- United States

- /

- Healthcare Services

- /

- NYSE:CNC

If EPS Growth Is Important To You, Centene (NYSE:CNC) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Centene (NYSE:CNC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Centene

Centene's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Centene has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

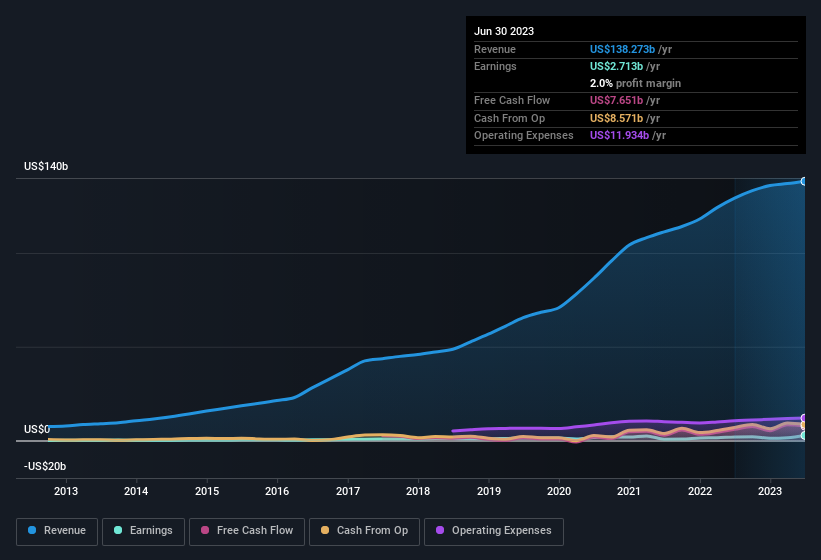

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Centene's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Centene achieved similar EBIT margins to last year, revenue grew by a solid 7.0% to US$138b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Centene?

Are Centene Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$3.4m buying Centene shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the CEO & Director, Sarah London, who made the biggest single acquisition, paying US$1.9m for shares at about US$62.60 each.

The good news, alongside the insider buying, for Centene bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth US$287m. While that is a lot of skin in the game, we note this holding only totals to 0.8% of the business, which is a result of the company being so large. This still shows shareholders there is a degree of alignment between management and themselves.

Should You Add Centene To Your Watchlist?

As previously touched on, Centene is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Now, you could try to make up your mind on Centene by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Centene, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, commercial organizations, and military families in the United States.

Very undervalued with solid track record.