- United States

- /

- Healthcare Services

- /

- NYSE:MD

Pediatrix Medical Group (MD) Is Up 6.6% After Q3 Revenue Beat and Policy Tailwinds - Has the Narrative Shifted?

Reviewed by Sasha Jovanovic

- In the past week, Pediatrix Medical Group reported third quarter revenues surpassing analyst forecasts by 3.2%, supported by improved collections, higher patient acuity, and a favorable payor mix, despite a year-over-year revenue decline.

- An additional boost to the outlook came as the White House proposed a two-year extension of key Obamacare subsidies, a policy seen as crucial for healthcare providers targeting the ACA marketplace.

- We'll explore how strong collection activity and policy momentum may influence Pediatrix Medical Group's investment narrative going forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Pediatrix Medical Group Investment Narrative Recap

To be a shareholder in Pediatrix Medical Group, one must have confidence that operational improvements, like stronger collections and a favorable payor mix, can offset ongoing pressures from industry reimbursement and labor costs. The White House's proposed extension of ACA subsidies may support a crucial revenue stream in the near term, but the most immediate catalyst remains sustained momentum in collection efforts, while the risk of hospital partners pushing back on price increases persists. None of the recent updates have materially changed this risk profile for the company.

Among recent announcements, the Q3 earnings release stands out, with rising net income reflecting successful revenue cycle management and improved collections. This financial progress reinforces the importance of strong operational execution as a short-term catalyst, even as broader industry risks remain significant. Yet, investors should keep an eye on pressures tied to pricing negotiations with hospital partners, as these issues...

Read the full narrative on Pediatrix Medical Group (it's free!)

Pediatrix Medical Group's outlook anticipates $2.1 billion in revenue and $145.1 million in earnings by 2028. This is based on annual revenue growth of 2.5% and a $35.2 million increase in earnings from the current $109.9 million level.

Uncover how Pediatrix Medical Group's forecasts yield a $22.67 fair value, a 7% downside to its current price.

Exploring Other Perspectives

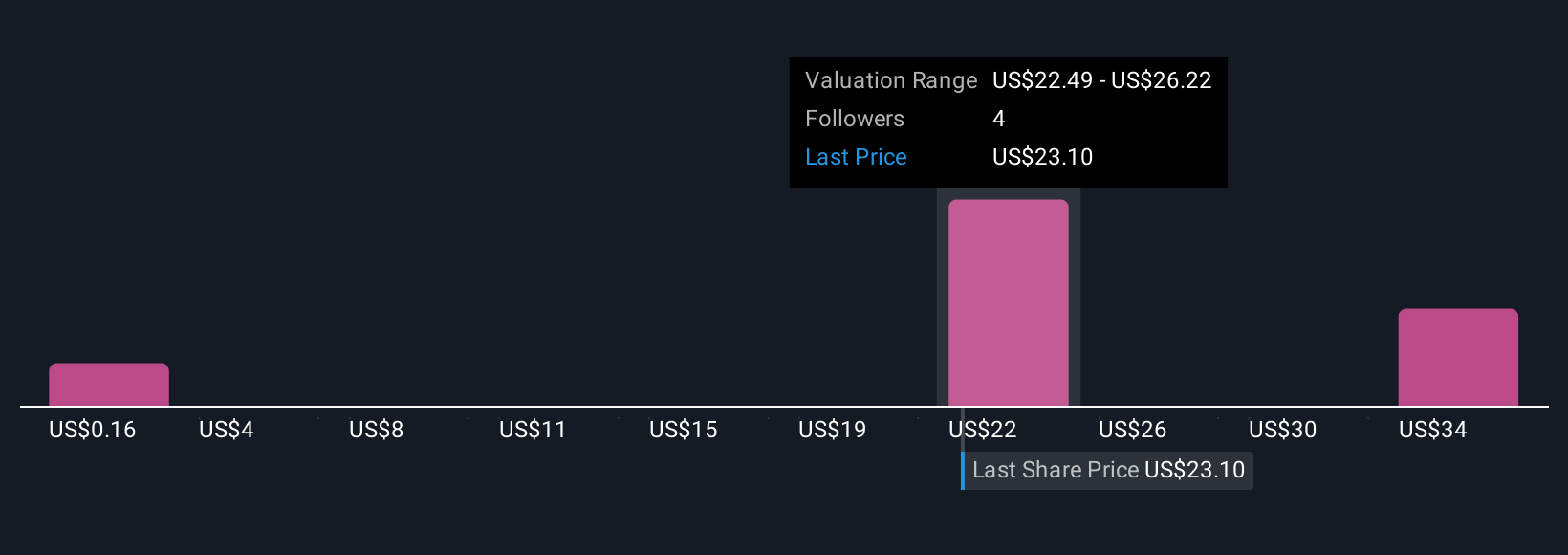

Four separate fair value estimates from the Simply Wall St Community span from just US$0.16 to US$37.38 per share. While many are optimistic about collection improvements, some continue to weigh the impact of evolving pricing discussions with hospital partners on long-term performance.

Explore 4 other fair value estimates on Pediatrix Medical Group - why the stock might be worth less than half the current price!

Build Your Own Pediatrix Medical Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pediatrix Medical Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pediatrix Medical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pediatrix Medical Group's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.