- United States

- /

- Healthcare Services

- /

- NYSE:HCA

HCA Healthcare (HCA): Evaluating Valuation After Strong Earnings and Growing Analyst Optimism

Reviewed by Kshitija Bhandaru

HCA Healthcare (HCA) is turning heads this week after reporting stronger earnings growth, which is drawing positive attention from analysts and investors. Growing momentum around its financial performance is sparking interest in the stock.

See our latest analysis for HCA Healthcare.

HCA Healthcare has been gaining traction, with a series of upbeat developments like robust quarterly results, facility expansions, and new clinical initiatives catching investors’ attention. This momentum is reflected in its latest 1-year total shareholder return of 13%, indicating that confidence in HCA’s long-term value story is building alongside recent business growth.

If the move in HCA is piquing your curiosity, take the opportunity to find other healthcare leaders on our discovery platform. See the full list for free: See the full list for free.

With all eyes on HCA’s momentum, the key question becomes whether its shares are still undervalued, or if the recent rally means the market has already factored in the next leg of growth. Is there a buying opportunity, or is future upside already priced in?

Most Popular Narrative: 6% Overvalued

With HCA Healthcare’s narrative fair value at $403.81 compared to a last close of $429.54, the market is placing a premium above what analysts believe is justified. This difference sets up a debate over the growth assumptions built into the price.

HCA Healthcare has been experiencing broad-based volume growth across various categories, including inpatient admissions, emergency room visits, and cardiac procedures. This indicates potential for future revenue growth as demand for healthcare services continues to rise. The company has achieved improvements in operating margins, driven by enhanced payer mix, effective cost management, and reduced contract labor usage. These operational efficiencies are expected to support future net margin and earnings growth.

Curious what underpins analysts’ cautious optimism? There is a subtle interplay between future facility expansion, earnings growth, and a profit multiple reset. See why growth estimates and margin projections weigh so heavily on the story.

Result: Fair Value of $403.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and rising labor costs could still disrupt HCA Healthcare’s earnings outlook and could impact future margin expansion for investors.

Find out about the key risks to this HCA Healthcare narrative.

Another View: Discounted Cash Flow Perspective

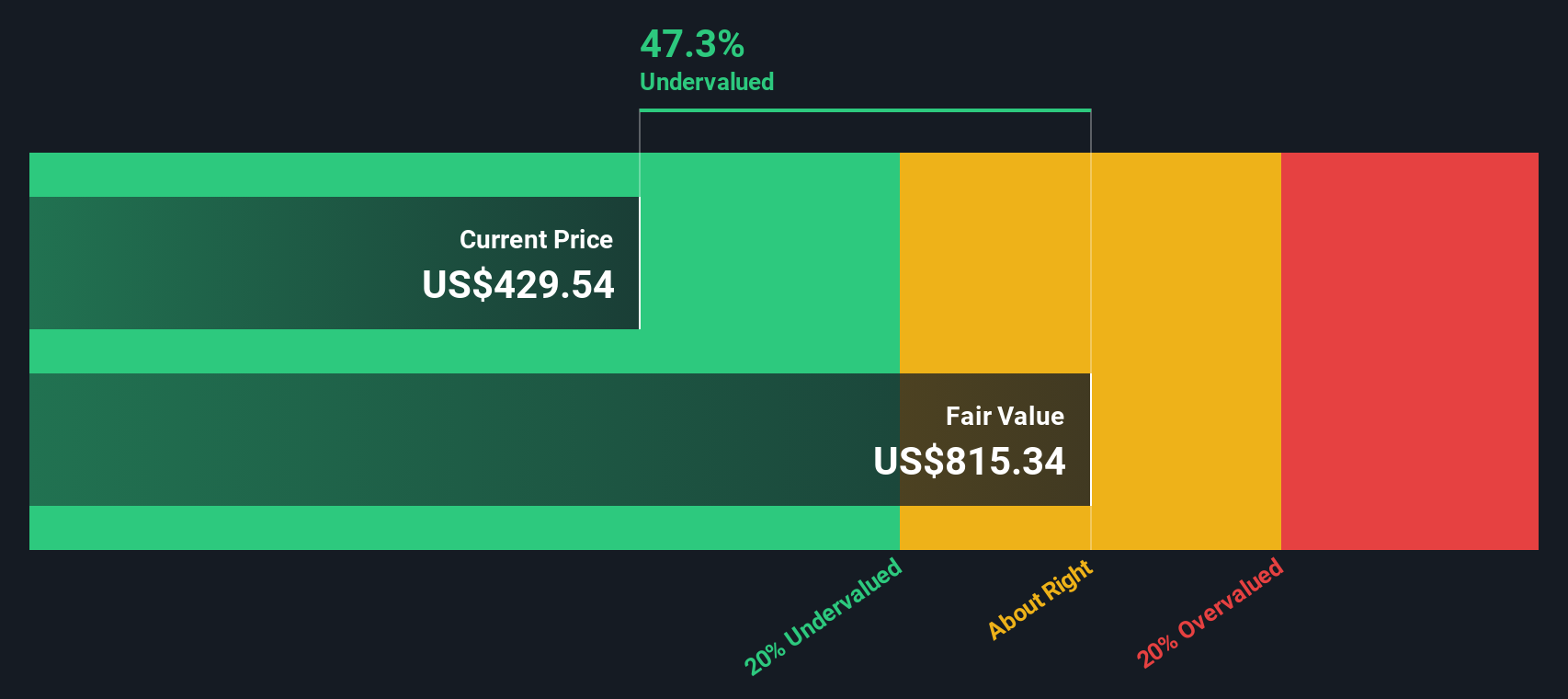

While the fair value based on future earnings projections suggests HCA Healthcare is overvalued, our DCF model tells a different story. The SWS DCF model estimates HCA shares to be trading about 47% below their intrinsic value. This highlights a potentially significant undervaluation. Could the market be missing something big?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HCA Healthcare Narrative

If you see the numbers differently or want to dig deeper on your own terms, you can shape your own story in just a few minutes. Do it your way

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There’s never been a better time to expand your horizon beyond a single stock. Find your next smart move where opportunity meets real potential.

- Uncover potential growth as you scan these 885 undervalued stocks based on cash flows, packed with companies trading below their intrinsic value and waiting for savvy investors to take notice.

- Catch the wave of technological innovation and browse these 24 AI penny stocks to spot businesses at the forefront of artificial intelligence advancement.

- Boost your portfolio’s income potential and check out these 19 dividend stocks with yields > 3%, offering robust yields above 3% for consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives