- United States

- /

- Healthcare Services

- /

- NYSE:CAH

What Recent Specialty Pharma Moves Mean for Cardinal Health’s Stock Valuation

Reviewed by Bailey Pemberton

- Wondering if Cardinal Health is delivering real value or is just riding a wave? You are not alone, and now is a great time to dig a little deeper.

- The stock has shown real momentum this year, climbing 76.2% year-to-date and an impressive 326.4% over five years. This follows a recent 1.5% slip in the last week.

- Much of this recent action follows Cardinal Health’s expansion into specialty pharmaceuticals and distribution partnerships. These moves made headlines as the company sharpened its focus on high-growth verticals. Investors have also taken notice of broader sector trends, pushing healthcare stocks higher as the regulatory landscape changes and demand for medical supplies increases.

- Right now, Cardinal Health scores a 2 out of 6 on our valuation checklist, which means it clears just a couple of the standard undervaluation hurdles. Next, we will break down the classic methods of valuation and offer a more insightful way to assess the company’s true worth by the end of the article.

Cardinal Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cardinal Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors judge whether a stock’s current price reflects its anticipated ability to generate profits over time.

For Cardinal Health, analysts estimate the company’s Free Cash Flow (FCF) for the last twelve months at $4.46 billion. Over the next decade, forecasts project continued growth, with FCF expected to reach about $4.39 billion by 2030. Notably, while analysts provide more concrete projections for the next five years, longer-term growth figures are extrapolated based on trends and industry expectations.

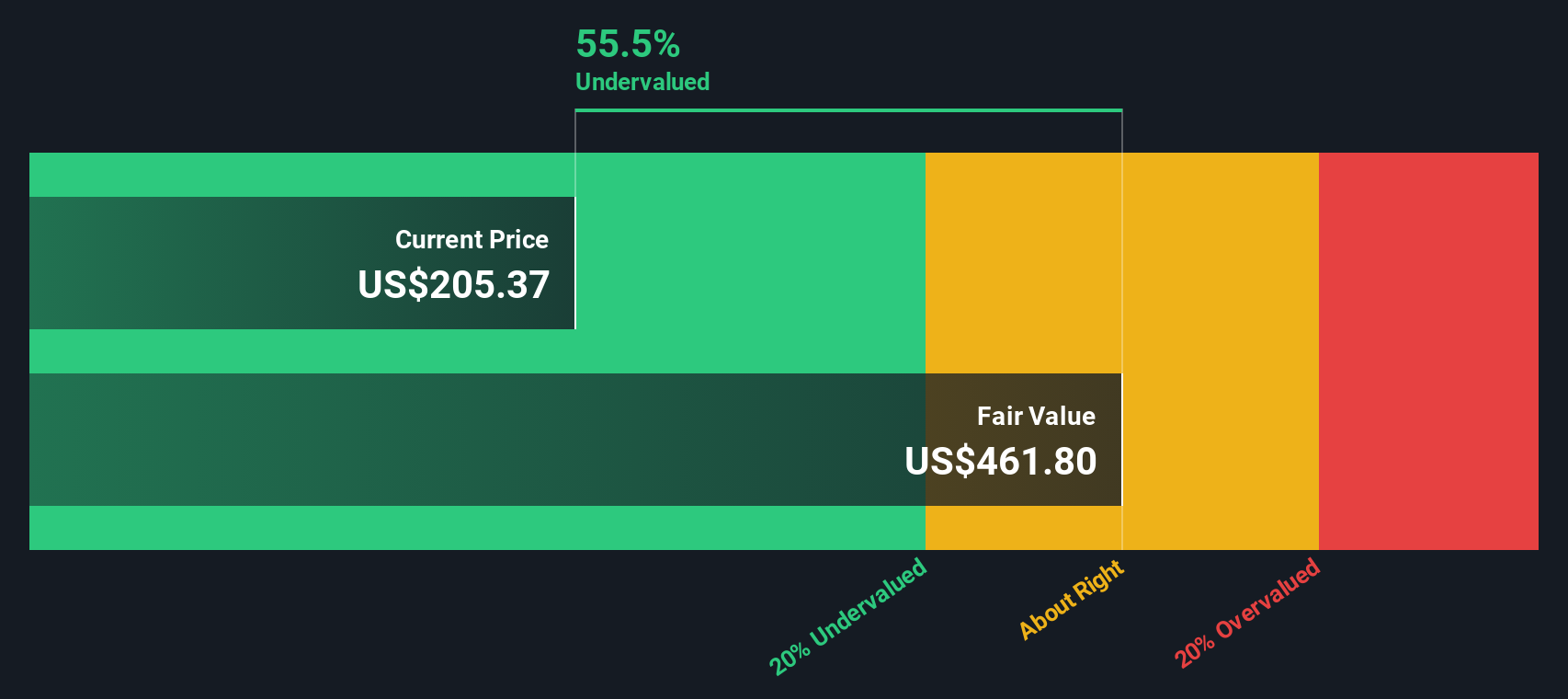

After discounting all these expected cash flows to the present, the DCF model estimates Cardinal Health’s intrinsic value at $461.80 per share. This is roughly 55% higher than its current share price, indicating a significant margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cardinal Health is undervalued by 55.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Cardinal Health Price vs Earnings

The price-to-earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Cardinal Health. It helps investors compare how much they are paying for each dollar of earnings, making it easier to spot relative value. For established, consistently profitable players, the PE ratio provides a clearer picture of how the market values the business based on its capacity to generate profits.

The right PE ratio for any company will depend on growth prospects and risk. If investors expect faster earnings growth and lower risk, they are often willing to pay a higher multiple, driving up the PE ratio. In contrast, companies with lower growth or greater risks typically trade at a discount, with lower PEs considered “fair.”

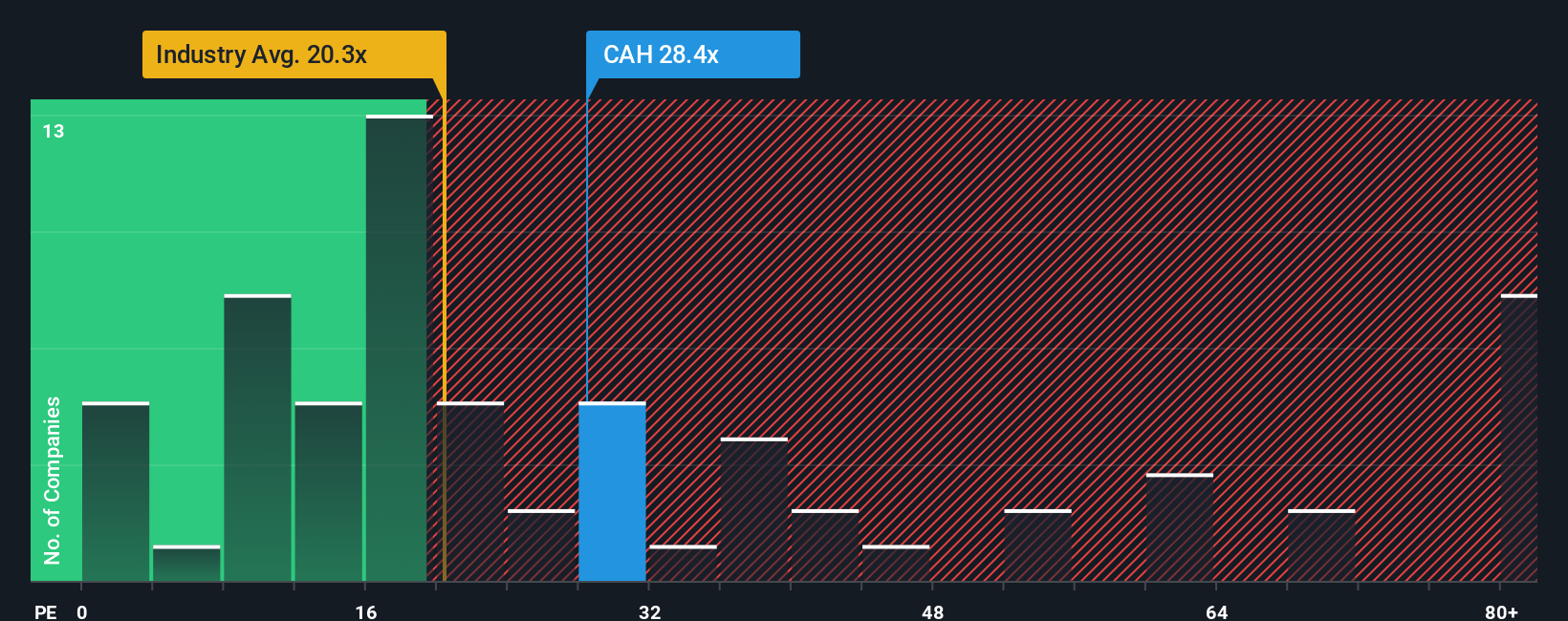

Currently, Cardinal Health trades at 31x earnings, a premium to both the healthcare industry average of 22.4x and the average for its peers of 27.6x. Simply Wall St’s proprietary Fair Ratio for Cardinal Health stands at 29.4x. This Fair Ratio goes beyond simply comparing with industry averages or similar peers as it adjusts for the company’s unique growth outlook, profit margins, risk factors, and overall market size.

Using the Fair Ratio helps capture the full investment picture for Cardinal Health. While the stock’s PE is slightly above the fair level, the difference is less than 0.10, suggesting that, at current prices, valuation is about right given the company’s financial profile and future potential.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cardinal Health Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a straightforward way to link your story about a company, like Cardinal Health, to an actual financial forecast and then to a fair value. Instead of relying on rigid formulas or a single set of numbers, Narratives let you express your own view. Whether that means expecting robust earnings from market leadership or taking a more cautious outlook because of industry headwinds, you can plug in your assumptions for future revenue, margins, and risks.

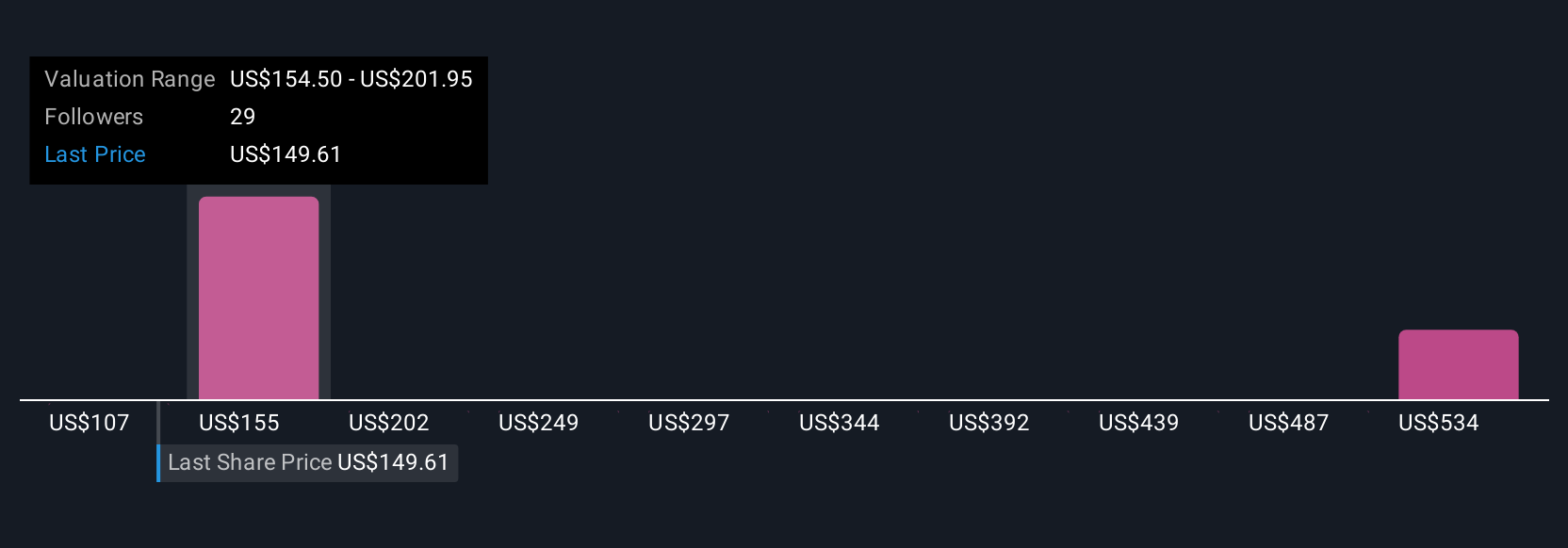

Simply Wall St’s Community page enables anyone to create or read investment Narratives, making it easy to see how different people weigh both the company’s prospects and its fair value in real time. Narratives are dynamic. When key news or earnings are released, your view and its estimated value update instantly, helping you decide if it’s time to buy, hold, or sell as new information arrives. For example, recent analyst Narratives for Cardinal Health estimate fair values spanning from $150 on the cautious side to $203 for the most optimistic cases, all based on different forecasts and market assumptions.

Do you think there's more to the story for Cardinal Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026