- United States

- /

- Healthcare Services

- /

- NYSE:MD

Why Pediatrix Medical Group (MD) Is Up 5.5% After Net Income Surges Despite Lower Revenue

Reviewed by Sasha Jovanovic

- Pediatrix Medical Group recently reported its third quarter 2025 results, posting US$492.88 million in sales and a sharp increase in net income to US$71.71 million compared to US$19.44 million a year earlier.

- Despite lower year-over-year revenue, the company delivered significantly higher earnings per share, highlighting improved profitability and stronger operational performance.

- We'll explore how the company's strong increase in net income shapes its investment narrative and outlook for future earnings growth.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Pediatrix Medical Group Investment Narrative Recap

To own shares in Pediatrix Medical Group, you need to believe that growth in specialized pediatric and neonatal services will deliver consistent cash flow and margin improvement, despite revenue volatility from portfolio restructuring. The recent earnings report showed a sharp rise in profitability, but ongoing contraction in top-line sales means the biggest short-term catalyst remains operational efficiency, while revenue declines and fee pressures are still the primary risk. The news doesn't materially reduce these risks, but confirms progress on margins.

Among recent announcements, the approval of a new US$250 million share repurchase program stands out. While this signals confidence from management and could improve per-share metrics, the impact on underlying business drivers, like sustained same-unit growth and exposure to shifting payer environments, remains closely tied to the catalysts and risks shaping Pediatrix’s outlook.

In contrast, investors should be aware of how further pushback on hospital fee increases could threaten...

Read the full narrative on Pediatrix Medical Group (it's free!)

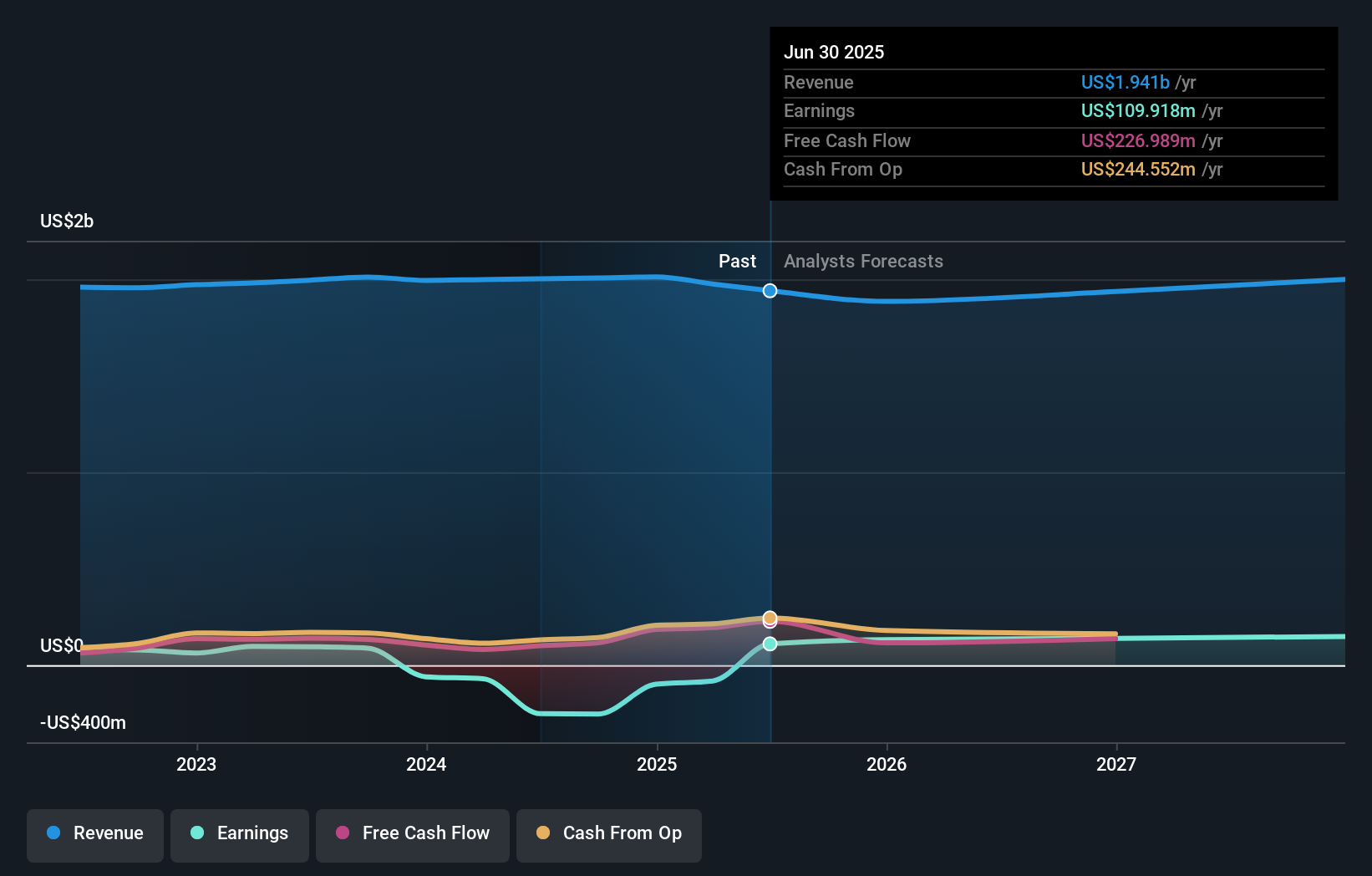

Pediatrix Medical Group's outlook anticipates $2.1 billion in revenue and $145.1 million in earnings by 2028. This forecast is based on an assumed revenue growth rate of 2.5% per year and a $35.2 million increase in earnings from the current level of $109.9 million.

Uncover how Pediatrix Medical Group's forecasts yield a $19.92 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for Pediatrix Medical Group range from US$0.16 to US$36.47 across four opinions, showing very different outlooks. While recent results highlight margin gains, ongoing revenue contraction seen in the latest earnings may have broader implications for future growth and stability, so it pays to examine a range of perspectives.

Explore 4 other fair value estimates on Pediatrix Medical Group - why the stock might be worth as much as 61% more than the current price!

Build Your Own Pediatrix Medical Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pediatrix Medical Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pediatrix Medical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pediatrix Medical Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives