- United States

- /

- Communications

- /

- NasdaqGS:HLIT

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the market has risen 1.8%, and in the last year, it has climbed 32%, with earnings expected to grow by 15% per annum over the next few years. In this favorable environment, identifying high growth tech stocks that show strong potential can be a promising strategy for investors looking to capitalize on these trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 252 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

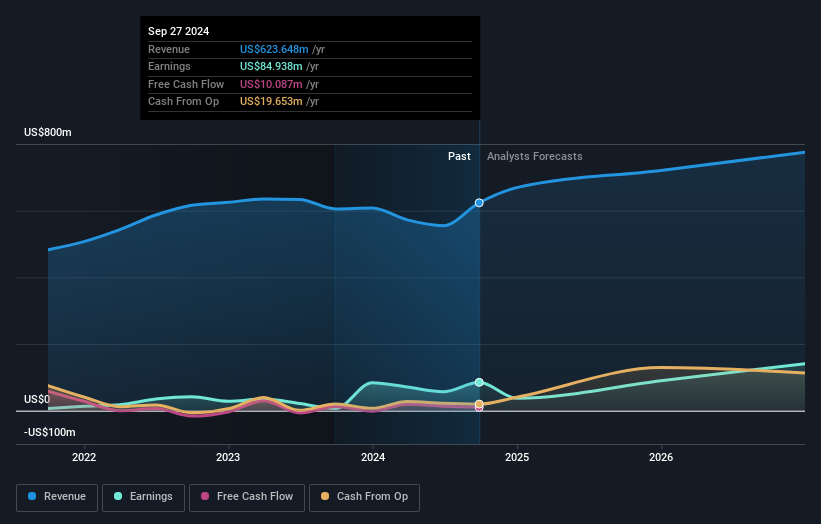

Harmonic (NasdaqGS:HLIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harmonic Inc., along with its subsidiaries, offers broadband solutions globally and has a market cap of $1.68 billion.

Operations: The company generates revenue through two primary segments: Video ($192.23 million) and Broadband ($362.87 million).

Harmonic is demonstrating robust growth in the tech sector, with revenue and earnings forecasted to surge by 24.4% and 54.7% annually, outpacing the broader US market significantly. This growth is underpinned by a strategic focus on R&D, where Harmonic invested heavily, aligning with its latest innovations like the cOS™ virtualized broadband platform used by Bluepeak Fiber to enhance broadband services. These developments not only underscore Harmonic's commitment to advancing technology but also position it well for sustained growth amidst evolving digital demands.

- Delve into the full analysis health report here for a deeper understanding of Harmonic.

Explore historical data to track Harmonic's performance over time in our Past section.

Waystar Holding (NasdaqGS:WAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waystar Holding Corp. develops a cloud-based software solution for healthcare payments and has a market cap of $4.51 billion.

Operations: Waystar Holding Corp. generates revenue primarily from its Internet Software & Services segment, which amounted to $863.29 million. The company focuses on providing a cloud-based software solution tailored for healthcare payments.

Amidst a challenging landscape, Waystar Holding has managed to secure a spot in the S&P TMI Index, reflecting potential investor confidence despite its recent financial turbulence. The company reported a significant revenue jump to $234.54 million in Q2 2024, up from $195.97 million the previous year, marking a 19.7% increase; however, it faced an expanded net loss of $27.69 million compared to $10.81 million year-over-year. On the innovation front, Waystar is actively seeking acquisitions to bolster its growth trajectory and has committed to R&D investments aimed at driving sustainable advancements—key moves that could reshape its market standing and fulfill its projection of accelerating revenues by 9.2% annually.

- Click here to discover the nuances of Waystar Holding with our detailed analytical health report.

Gain insights into Waystar Holding's past trends and performance with our Past report.

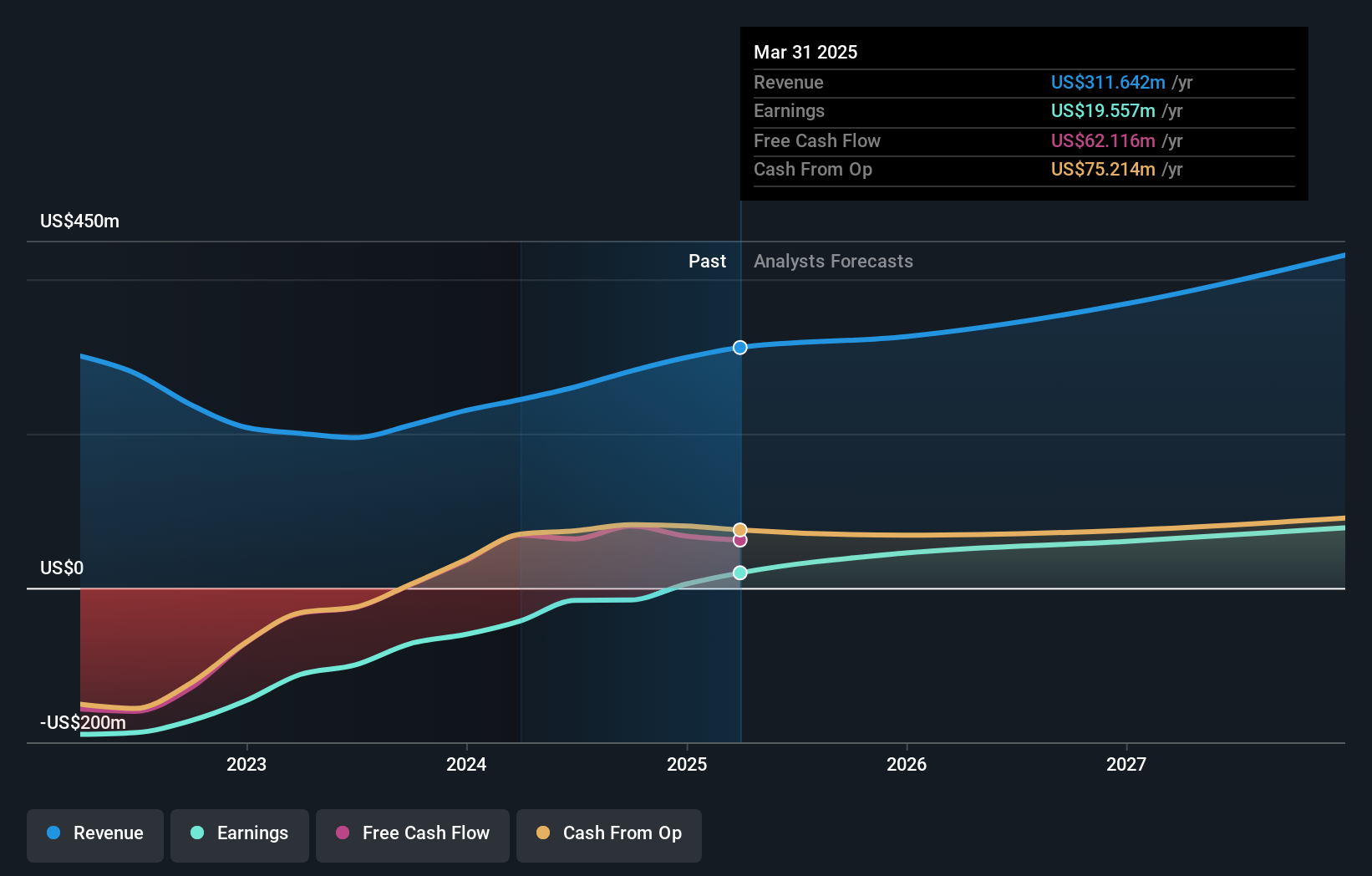

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. provides a specialized Internet of Things (IoT) cloud development platform in China and globally, with a market cap of $845.39 million.

Operations: Tuya Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $260.44 million. The company operates internationally, focusing on providing a cloud development platform for Internet of Things (IoT) applications.

Tuya's recent performance and strategic maneuvers underscore its resilience in the tech sector, despite being dropped from the FTSE All-World Index. The company's pivot towards enhancing its R&D capabilities is evident with a significant 15.2% year-over-year revenue growth, reaching $134.94 million in the first half of 2024, coupled with a turnaround to a net income of $3.13 million from a substantial loss previously. This shift is further supported by Tuya’s aggressive pursuit of smart technology partnerships across Southeast Asia, notably with AiTAN to dominate Thailand’s booming real estate market through advanced IoT solutions. These strategic alliances are pivotal as they leverage Tuya’s robust platform to deliver integrated software and hardware solutions that cater to diverse industry needs, setting the stage for sustained growth in regional markets.

- Unlock comprehensive insights into our analysis of Tuya stock in this health report.

Gain insights into Tuya's historical performance by reviewing our past performance report.

Seize The Opportunity

- Take a closer look at our US High Growth Tech and AI Stocks list of 252 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

High growth potential with proven track record.