- United States

- /

- Healthcare Services

- /

- NasdaqGS:WGS

GeneDx (WGS) Valuation After Q3 2025 Revenue Beat, Guidance Raise and Fresh Support From ARK Invest

Reviewed by Simply Wall St

GeneDx Holdings (WGS) just delivered a Q3 2025 update that combined an earnings per share miss with a revenue beat, then raised its 2025 outlook, drawing fresh support from analysts and ARK Invest.

See our latest analysis for GeneDx Holdings.

The latest earnings surprise and ARK’s incremental buying come after a powerful run, with a roughly 100% year to date share price return and a triple digit 1 year total shareholder return. This suggests momentum is still very much intact despite recent pullbacks.

If GeneDx’s surge has you thinking more broadly about healthcare innovation, this could be a good time to explore other high potential names via healthcare stocks.

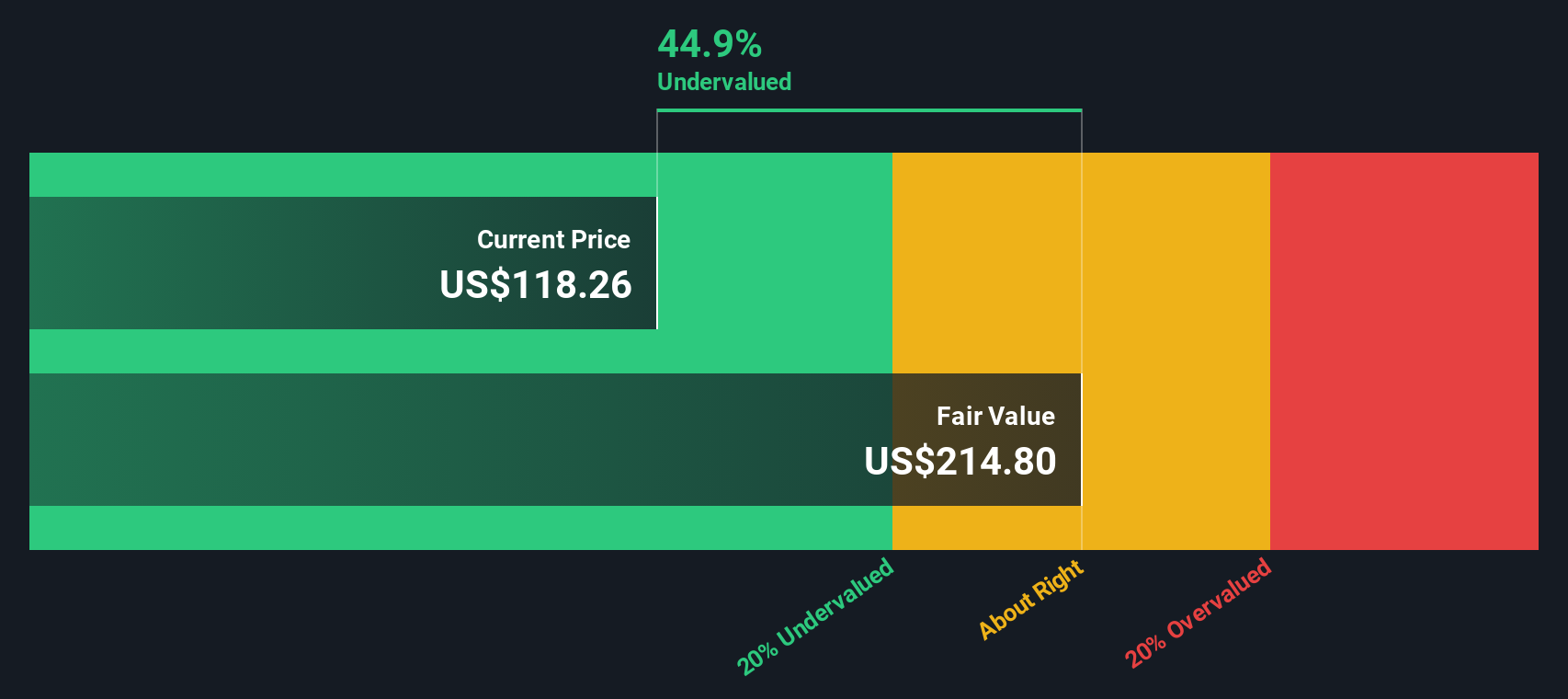

With shares hovering just below analyst targets but still trading at a steep intrinsic discount, investors face a key question: is GeneDx a rare growth story still mispriced, or is the market already discounting years of expansion ahead?

Most Popular Narrative Narrative: 30% Overvalued

Compared with the last close near 159 dollars, the most popular narrative sees fair value closer to 158 dollars, implying a modest downside from here.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.3x on those 2028 earnings, down from 2599.3x today. This future PE is greater than the current PE for the US Healthcare industry at 20.9x.

Curious why a fast growing genomics player might still warrant a premium valuation multiple far above the wider healthcare sector, even years out? The narrative rests on bold assumptions about revenue scaling, margin expansion, and what investors will be willing to pay for those future profits. Want to see exactly how those moving parts fit together into a single fair value number?

Result: Fair Value of $158.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reimbursement pressure or slower than expected pediatric adoption could quickly undermine margin expansion assumptions and challenge today’s rich valuation narrative.

Find out about the key risks to this GeneDx Holdings narrative.

Another View: Discounted Cash Flow Points to Upside

While the popular narrative suggests GeneDx is slightly overvalued near 158 dollars, our DCF model tells a different story, putting fair value closer to 253 dollars, around 37 percent above today’s price. If cash flows are right, is the real risk missing further upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GeneDx Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GeneDx Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised GeneDx narrative in minutes. Do it your way.

A great starting point for your GeneDx Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St Screener to uncover focused, data backed ideas you might otherwise miss.

- Capture asymmetric upside by hunting for mispriced opportunities through these 907 undervalued stocks based on cash flows that strong cash flow potential suggests the market has overlooked.

- Ride the next wave of innovation by targeting early stage leaders using these 26 AI penny stocks positioned at the intersection of software, chips, and real world AI adoption.

- Strengthen your portfolio’s income stream by pinpointing reliable payers with these 15 dividend stocks with yields > 3% that offer attractive yields without ignoring balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WGS

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026