- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Can Hims & Hers Health's (HIMS) Compounded GLP-1 Bet Outweigh Legal and Regulatory Uncertainties?

Reviewed by Sasha Jovanovic

- In recent days, Hims & Hers Health announced the launch of compounded GLP-1 microdosing treatments for individualized metabolic health care, expanding its offerings to conditions such as sleep apnea and high blood pressure while still offering compounded versions of semaglutide amid legal disputes with Novo Nordisk.

- This expansion comes as the company faces a pending securities fraud lawsuit and regulatory attention over the promotion and sale of compounded GLP-1 medications, raising questions about balancing innovation in telehealth with compliance challenges.

- We'll look at how the expanded metabolic health offerings and related legal uncertainties influence Hims & Hers Health's investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hims & Hers Health Investment Narrative Recap

For shareholders of Hims & Hers Health, the investment case rests on believing in the company's ability to grow through rapid expansion in telehealth-led personalized care, capturing new demand in areas like metabolic and hormonal health. The recent GLP-1 microdosing launch represents a fresh growth catalyst but does not materially change that regulatory pressure and legal risks related to compounded medications remain the most critical short-term focus for the stock.

The introduction of GLP-1 microdosing plans, now targeting metabolic risks beyond BMI, such as sleep apnea and hypertension, is especially relevant, as it fuels product diversification and could benefit user retention. However, these advancements are happening as Hims & Hers faces a pending securities lawsuit and FDA scrutiny, highlighting how growth ambitions are inseparable from compliance and reputational risk.

But, for those weighing their next move, the unresolved legal uncertainties around compounded GLP-1 treatments are risks that investors should consider...

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health's outlook anticipates $3.3 billion in revenue and $261.3 million in earnings by 2028. This is based on an 18.3% annual revenue growth rate and a $67.7 million increase in earnings from the current $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $47.42 fair value, a 4% upside to its current price.

Exploring Other Perspectives

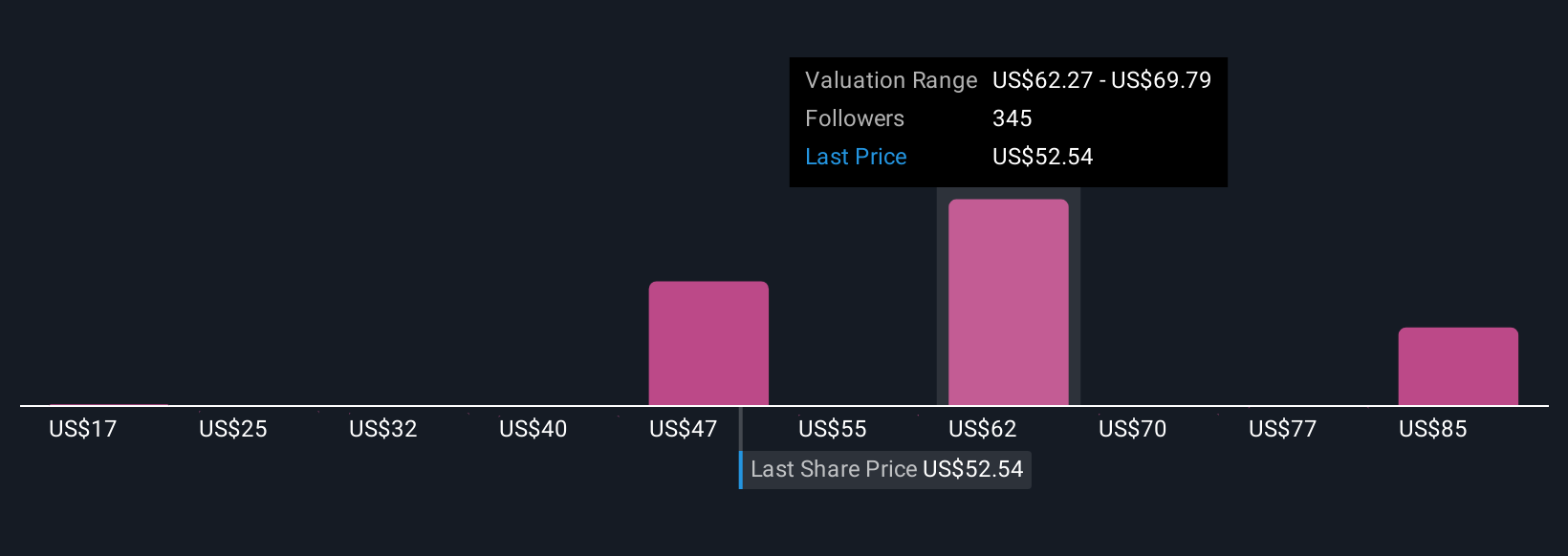

Across 35 independent fair value estimates from the Simply Wall St Community, targets for Hims & Hers range widely from US$40.72 to US$97.04 per share. With regulatory risk top of mind, these differing views highlight why many investors see the company’s near-term path as far from settled.

Explore 35 other fair value estimates on Hims & Hers Health - why the stock might be worth 10% less than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives