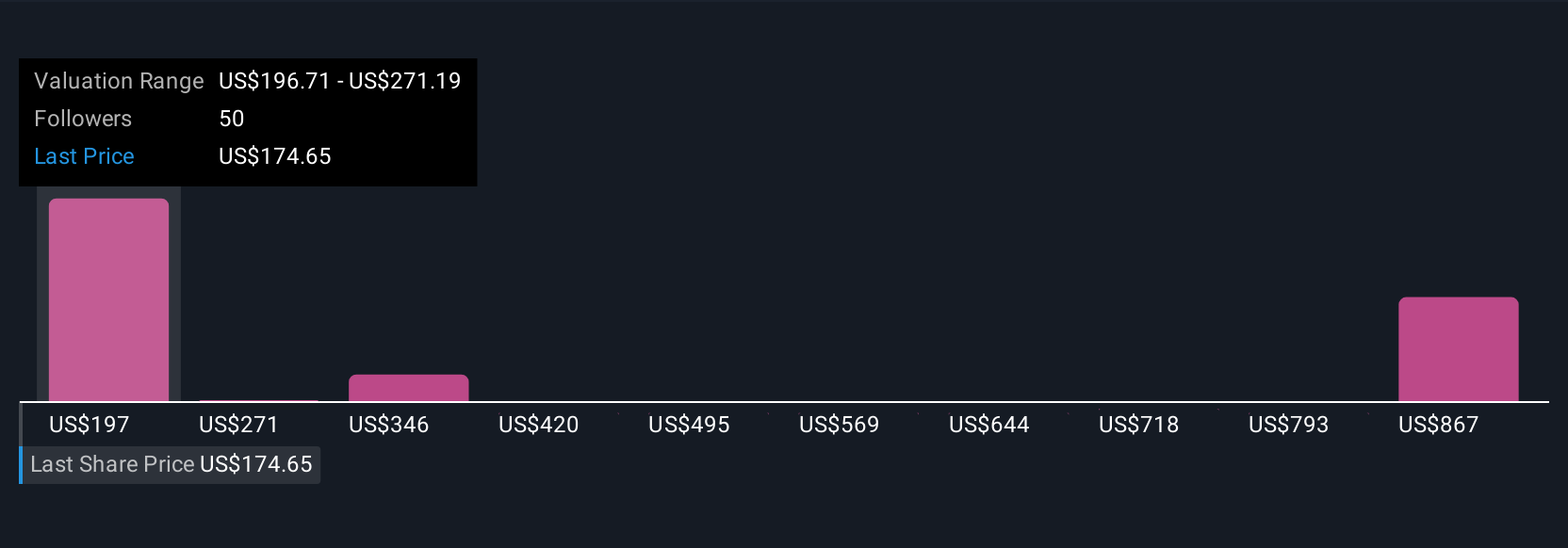

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are stories investors create that connect a company's prospects to concrete financial forecasts and fair value estimates. A Narrative is your personal take on where Molina Healthcare is headed, allowing you to blend your insights with hard numbers about future revenue, margins, and valuation.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy and accessible tool to give meaning to the numbers and to visualize their own expected fair value for a company. Narratives make it simpler to decide when to buy or sell by comparing your projected fair value against the current share price, as well as showing how your view stacks up against other investors’ perspectives.

They also update automatically whenever new and relevant information or news is released, meaning your Narrative evolves as the facts change. For example, when looking at Molina Healthcare, some investors expect $1.3 billion in earnings by 2028 with a fair value of $330 per share, while others see $1.1 billion in earnings and a much lower target of $153. This shows just how Narratives capture a wide spectrum of beliefs built on the latest data.

Do you think there's more to the story for Molina Healthcare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives