- United States

- /

- Healthcare Services

- /

- NYSE:MD

Pediatrix Medical Group (MD): Exploring Valuation After Earnings Beatings and Renewed Investor Momentum

Reviewed by Kshitija Bhandaru

Pediatrix Medical Group (MD) is drawing fresh interest from investors as the stock hits a new 52-week high. The company's streak of outperforming earnings estimates, along with attractive valuation measures, are helping to fuel this momentum.

See our latest analysis for Pediatrix Medical Group.

Pediatrix Medical Group’s climb to a fresh 52-week high is part of a larger upswing for the stock, with a year-to-date share price return of 35.1% and a stellar 1-year total shareholder return of 48.8%. Recent strong results and the company’s solid valuation profile are clearly boosting confidence, and momentum appears to be firmly in the stock’s favor after a nearly 30% gain over the last three months.

If market momentum or Pediatrix’s recent surge has you thinking bigger, now may be a good time to broaden your search and discover See the full list for free.

With Pediatrix Medical Group grabbing headlines for its relentless gains, the key question for investors is whether the recent rally still leaves the stock undervalued, or if the market is already pricing in all future growth potential.

Most Popular Narrative: 5.3% Overvalued

Compared to the consensus view, Pediatrix Medical Group’s fair value lags behind the last close, suggesting the price might be running ahead of fundamentals. The following excerpt highlights one key driver behind this valuation perspective and sets the stage for deeper insight.

Pediatric and neonatal care volumes are benefitting from stable or improving reimbursement and payer mix (including favorable outcomes from arbitration and contract negotiations), which should support both revenue growth and net margin expansion.

What is the secret sauce fueling this valuation? The underlying assumptions hint at steady revenue climbs and margin improvements, but the real twist is in the profit forecast and the future earnings multiple. Want to discover exactly which numbers drive this fair value math? Dive into the full story to uncover what analysts see just over the horizon.

Result: Fair Value of $16.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing portfolio restructuring and rising compensation costs could challenge revenue stability and margin growth if these factors are not offset by robust operational gains.

Find out about the key risks to this Pediatrix Medical Group narrative.

Another View: What Do Market Multiples Reveal?

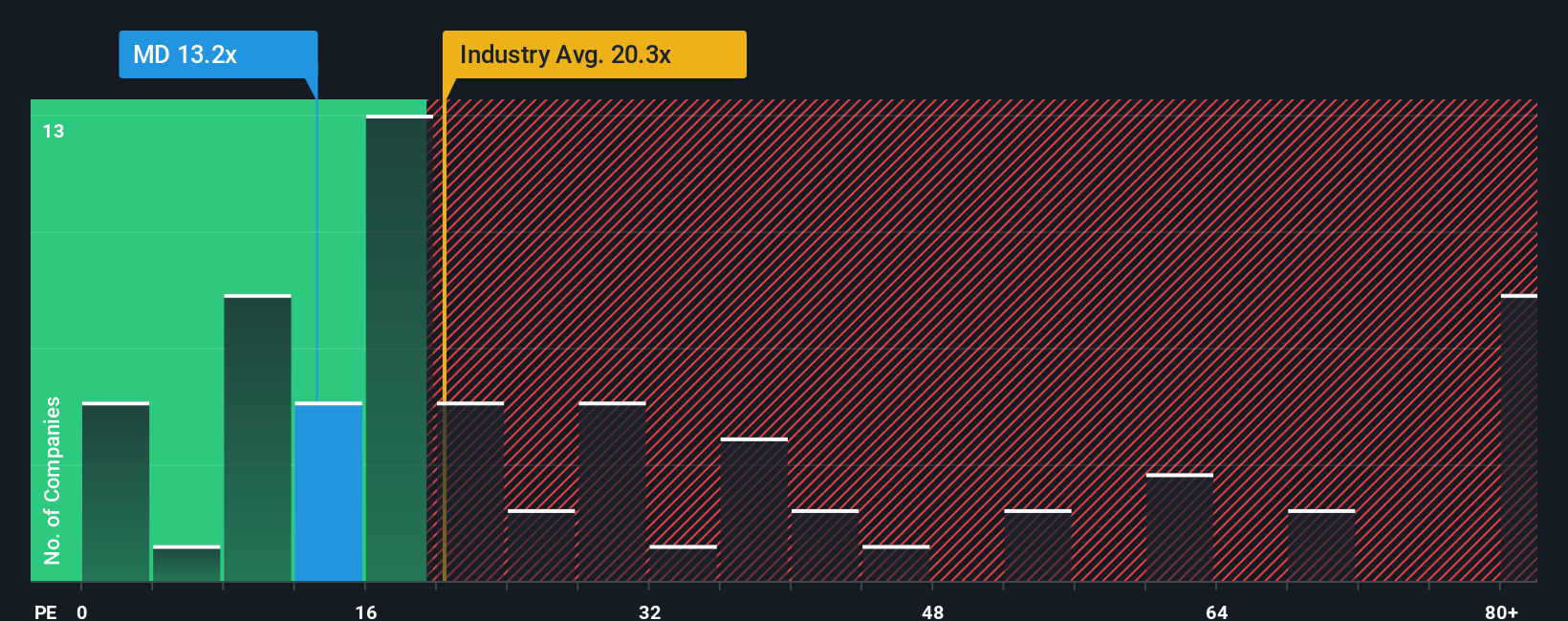

Switching gears from analyst projections to market multiples, Pediatrix Medical Group looks like a bargain when you compare its 13.7x earnings ratio to the U.S. healthcare industry average of 21.3x and peer average of 54.3x. Even the estimated fair ratio is higher, coming in at 19.1x. This gap suggests that, despite recent gains, investors may have overlooked potential value, or are they rightly cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pediatrix Medical Group Narrative

If you see the numbers differently, or want to dig deeper on your own terms, you can easily build your own narrative in just a few minutes with our tools, and Do it your way.

A great starting point for your Pediatrix Medical Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of opportunities waiting for savvy investors who look beyond the headlines. Start your search with these high-potential stock ideas and see what could be working for you next.

- Boost your passive income by targeting strong yields with these 19 dividend stocks with yields > 3%, offering reliable dividend opportunities that can add stability to your portfolio.

- Get ahead of the next paradigm shift by tapping into these 26 quantum computing stocks, where groundbreaking quantum computing companies are reshaping data, security, and tech frontiers.

- Supercharge your portfolio with growth potential and uncover value by checking out these 894 undervalued stocks based on cash flows, poised for upside based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives