- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Are Boston Scientific Shares Stretched After Recent 10.5% Drop?

Reviewed by Bailey Pemberton

If you are holding Boston Scientific stock or considering adding it to your portfolio, you are far from alone in wondering whether now is the right time to act. After all, few companies have delivered the kind of long-term outperformance that Boston Scientific has managed. Returns are up more than 144% over the past three years, and over 138% in the last five. Despite some recent turbulence, including a 10.5% slide in the past month, the stock remains in positive territory for 2024 and has notched an impressive 11.6% gain over the past year.

What is fueling these ups and downs? Recent market developments in the healthcare sector, as well as shifts in sentiment towards medical device makers in general, have played a role. Investors seem to be weighing the company’s growth potential against concerns about the broader industry landscape. Even with the recent dip, the stock has proven remarkably resilient, up 1% in just the last week alone.

But should this momentum, or the occasional setbacks, influence your buy, hold, or sell decision? To get a clearer picture, we turn to valuation metrics. By our assessment, Boston Scientific scores a 1 out of 6 on the undervaluation scale, meaning it only checks one of six boxes typically used to flag bargains in the market.

Let’s dig deeper into how those valuation checks work and what they tell us about the stock. Be sure to read on, because we will wrap up with an even smarter way to look at valuation that could change how you see Boston Scientific altogether.

Boston Scientific scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Boston Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to their value today. This approach helps investors understand what the stock should be worth if its future growth plays out as expected.

For Boston Scientific, the most recent twelve months’ Free Cash Flow stands at $3.45 billion. Looking forward, analysts forecast healthy growth, projecting Free Cash Flow could reach nearly $4.45 billion by the end of 2027. While direct analyst estimates usually extend up to five years, further projections out to 2035 in this case are generated based on forecasted growth rates. These long-term projections, provided by Simply Wall St, suggest steadily rising cash flows, though with a gradually moderating pace after 2027.

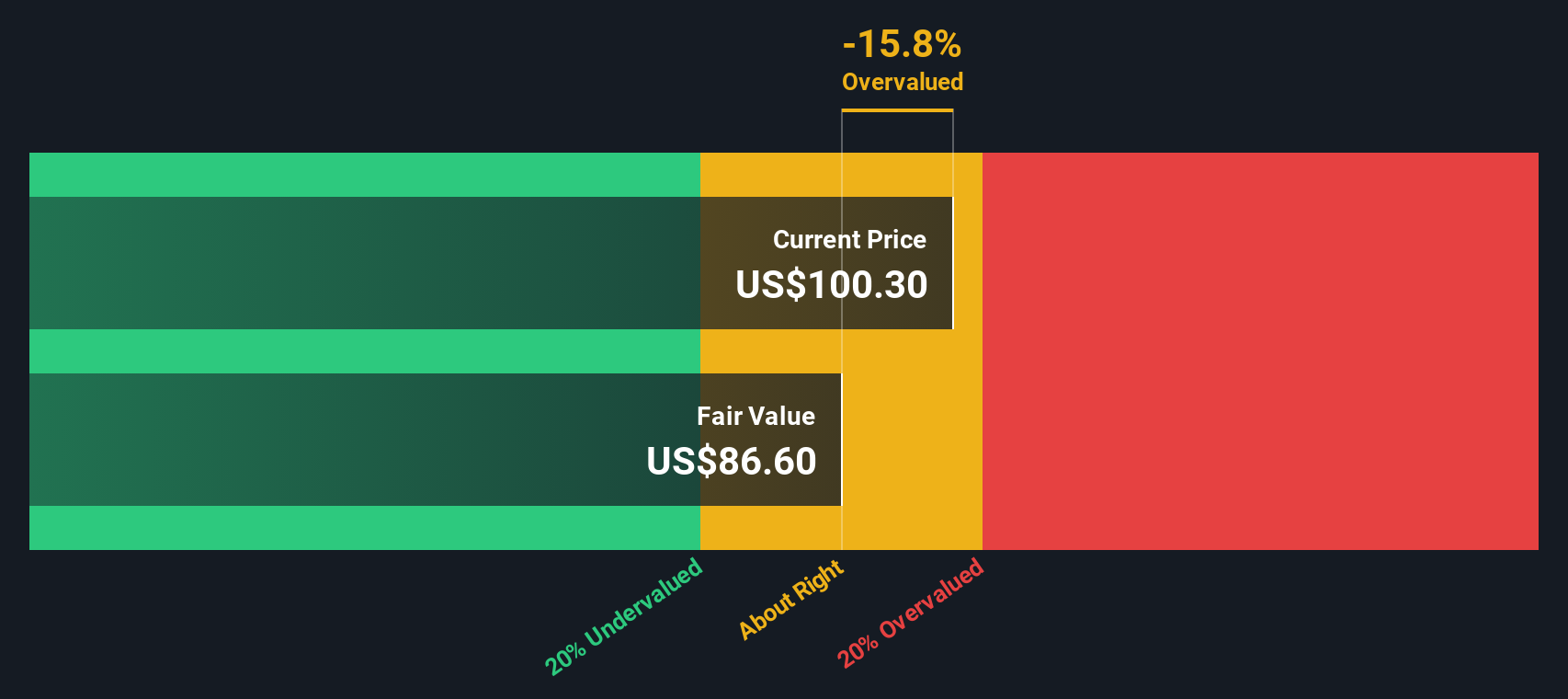

Factoring in these projections, the DCF model suggests an intrinsic value of $79.37 per share for Boston Scientific. However, when compared to the current share price, the stock screens as 22.0% overvalued on this basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boston Scientific may be overvalued by 22.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Boston Scientific Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Boston Scientific. It helps investors gauge how much they are paying for each dollar of earnings, making it especially useful for companies with a strong track record of profitability.

It's important to understand that what counts as a "normal" or "fair" PE ratio depends on market expectations for the company's growth and the risks it faces. Faster-growing or lower-risk businesses tend to justify higher PE ratios, while slower-growing or riskier firms trade at lower multiples.

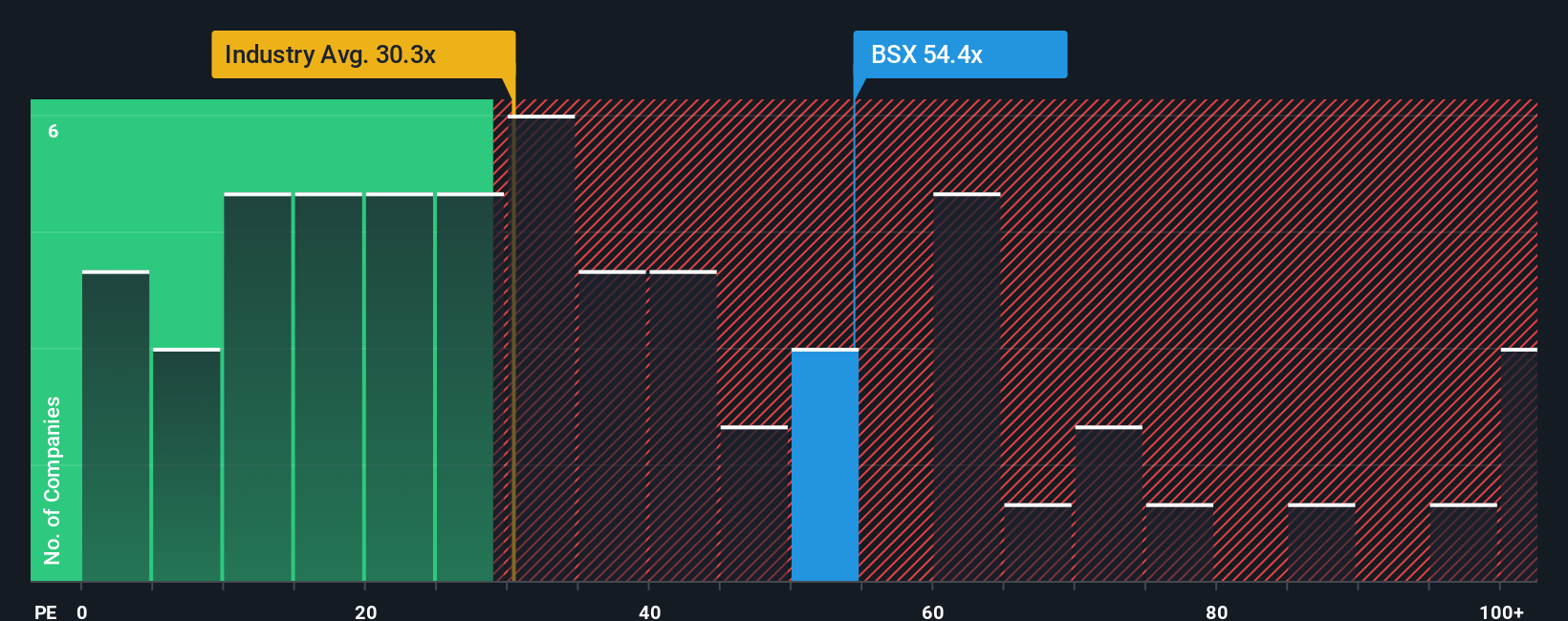

Boston Scientific currently trades at a PE ratio of 57.25x, which is notably higher than both the medical equipment industry average of 30.52x and the peer group average of 38.62x. On the surface, this appears expensive relative to common benchmarks. However, Simply Wall St's proprietary "Fair Ratio" model is designed to give a more tailored view. This Fair Ratio considers a range of factors unique to Boston Scientific, such as its earnings growth, industry dynamics, profit margins, market capitalization and risk profile, rather than relying on broad averages that may not capture the company's specific situation.

For Boston Scientific, the Fair Ratio is calculated at 35.72x. Compared with the current PE of 57.25x, the stock is trading well above where it might be considered fairly valued based on the company’s fundamentals and risk outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boston Scientific Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an approach that connects your view of a company’s story directly to forecasted financials and fair value. A Narrative allows you to combine what you know about Boston Scientific’s products, market expansion, and industry trends with your own estimates of future revenue, earnings, and profit margins. On Simply Wall St's Community page, you can access and contribute Narratives, joining millions of investors as you articulate your perspective and then see how it stacks up against others.

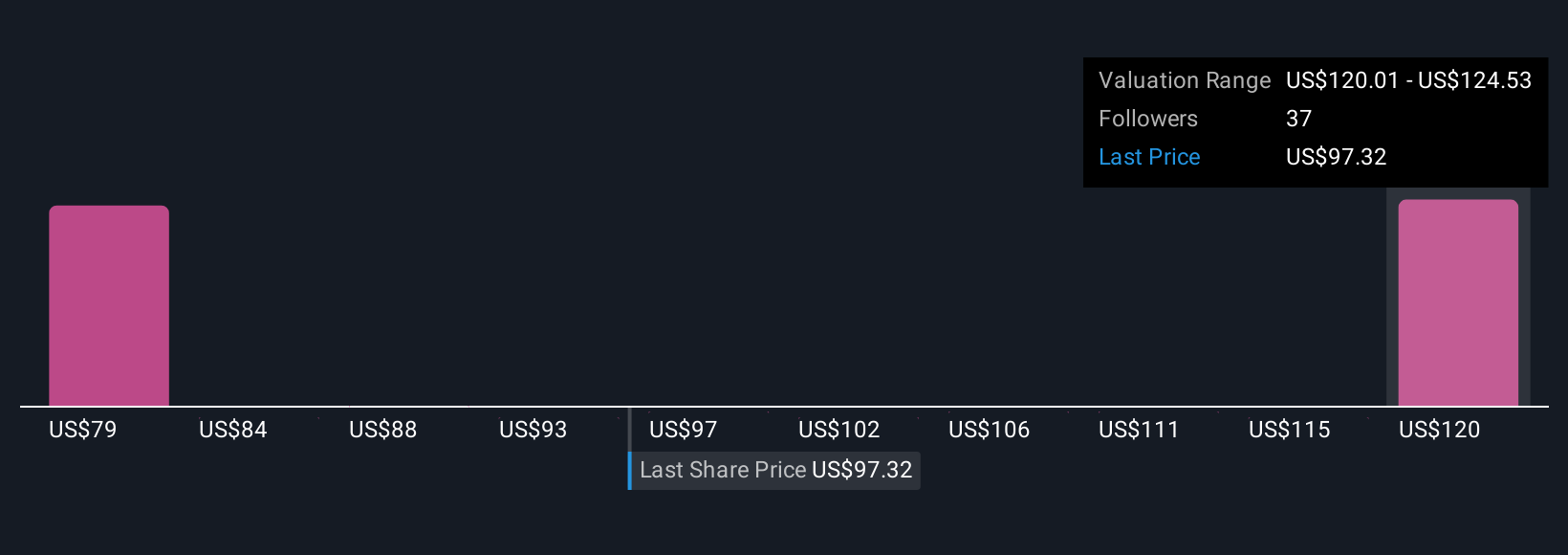

This tool does not just attach numbers to a company; it highlights the reasons behind them and dynamically updates as fresh news, earnings, or regulatory changes hit the market. Narratives make it easy to see at a glance if your fair value is above or below the current price, supporting clear and confident investment decisions. For example, some Boston Scientific investors believe advanced therapies and global expansion could lead to a fair value near $140 if bullish forecasts play out, while others see risks that point to a much lower value around $99, reflecting their more cautious expectations.

Do you think there's more to the story for Boston Scientific? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives