- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Could Inspire Medical Systems' (INSP) Legal Challenge Reveal Deeper Issues in Management Credibility?

Reviewed by Sasha Jovanovic

- Grant & Eisenhofer P.A. filed a class action lawsuit on behalf of City of Pontiac Reestablished General Employees’ Retirement System against Inspire Medical Systems, Inc. and three senior executives, alleging securities fraud related to misleading statements about the Inspire V sleep apnea device launch.

- This lawsuit follows notable operational setbacks amid the Inspire V rollout, highlighting potential gaps between management statements and the actual state of product adoption and demand.

- We'll now examine how the class action lawsuit regarding Inspire V disclosures could affect Inspire Medical Systems' investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Inspire Medical Systems Investment Narrative Recap

To be an Inspire Medical Systems shareholder today, you must believe in the company's ability to restore trust and regain momentum with its Inspire V sleep apnea device, despite the cloud of a recent class action lawsuit. This legal action injects new uncertainty into the short-term outlook, increasing execution risk and drawing attention to the already fraught Inspire V rollout, the single biggest near-term catalyst for recovery and the most significant operational challenge facing the business.

Among the latest corporate updates, Inspire's Q3 2025 earnings are particularly relevant: although revenue reached US$224.5 million, net income fell meaningfully compared to last year. This signals immediate margin pressure tied to rollout delays and operational costs, issues at the heart of both the legal case and the challenge of re-accelerating growth tied to Inspire V adoption.

Yet, in contrast to management’s projections, the legal and operational overhang from the Inspire V rollout poses risks investors should be aware of, especially if...

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems' outlook anticipates $1.3 billion in revenue and $103.6 million in earnings by 2028. Achieving this would require annual revenue growth of 14.5% and an earnings increase of about $50 million from the current $53.1 million.

Uncover how Inspire Medical Systems' forecasts yield a $117.40 fair value, a 36% upside to its current price.

Exploring Other Perspectives

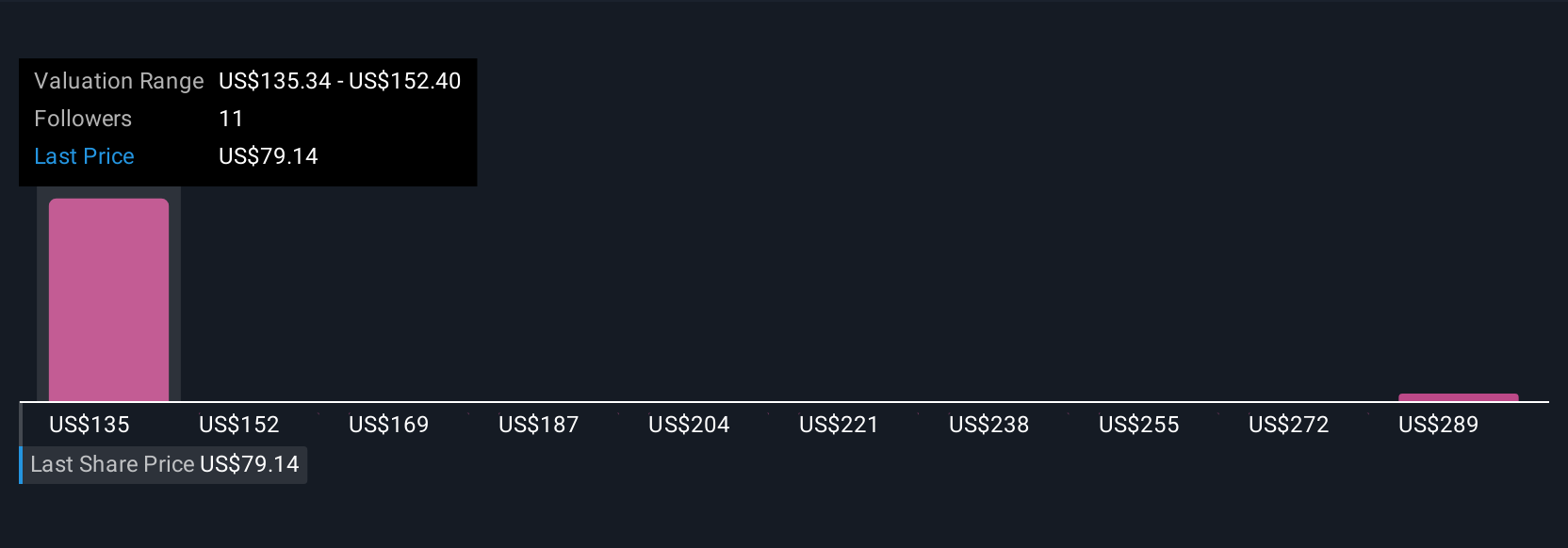

Eight fair value estimates from the Simply Wall St Community for Inspire Medical Systems range widely from US$93.33 to US$270.86 per share. This diversity of opinion reflects major differences in how investors weigh rollout challenges and legal risks against potential for recovery and future growth.

Explore 8 other fair value estimates on Inspire Medical Systems - why the stock might be worth just $93.33!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives