- United States

- /

- Healthcare Services

- /

- NYSE:MCK

A Look at McKesson (MCK) Valuation Following Strong Q2 and Half-Year Earnings Growth

Reviewed by Simply Wall St

McKesson (MCK) released second-quarter and six-month earnings results that showed substantial increases in both sales and net income compared to the prior year. This has captured the attention of investors focused on operational momentum.

See our latest analysis for McKesson.

McKesson’s momentum has clearly been building, with the stock posting a 26.6% share price return in the latest quarter and tallying a 50.5% share price gain year-to-date. Total shareholder return sits at an impressive 39.6% for the past twelve months and a remarkable 380% over five years, reflecting growing investor confidence following strong earnings and steady dividends.

If consistency and growth in healthcare catch your attention, consider broadening your search and discover See the full list for free.

With such robust gains in both earnings and stock performance, investors may wonder whether McKesson remains undervalued at current levels, or if the recent rally means future growth is already priced in. Could there still be a buying opportunity here?

Most Popular Narrative: Fairly Valued

McKesson’s fair value and recent close price are closely matched, according to the most-followed narrative backed by widely referenced analyst research. Investors are now weighing if McKesson’s disciplined expansion and margin growth strategies can sustain its premium pricing in the market.

Investments in digitization, automation, and advanced analytics across distribution centers and logistics (e.g., automated picking systems, AI, robotics) are enhancing operational efficiency, driving measurable reductions in operating expenses and supporting long-term net margin improvement.

Curious if McKesson’s margin and automation push is bold enough to support this valuation? There are game-changing assumptions about future earnings growth and profitability behind the scenes. Uncover which financial forecasts set this fair value apart and the real hurdles that could sway outcomes. The real story is inside the narrative. Will you spot what the market may be missing?

Result: Fair Value of $844.57 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny on drug pricing and industry consolidation could put pressure on McKesson’s margins and challenge its current growth trajectory.

Find out about the key risks to this McKesson narrative.

Another View: Sizing Up with Multiples

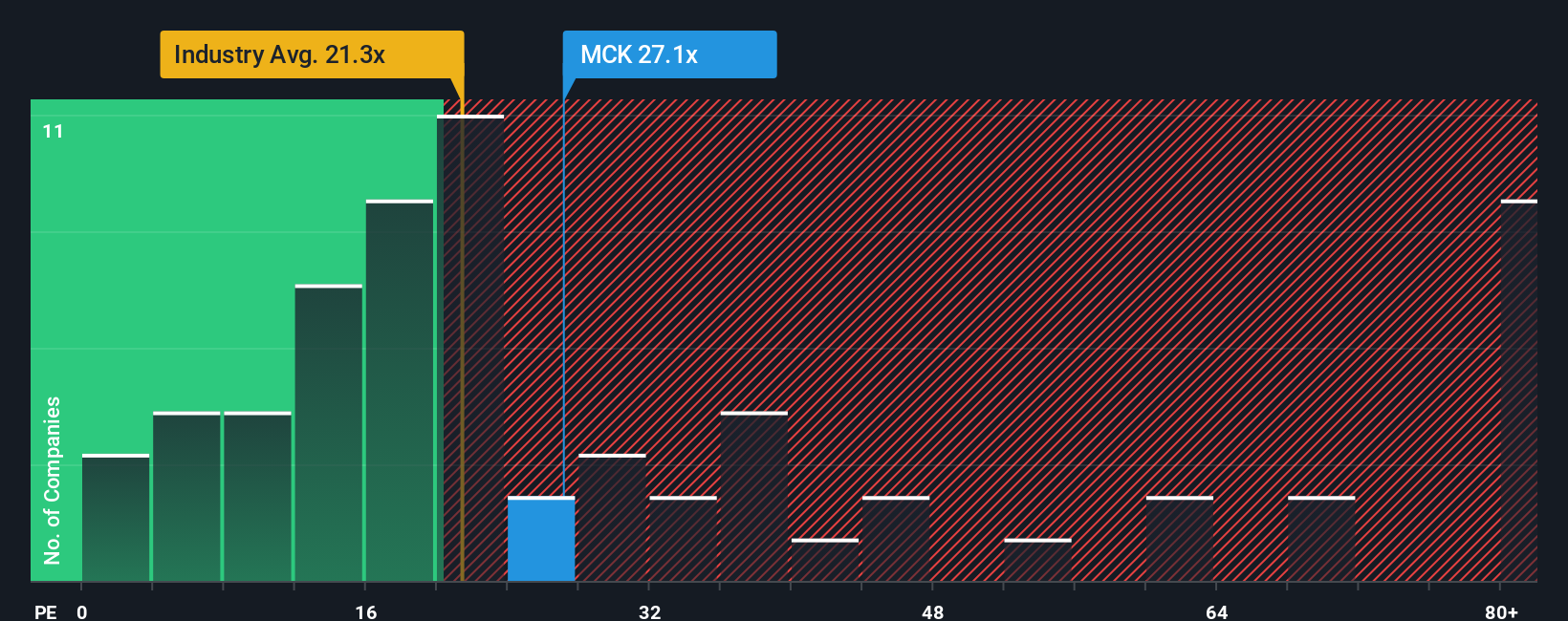

A different lens is the price-to-earnings approach. McKesson currently trades at 26.1 times earnings, notably above the US Healthcare industry average of 21.5 times, but below peer group averages and its fair ratio of 32.9. This spread suggests the stock could be reasonably valued relative to peers, even as industrywide risks remain. Which measure should sway investors’ confidence more: market sentiment or underlying fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McKesson Narrative

If you see the story differently or want to dig into the numbers on your own terms, shaping your personal take takes just a few minutes, so why not Do it your way?

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Market Opportunities?

Smart investors always stay ahead by searching for fresh stock ideas that fit today’s trends and tomorrow’s potential. The tools below give you a significant edge. Don’t miss out on what others overlook.

- Uncover potential in tomorrow's technology by reviewing these 25 AI penny stocks making waves in artificial intelligence and automation breakthroughs.

- Boost your portfolio’s income stream by targeting these 16 dividend stocks with yields > 3% offering attractive yields and stable payouts above 3%.

- Seize opportunities among undervalued gems hidden in plain sight by scanning these 876 undervalued stocks based on cash flows based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives