- United States

- /

- Healthcare Services

- /

- NYSE:CHE

Chemed (CHE): Evaluating Valuation Potential After Recent Modest Share Price Moves

Reviewed by Simply Wall St

See our latest analysis for Chemed.

Chemed’s share price has been fairly rangebound lately, but recent momentum has started to wane after a 7-day share price return of 3.6%. Looking at the bigger picture, the stock’s total shareholder return is down 20% over the past year, reflecting broader investor caution despite mid-term earnings growth.

If you’re weighing your options in healthcare, this is the perfect moment to explore the full range of stocks in our curated list: See the full list for free.

With shares down over the past year and trading at a 31% discount to analyst price targets, investors have to wonder if Chemed is currently undervalued or if the market is correctly anticipating its future growth prospects.

Most Popular Narrative: 23.4% Undervalued

Chemed's most-followed narrative values the stock well above its recent close, suggesting significant upside if growth trends play out as projected. The current fair value estimate points to room for share price recovery, especially if anticipated catalysts materialize.

The ramp-up of new Certificate of Need (CON) locations in underserved Florida counties, such as Pinellas and Marion, is expected to materially expand VITAS's service footprint. This aligns with the continued aging U.S. population and the shift toward home-based care, both key drivers of higher patient volumes and long-term top-line revenue growth.

Want to know what makes this price target so compelling? This narrative banks on bold revenue and profit margin improvements, all hinging on future demographic waves and operational upgrades. Are analysts betting on something the market has missed? Unlock the full story to see the exact projections and financial levers driving this valuation.

Result: Fair Value of $582.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor costs and ongoing Medicare reimbursement pressures could hinder Chemed’s profitability turnaround. These factors could potentially challenge the current bullish outlook.

Find out about the key risks to this Chemed narrative.

Another View: By the Numbers

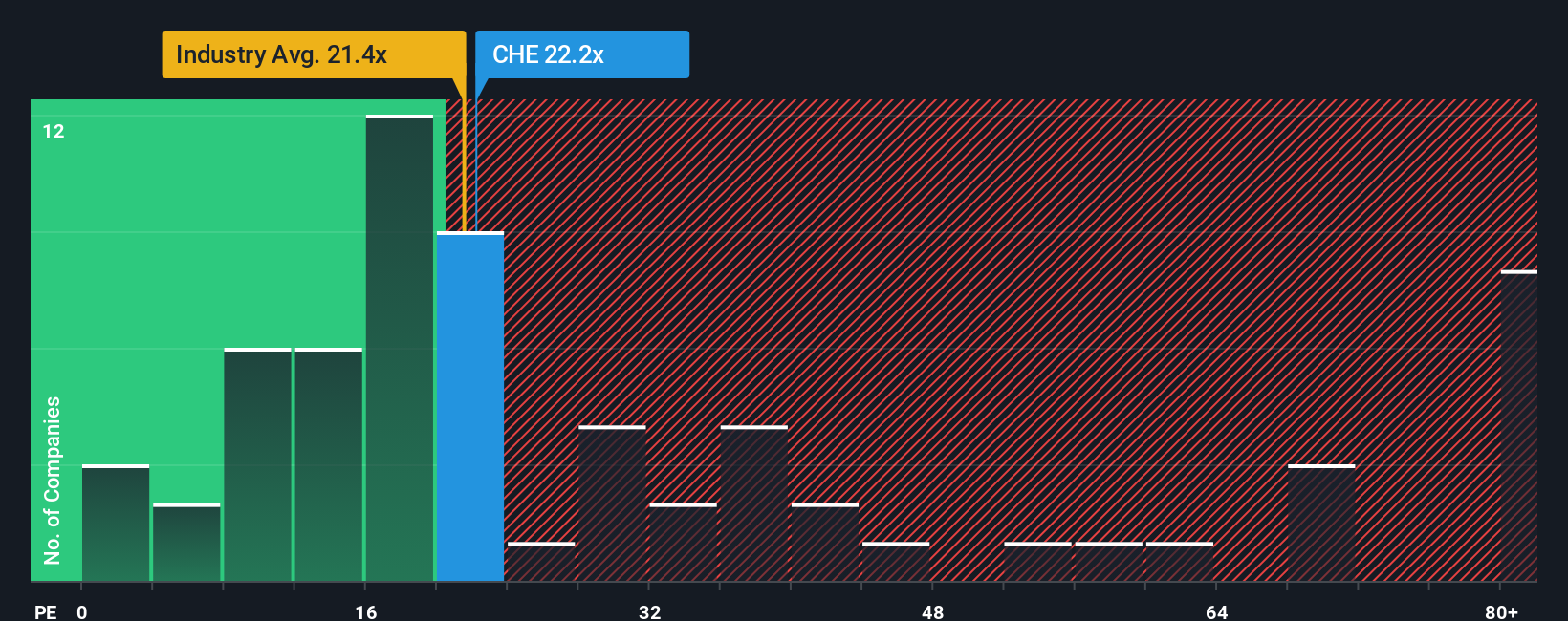

Looking through the lens of earnings multiples, Chemed currently trades at 22.6 times earnings. While this aligns closely with the industry average of 22 times, it is slightly above the fair ratio of 21 times that the broader market could revert to. Does this suggest over-optimism, or is it warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chemed Narrative

If the current narrative does not resonate with your perspective, you can dive into the numbers and develop your own in just a few minutes. Do it your way

A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Amplify your portfolio by acting now, not later. There’s a world of fresh opportunities waiting if you’re willing to look beyond the obvious picks.

- Capitalize on groundbreaking artificial intelligence by targeting these 27 AI penny stocks, which offer superior growth potential and innovative business models that are transforming entire industries.

- Lock in higher yields this year by scanning these 15 dividend stocks with yields > 3%, which provide steady income flows and attractive payouts above 3% to reward smart investors.

- Ride the upside of attractive valuations and unlock bargains when you focus on these 868 undervalued stocks based on cash flows, as these show strong fundamentals but are still trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHE

Chemed

Provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives