- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Bausch + Lomb (NYSE:BLCO): Assessing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Bausch + Lomb.

Bausch + Lomb’s share price momentum has picked up notably, with a 10.81% gain over the past week and an 11.34% rise in the last 90 days. These increases have helped to offset a tough start to the year. However, longer-term total shareholder return remains negative at -18.88% over one year, so sentiment is still recovering. The recent uptick suggests investors are beginning to revisit the company’s outlook as growth prospects and risks are reassessed.

If the moves in healthcare stocks have you interested, there’s no better time to check out the opportunities on our See the full list for free.

With recent gains and renewed investor interest, the big question is whether Bausch + Lomb’s share price still offers upside. Alternatively, have expectations for future growth already been reflected in the current price? Is there value left for buyers?

Price-to-Sales Ratio of 1.2x: Is it justified?

Bausch + Lomb’s shares are currently trading at a price-to-sales (P/S) ratio of 1.2x, positioning the stock as undervalued relative to both its direct peers and the broader US Medical Equipment industry. Considering the last close price of $16.20, the market appears to be pricing the company well below the averages seen across the sector.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of the company's revenue. For medical device makers like BLCO, this metric is especially relevant as it helps to gauge the market’s expectations for future revenue growth and operating scale, even when profits are negative.

BLCO’s P/S ratio is far below the US Medical Equipment industry average of 3.4x, and it is also lower than the average for its peer group, which sits at 2.6x. In addition, this is well below our modeled Fair Price-to-Sales Ratio of 2.4x, indicating that there could be meaningful price appreciation if market perceptions shift toward this level.

Explore the SWS fair ratio for Bausch + Lomb

Result: Price-to-Sales Ratio of 1.2x (UNDERVALUED)

However, persistent negative net income and slow revenue growth continue to pose risks that could limit Bausch + Lomb’s ability to sustain this recent momentum.

Find out about the key risks to this Bausch + Lomb narrative.

Another View: Discounted Cash Flow Tells a Different Story

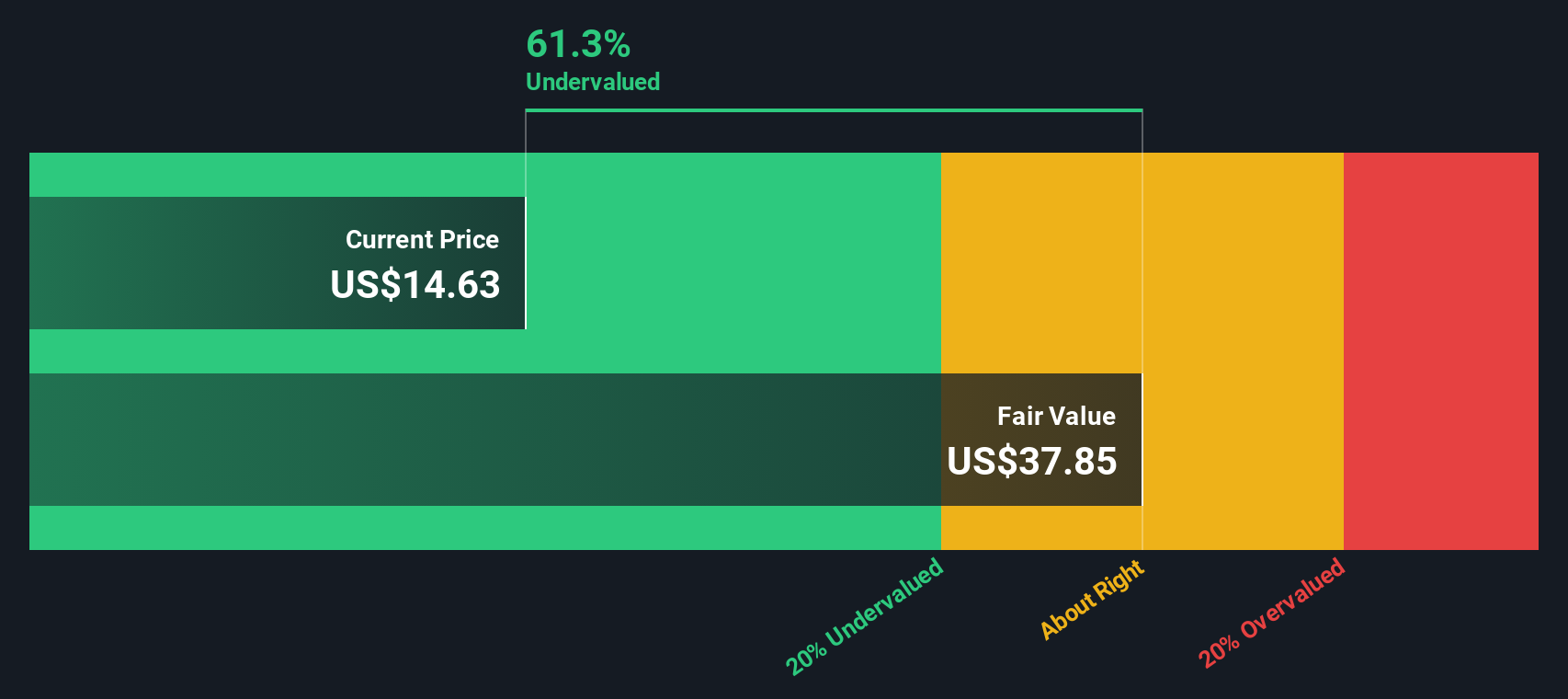

Looking at valuation from another angle, our DCF model paints an even more dramatic picture. The shares are trading 54% below what the SWS DCF model estimates as their fair value. This indicates a much higher potential upside than what using sales multiples alone might suggest. Could the market be overlooking something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bausch + Lomb for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bausch + Lomb Narrative

If you’d rather dig into the numbers on your own or have a different take on Bausch + Lomb’s outlook, it’s easy to craft your own perspective in moments. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bausch + Lomb.

Looking for more investment ideas?

Seize the chance to get ahead. Unique investing opportunities are waiting for those willing to look beyond the obvious. Don’t settle for average returns when better prospects are within easy reach.

- Tap into high-potential tech by reviewing these 25 AI penny stocks that are shaping the future of artificial intelligence and automation across industries.

- Boost your portfolio’s income stream by selecting from these 15 dividend stocks with yields > 3% offering reliable yields and strong financials for stability and growth.

- Grab the opportunity to find mispriced gems among these 928 undervalued stocks based on cash flows, giving you an edge as valuations rebalance in favor of patient investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success