- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Centene (NYSE:CNC) Expands Board With Kenneth Tanji Appointment Adding Financial Expertise

Reviewed by Simply Wall St

Centene (NYSE:CNC) announced the appointment of Kenneth Y. Tanji to its Board of Directors, an executive with extensive finance expertise, which aligns with the company's focus on robust corporate governance. Over the past week, the company’s share price rose 3.64%, a notable movement given the backdrop of broader market declines. While the S&P 500 and Nasdaq faced a downward trajectory, with respective declines of 1% and 1.9% amid technology sector challenges and economic uncertainties, Centene's positive return might reflect investor confidence in its leadership strategy, enhanced by Tanji's newly assumed role. This leadership boost comes as the Dow experienced marginal gains following a challenging week and may have provided Centene with increased investor attention. Amidst this broader market turmoil, Centene's performance not only diverges from the overall slump but also highlights its potential resilience in steering towards effective governance and operational growth.

Unlock comprehensive insights into our analysis of Centene stock here.

Across the last five years, Centene's total return, which includes both share price and dividend performance, amounted to 6.3%. This modest growth stands out in the context of Centene's underperformance relative to the broader US market and the healthcare industry over the past year. The company's share buyback initiatives, notably between July 2024 and February 2025, where it repurchased shares worth approximately US$2.15 billion, have likely contributed to shareholder returns during this period. Additionally, the expansion of Ambetter solutions in various states in October 2024 highlighted Centene's consistent efforts to broaden its market presence.

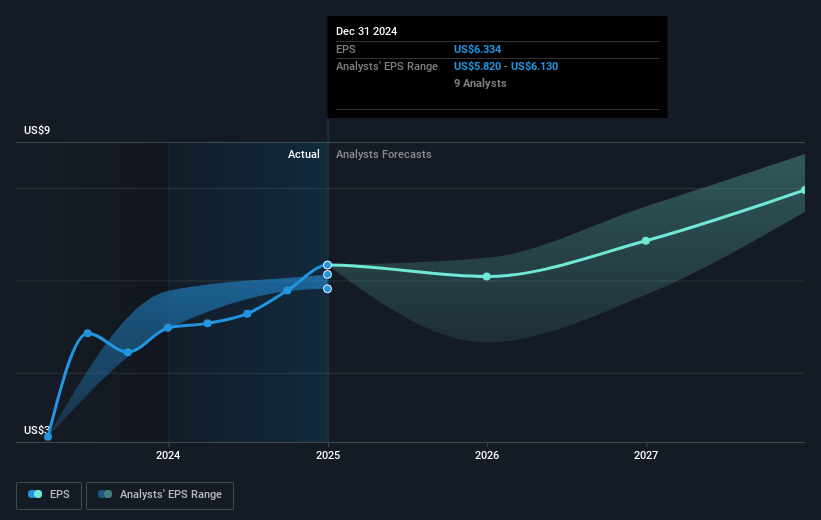

In terms of financial performance, Centene reported earnings growth, surpassing industry averages, with earnings accelerating by 22.3% over the last year alone. Despite being undervalued based on its estimated fair value, Centene's consistent financial results, including an earnings per share of US$6.33 for 2024, may point to strong operational execution. Furthermore, the recent settlement of legal matters without admission of liability in June 2024 could have removed uncertainties, contributing positively to the company’s stability.

- Learn how Centene's intrinsic value compares to its market price with our detailed valuation report.

- Uncover the uncertainties that could impact Centene's future growth—read our risk evaluation here.

- Is Centene part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, commercial organizations, and military families in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives