- United States

- /

- Healthcare Services

- /

- NasdaqCM:TOI

Market Cool On The Oncology Institute, Inc.'s (NASDAQ:TOI) Revenues Pushing Shares 26% Lower

The Oncology Institute, Inc. (NASDAQ:TOI) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 985%.

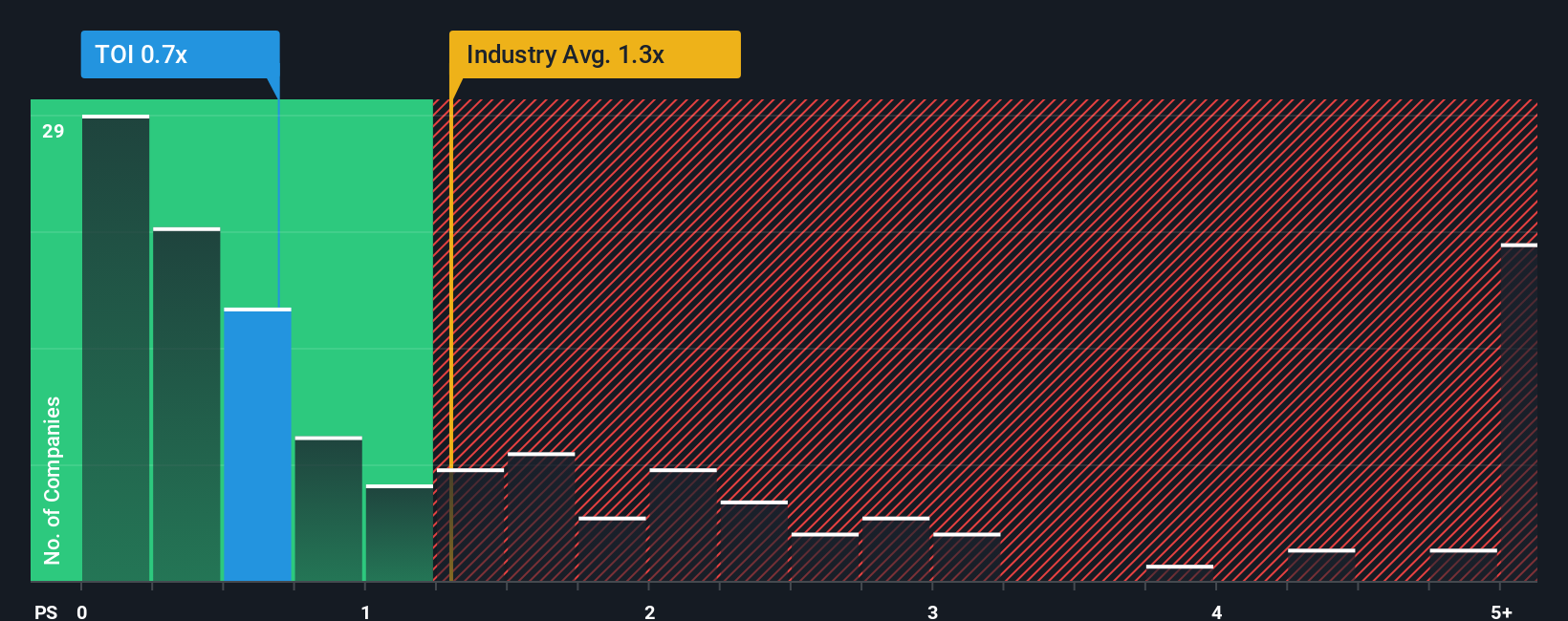

After such a large drop in price, given about half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Oncology Institute as an attractive investment with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Oncology Institute

How Oncology Institute Has Been Performing

With revenue growth that's superior to most other companies of late, Oncology Institute has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Oncology Institute will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Oncology Institute?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Oncology Institute's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The strong recent performance means it was also able to grow revenue by 92% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 23% as estimated by the three analysts watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Oncology Institute is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Oncology Institute's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Oncology Institute's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Oncology Institute (1 shouldn't be ignored) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TOI

Oncology Institute

An oncology company, provides various medical oncology services in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives