- United States

- /

- Healthcare Services

- /

- NasdaqGS:WGS

GeneDx (WGS) One-Off $14.5M Loss Raises Questions Despite Strong Growth Outlook

Reviewed by Simply Wall St

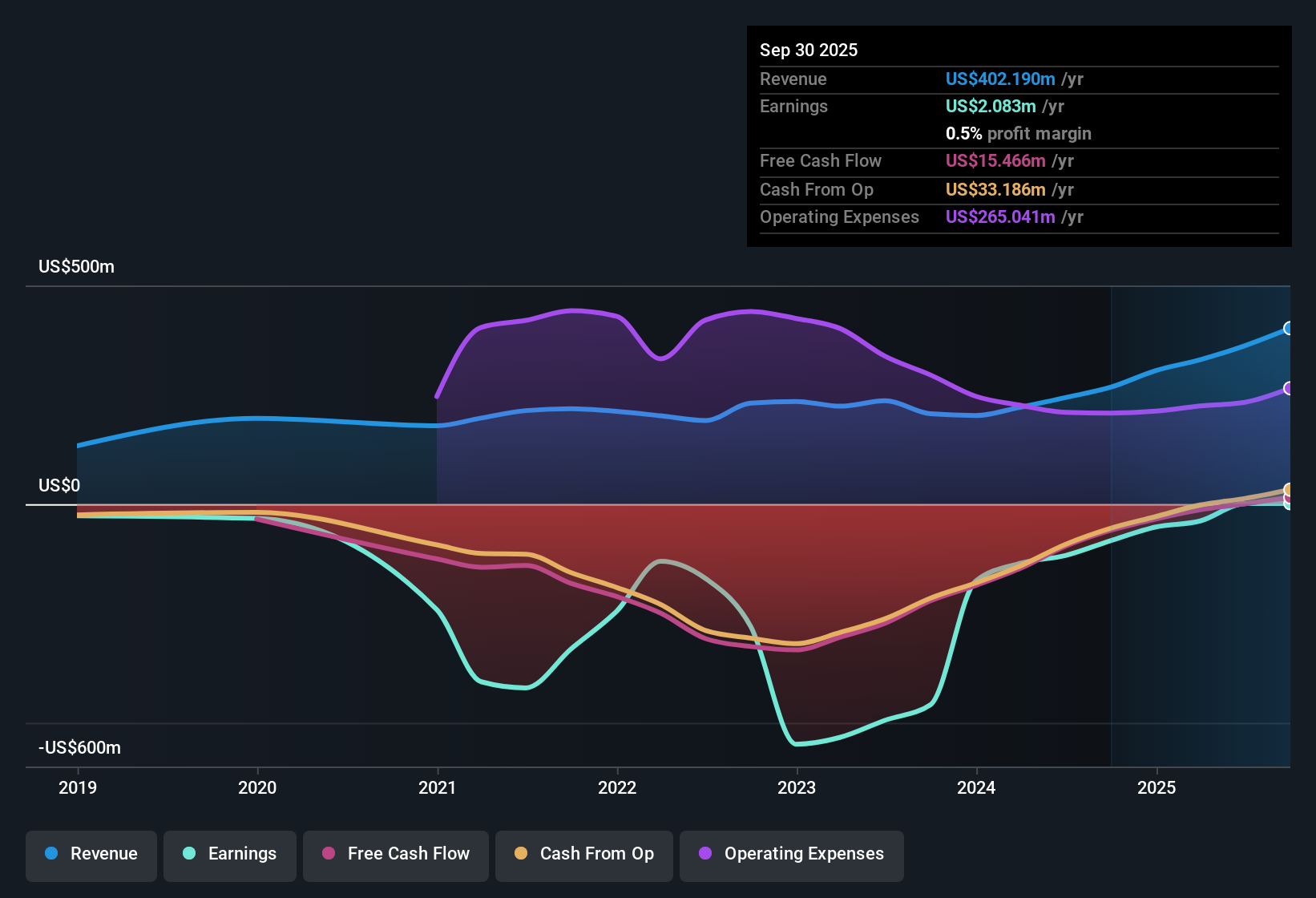

GeneDx Holdings (WGS) delivered standout growth in its latest earnings update, with earnings forecast to surge 50% per year, easily outpacing the US market’s 15.6% per year outlook. Revenue is projected to climb 18.1% annually, and the company has achieved a five-year compound earnings growth rate of 29.5% per year. This comes despite a one-off loss of $14.5 million reported for the twelve months ending September 30, 2025. Investors are weighing these rapid growth prospects and the company’s recent turn to profitability against the lingering impact of the extraordinary loss on reported results.

See our full analysis for GeneDx Holdings.The next section will put these headline numbers side by side with the prevailing market narratives, highlighting where investor expectations may need to shift.

See what the community is saying about GeneDx Holdings

Margins Set to Jump as AI Powers Efficiency

- Analysts anticipate GeneDx Holdings' profit margins will climb from 0.4% today to 18.9% within three years, a transformation chiefly driven by their proprietary AI-powered genomic interpretation and the integration of Fabric Genomics technology.

- The analysts' consensus view suggests margin expansion should reinforce the company's competitive advantage as automation lowers per-sample costs and supports stronger profitability.

- Consensus narrative highlights that scaling their enhanced AI platforms, plus a rich rare disease data set, enables premium pricing and high barriers to entry.

- Improving reimbursement and deeper partnerships with biopharma further support sustained top-line growth and recurring revenues. Together, these create a foundation for durable margin growth.

Premium Price-to-Sales Ratio Under the Microscope

- GeneDx trades at a Price-to-Sales multiple of 9.5x, which is over twice the 3.7x of its peer group and more than seven times the 1.3x US healthcare industry average. This comes even though the stock is currently below its DCF fair value of $247.35.

- The analysts' consensus view acknowledges that while these elevated valuation multiples reflect optimism for long-term growth and profitability, there is some tension because the current share price of $131.76 is still 46% below DCF fair value and yet remains expensive relative to peers when evaluated on a sales basis.

- Consensus narrative notes GeneDx’s ability to command such a rich multiple rests on rapid adoption of genomics, expanding datasets, and the strength of high-margin, recurring revenue streams.

- With rising investment and growing competition, maintaining this premium will likely depend on GeneDx’s pace of market penetration and profitability timeline.

Analysts Forecast Sharp Earnings Acceleration

- Profit is forecast to increase from $1.4 million today to $117.1 million by September 2028, implying a required PE multiple drop from 2,599.3x now to 38.3x, which remains well above the US healthcare industry’s 20.9x.

- The analysts' consensus view points out that for shares to catch up to the consensus price target of $139.56, GeneDx must deliver on high revenue growth and achieve the ambitious margin gains analysts expect.

- If analysts’ projections are realized, revenues should reach $618.3 million by 2028. However, any slowdown in adoption rates or reimbursement could put pressure on these targets.

- The relatively narrow gap between the current share price and analyst target also signals an expectation that much of the future upside is already reflected in today’s valuation.

What’s driving analysts’ confidence in GeneDx’s future trajectory? Get the full breakdown in the consensus investor narrative and see if the current numbers support their case. 📊 Read the full GeneDx Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for GeneDx Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the data in a new way? Take just a few minutes to bring your perspective to life and shape your unique narrative. Do it your way

A great starting point for your GeneDx Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite rapid growth, GeneDx’s high valuation relative to peers signals elevated expectations and leaves investors vulnerable if revenue or margin targets fall short.

If you’d rather spot more attractively priced opportunities, use our these 855 undervalued stocks based on cash flows to discover companies whose valuations offer a greater margin of safety today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WGS

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives