- United States

- /

- Medical Equipment

- /

- NYSE:EW

Edwards Lifesciences (EW): Valuation Check After Upbeat 2025 Outlook, New 2026 EPS Guidance and Analyst Upgrades

Reviewed by Simply Wall St

Edwards Lifesciences (EW) used its latest Investor Day to double down on its growth story, pairing an upbeat 2025 revenue outlook with fresh 2026 earnings guidance that underscores confidence in its pipeline.

See our latest analysis for Edwards Lifesciences.

That optimism has been filtering into the market. The latest $86.19 share price comes after a 30 day share price return of 4.04% and a year to date share price return of 18.74%. The 1 year total shareholder return of 20.49% suggests steady, if not explosive, compounding as investors reassess growth and risk following strong quarterly results and upbeat guidance.

If Edwards Lifesciences has you rethinking the healthcare opportunity set, this could be a good moment to explore other specialist names across healthcare stocks and see what else fits your strategy.

With revenue and earnings guidance marching higher and analysts nudging up their targets, investors face a key question: is Edwards Lifesciences still flying under the radar, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 8.3% Undervalued

With Edwards Lifesciences closing at $86.19 versus a narrative fair value of $93.94, the current price sits below where long term assumptions converge.

The analysts have a consensus price target of $87.731 for Edwards Lifesciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $101.0, and the most bearish reporting a price target of just $72.0.

Want to see how steady revenue expansion, resilient margins, and a rich future earnings multiple all line up to justify that higher value? The full narrative connects every dot.

Result: Fair Value of $93.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff headwinds and potential EPS dilution from the JenaValve acquisition could pressure margins and challenge confidence in the current growth narrative.

Find out about the key risks to this Edwards Lifesciences narrative.

Another View: Valuation Looks Rich On Earnings

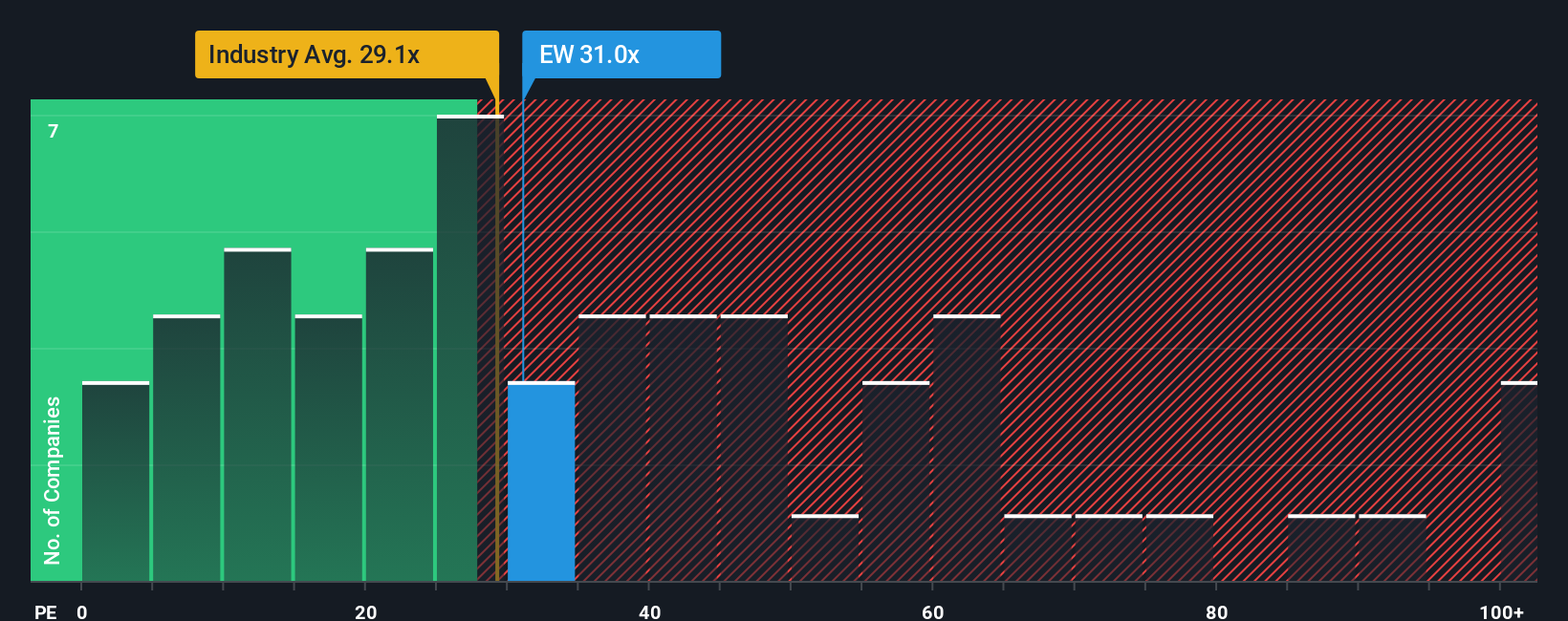

While the narrative fair value suggests Edwards Lifesciences is 8.3% undervalued, its current 37.3x earnings multiple is well above both the US Medical Equipment industry at 28.9x and peers at 33x, and even the 29.6x fair ratio the market could gravitate toward. That premium could compress fast if growth stumbles, or widen further if new data keeps surprising to the upside, leaving investors to judge whether they are paying up for quality or for hope.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

If you see the story differently, or simply prefer digging into the numbers yourself, you can build a custom narrative in just minutes using Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Edwards Lifesciences.

Looking for your next investing edge?

Before you move on, lock in a few fresh ideas by using the Simply Wall Street Screener to spot opportunities you might otherwise overlook.

- Target reliable cash generators by focusing on income potential with these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s long term returns.

- Position yourself ahead of the next tech wave by scanning these 26 AI penny stocks that are pushing boundaries in artificial intelligence innovation.

- Hunt for pricing mismatches with these 908 undervalued stocks based on cash flows that may be trading below what their cash flows truly justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026